India Needs to Reform State Entities Post Nirav Modi Scam

Physically handicapped employees of the Hyderabad Gems Special Economic Zone (SEZ) protest outside Rajiv Gems Park at Ravirala village on the outskirts of Hyderabad, Feb. 21. Some 300 physically handicapped employees fear for their jobs due to the involvement of Gitanjali group, which has been linked to the PNB bank scam. Nirav Modi and his uncle and business partner Mehul Choksi, and Gitanjali group, have been accused by investigators of defrauding the Punjab National Bank of 2.8 billion rupees ($43.8 million), part of the total losses. (Noah Seelam/AFP/Getty Images)

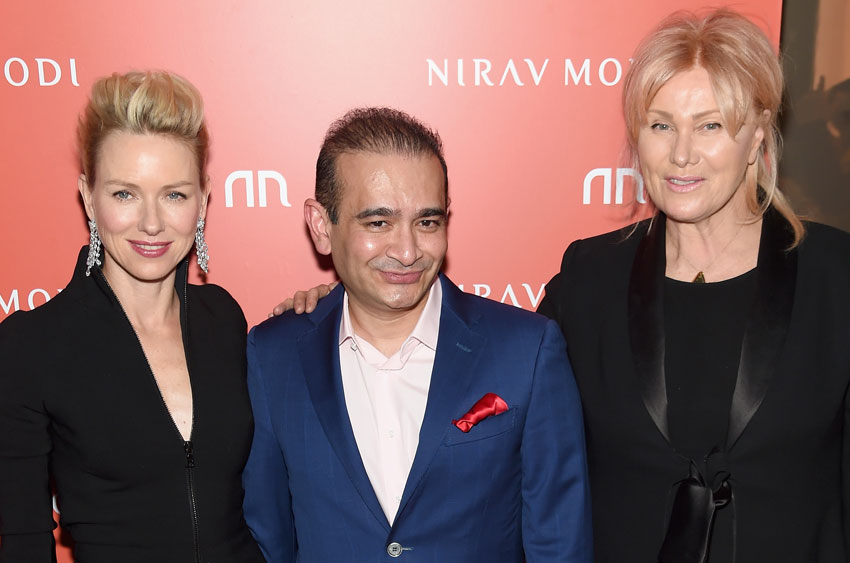

There have been calls to disband, merge or privatize state-owned public-sector banks following the $2 billion fraud perpetrated by diamantaire Nirav Modi in cahoots with executives of Punjab National Bank. The fact that such a huge amount of public money could be so easily siphoned off has raised relevant questions about bureaucrats rather than professionals running businesses. The government, as is often said, should be involved in ensuring that an impartial regulatory paradigm is created for the private sector to function, writes Siddharth Srivastava.

Not in running of enterprise. Indian Railways, given its poor safety record due to lack of technological upgradations, is a stark example of failure of a state-owned agency to deliver. Politically savvy owners of Indian conglomerates have relied heavily on state-run banks for capital using methods that have not been entirely above board. For instance, like Nirav Modi, escaped tycoon Vijay Mallya too milked state banks given due to laxity in following norms.

In the past Harshad Mehta sourced money illegally from state banks to speculate in the stock markets. Government focus instead should be on targeted delivery of welfare schemes related to education and health care due to existence of severe socio-economic disparities in India.

Bureaucracy Resists Change

The bureaucracy, however, continues to push back and resist moves to reduce its relevance.

In recent comments Rajnish Kumar, head of State Bank of India, country’s largest bank by assets in its balance sheet, has hit back at those seeking privatization of public sector banks.

He said almost all bad loans and poor governance standards cases are from private sector enterprises while state-run firms have high governance standards. “If the private sector is all about good corporate governance then tell me which public sector company is in NCLT (National Company Law Tribunal) today? They are all private sector companies,” Kumar said.

“They all default and sit in the front rows of the industry associations. That is the reality today.”

Kumar said there is a critical role that state-run entities play for the betterment of society which the private sector would be unwilling to perform. Responding to comments by billionaire Uday Kotak, executive vice-chairman of Kotak Mahindra Bank, who has said that there is no need for so many state-run banks, Kumar said there is a huge socio-economic agenda which only public-sector banks cater to. “Does anyone speak about who will run branches in the troubled and remote parts of the country where you have to walk for 12 hours to reach the branch?’’

Reforming State Entities

The Modi government has been making some moves to reduce involvement of state-owned entities in running businesses that can be handled well by the private sector. Privatization of the heavily loss-making Air India is one instance. New Delhi has announced plans to allow the private sector to mine coal for commercial purposes, thus ending the monopoly of Coal India.

The most significant change, however, has been the recent creation of India’s first vertically integrated oil major with presence across the downstream and upstream value chain.

In a regulatory filing state-owned explorer Oil and Natural Gas (ONGC) has said it has bought government’s entire 51.11% stake in oil refiner Hindustan Petroleum Corp (HPCL) for over Rs. 369 billion. “The transaction is furtherance of government objective to combine central public enterprises to give them capacity to bear higher risks, avail economies of scale, take higher investment decisions and create more value for stakeholders and create an oil major which is able to match performance of international and domestic private oil and gas companies,” ONGC said. Rating agency Moody’s has affirmed stable ratings for ONGC as a reflection of the explorers position as the only integrated oil and gas company in India with significant reserves, production and crude distillation capacity, post the acquisition. The government, meanwhile, has emphasized merger of ONGC and HPCL has created for the first time an integrated supply chain in the oil sector in India that will be overseen by one company. Global examples include Exxon Mobil, Shell, BP, Total, Rosneft, Gazprom, Aramco and Sinopec.

However, in order to disprove skeptics that the acquisition was not just a clever way to earn windfall revenues and meet disinvestment target, New Delhi will need to take the integration process forward that involves the entire gamut of standalone state-owned companies across sectors, including financial. In the oil and gas sector, it may be a good idea initiate integration of gas utility, GAIL, Mangalore Refinery and Petrochemicals Limited (MRPL) and refiners and oil marketing companies IOC and Bharat Petroleum Corp (BPCL). In the financial sector, multiple smaller banks could be merged with the big three, SBI, PNB and Bank of Baroda. However, with countdown to general elections that may happen earlier than scheduled in May next year, the government is unlikely to announce any major restructuring or policy changes. No doubt opposition will like to pin down Modi government over the Nirav Modi heist for electoral gains.