Wirecard shares plunge on new fraud report

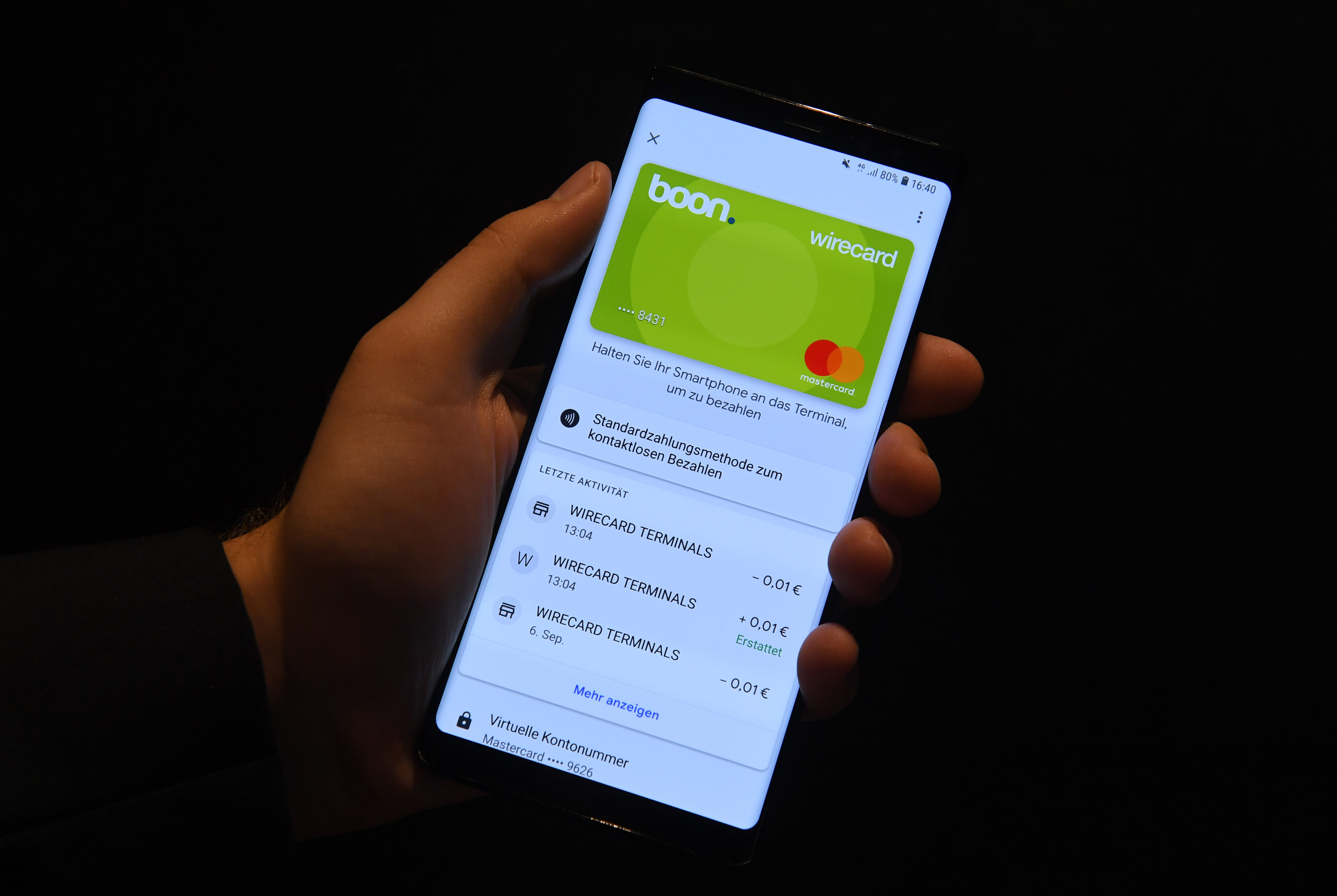

Wirecard is a specialist for cashless payments (Christof STACHE)

Frankfurt am Main (AFP) – Shares in German payment processing firm Wirecard plunged for the second time in a week Friday, after a newspaper report added fuel to allegations of fraud in its Asian operations.

Stock in the company, which knocked banking stalwart Commerzbank out of the prestigious DAX blue-chip index last year, plummeted 21.87 percent to trade at 113.05 euros ($129.54) by 4:55 pm in Frankfurt (1555 GMT).

The share had earlier plunged by as much as 30 percent.

The tumble came immediately after the Financial Times reported it had seen documents from lawyers commissioned by Wirecard, showing they found evidence of “serious offences of forgery and/or of falsification of accounts/documents” at the group’s Singapore office.

“There are reasons to suspect that they may have been carried out to conceal other misdeeds, such as cheating, criminal breach of trust, corruption and/or money laundering,” the document seen by the FT continued.

Wirecard hit back at what it described as “yet another inaccurate, misleading and defamatory” article.

After its shares crumbled following the earlier report, Wirecard on Wednesday also issued a categorical denial of the FT’s original article on suspected fraud at the company, which the paper said was based on a different internal document.

And German financial markets watchdog Bafin said Thursday it was launching an investigation into possible market manipulation over the story.

Wirecard stunned the traditional German banking sector last year by displacing Commerzbank, which had enjoyed sizeable enough market capitalisation and trading volumes to be listed on the DAX for decades.

Hailed as a champion of the insurgent “fintech” (financial technology) scene with its software for cashless and contactless payments, it then boasted a market valuation of more than 23 billion euros — outweighing even giant Deutsche Bank.

But since January 1, the stock has shed 5.2 percent of its value, leaving the firm’s capitalisation at 17.9 billion euros.

Disclaimer: This story is published from a syndicated feed. Siliconeer does not assume any liability for the above story. Validity of the above story is for 7 Days from original date of publishing. Content copyright AFP.