REAL ESTATE:

Recession Over? R.E. Market Trends

While the home sales and foreclosure equations keep changing, calling the current real estate market conditions a recession is not entirely appropriate, writes realtor Ashok Gupta.

If you follow the news, you would already know that existing home sales climbed for the second month in a row with a 10% rise in September to a seasonally adjusted annual rate of 4.53 million units last month. This was up from 4.12 million units in August 2010 as reported by National Association of Realtors, fueling some hope that a housing recovery is underway.

So the good news is – the real estate recession is officially over.

Why would I say something like this to all of you? I know you are intelligent and always have a watchful eye on the market conditions in real estate or any area of investments. The reason I say it is because this real estate recession that we have experienced has completed five-and-a-half to six years and it is no longer a recession ... it is now simply the way it is. This is the market we have ... this is the market we’re going to continue to have ... and therefore, it’s no longer a recession ... it is a normal real estate market.

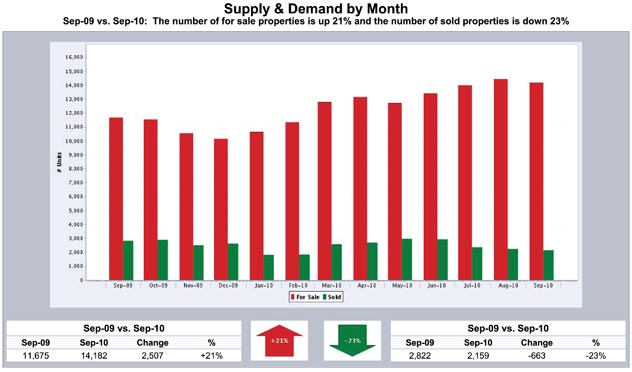

We all feel the pinch in this economy which has been particularly hard on many homeowners. I meet people every day who thought they made a responsible decision on their mortgage loans, only to be hit with the unexpected. There are more homes on sale than a year ago and less number of homes sold per month than a year ago, increasing the inventory in Bay Area counties. (See Supply & Demand chart below)

Yes, we all know short sales are still taking place every day, however, the fact is that the real number of short sales are reducing gradually . . . Yes, we all know banks are repossessing properties . . there are still lenders funding real estate loans . . . appraisals are coming back to normal as compared to the very low values just months earlier. Sellers are becoming more reasonable in pricing and homes are selling . . . Buyers are being reasonable shoppers instead of looking for steal in every deal, and, this is resulting in bringing the inventory back to a normal range nationwide.

In August and September, we saw the number of home sales throughout North America regain momentum, and instead of being down 30-40% from the peak, they are now down 10-20%. We have to realize that this is the market that we have to face and deal with, hence the panic factor is down considerably. The world is adjusting to the economy we have today.

For those who complain or are upset about the market, they have to work on improving their thought process. The market is fairly stable and corrected doing so for the last five to six years. We have had the time to adjust to it and being upset about the lower valuation does not really make sense. At some point we all have to come to grips with the market as we see it today. Understand that the market we have today is a great real estate market. Whining and complaining is not a stable mental state to stay in.

Simply stated, the recession has ended, and now we have to go to work doing all of the things that have to be done to be a success at any business with a strong, focused, positive mindset ... no more excuses.

There is a section of us who are still not convinced about the market, the foreclosure issues, the short sale process, or the moratorium on foreclosures. It’s been in the news — errors riddled foreclosures across the country. Now several large lenders have halted operations amid law suits and calls for a national moratorium. This is all so depressing.

A lot of people have called me with questions on foreclosure freeze by major lenders and what it means to them as distressed homeowners. Here are some tips that can help make sense of such issues.

The foreclosure freeze really translates into more time for struggling homeowners to find better alternatives to foreclosure. It’s not an excuse to avoid paying your mortgage, but it has helped many buy time to go over their options.

There are solutions even if a homeowner is heading for foreclosure or they owe more on their home than what it is currently worth but don’t know what to do.

If you are behind on mortgage payments and do not see a way to catch up, avoiding foreclosure can help you recover your finances more quickly. Short sales and Deeds-in-lieu of foreclosure are two dignified alternatives that most homeowners can use to avoid the financial impact of foreclosure.

A short sale is when the lender agrees for the property to be sold at a price lower than the mortgage balance owed.

A deed-in-lieu is when the lender receives the house deed in place of the mortgage balance, although in some cases the lender will still pursue the homeowner for the leftover mortgage balance, which is called a deficiency judgment.

So what should a distressed homeowner do?

The first and best move in this position is to educate yourself on what your options are based on your financial situation. Avoiding foreclosure is always something worth pursuing if you can, and there really are dignified alternatives available.

Consulting a qualified realtor who is also a educated in handling distressed properties, can rescue the homeowner or the distressed property from the Trustee Sale or foreclosure.

Here is a powerful thought – According to USA Today – In mid-2007 there were 2.1 million real estate agents in the U.S. as compared to less than 1 million (960,000 approx.) today. What do you think led these agents to leave the business?

Is it because they didn’t know how to operate in the economy we’re dealing with?

Was it the agents who thought they knew how to sell and really didn’t know what to do? Or,

Was it the agents who really knew how to sell and really knew what to do?

You already know the answer. The question is ... which category does your Real Estate professional belong?

Concluding my thoughts, the market is what it is and will stay this way for now. You could call it bad or recessed but that applies if you can predict when it will bounce back. The reality of the situation demands that we accept things at their face value and not mere assumptions based on past performances as the saying goes — “past performance is not a guarantee of future results.” It is entirely up to an individual to decide how to interpret the scenario. The homeowner, whether a first time buyer or someone who has purchased a property when the market was high and is now relenting the deal or facing financial hardship is always vulnerable to such situations. The trick really is to find the right help, whether it is to buy a home, invest, sell it or save it.

|