Vaccine hopes help push Asian equities higher

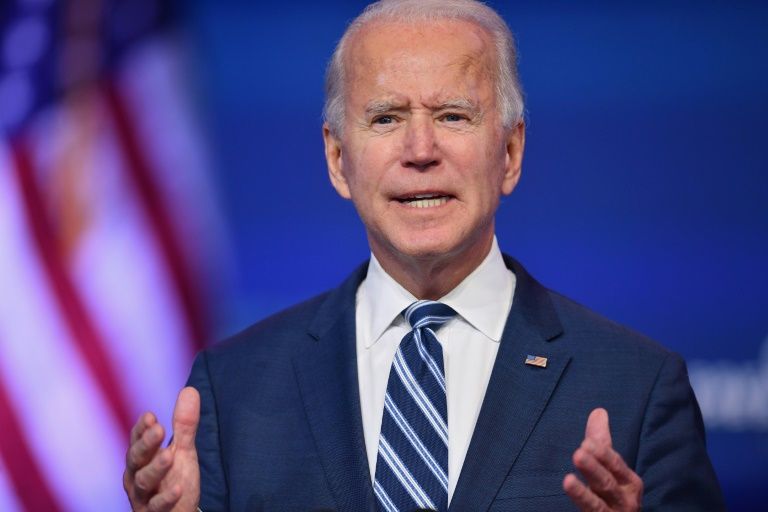

Hong Kong (AFP) – Optimism about a virus vaccine helped push Asian markets higher Monday while traders were also cheered by a pledge from President-elect Joe Biden’s team that they were not planning an economically damaging nationwide lockdown despite surging cases.

However, while there is growing expectation a treatment will be available in the new year, gains were tempered by worries about a spike in the disease in the US and across Europe.

After a painful October, equities have enjoyed a huge bounce this month after Biden’s election win, which was followed by news that Pfizer and BioNTech’s vaccine candidate had proved 90 percent effective, lifting hopes the world can soon begin returning to normal.

“The vaccine enthusiasm booster shot remains the dominant narrative, even with surging infections across the US: now more than 1 million since the start of November,” said Axi strategist Stephen Innes. “Indeed, the vaccine could prove to be the ultimate market backstop and recessionary economic plugger.”

Tokyo led the gains, jumping 1.7 percent, helped by news that the world’s number three economy had surged out of recession in the third quarter, expanding a forecast-beating five percent thanks to a pick-up in domestic demand and exports.

Sydney rose 1.2 percent before trading was suspended owing to what the stock exchange said were data issues.

Seoul, Taipei and Singapore added more than one percent, while Hong Kong, Shanghai, Jakarta and Wellington were also up.

The gains came after another strong performance on Wall Street, where the S&P 500 finished at a record high. All three main New York indexes were up in futures trading.

Traders also cheered the signing of the world’s biggest free-trade deal by 15 Asia-Pacific countries Sunday, including Japan and China, that covers about a third of the planet’s GDP.

The upbeat mood was helped by one of Biden’s advisers saying the incoming president would not impose a national lockdown to contain the virus, which has now infected more than 11 million Americans.

Instead, Vivek Murthy said officials would use targeted measures to limit the disease’s spread, preferring to protect people’s jobs and the already shaky economic recovery.

– ‘Positive mood music’ –

Chris Weston, at Pepperstone Group, said: “There is certainly elevated chatter that potential shutdowns in the US will weigh more in the near-term and maybe so, but investor sentiment is the most elevated since 2017.”

And Innes added that comments from the heads of the US, UK and European central banks “also sprinkled just enough forward guidance fairy dust to ensure investors are confident the market will be sufficiently flush to bridge the gap between now and hopefully when the vaccines arrive”.

“Indeed, this is very positive mood music to the market ears and allows investors to look through the current level of headline Covid uglies.”

However, China-US tensions were back on the radar after Axios reported that Trump was considering a range of new tough measures against Beijing in the last few weeks of his presidency.

The report said he could unveil sanctions or trade restrictions against more firms, government entities or officials, citing human rights violations or national security. The moves would be made in such a way as to make it tough for Biden to row them back.

The story comes after the president last week signed an order banning investments in Chinese firms that could help the country’s military and security apparatus.

Sterling extended gains after news that Boris Johnson’s top adviser and Brexit mastermind Dominic Cummings will leave later this year, which analysts said could pave the way for the government to agree a Brexit trade deal.

– Key figures around 0300 GMT –

Tokyo – Nikkei 225: UP 1.7 percent at 25,805.30 (break)

Hong Kong – Hang Seng: UP 0.4 percent at 26,271.03

Shanghai – Composite: UP 0.6 percent at 3,329.98

Euro/dollar: UP at $1.1850 from $1.1832 at 2200 GMT on Friday

Pound/dollar: UP at $1.3221 from $1.3186

Dollar/yen: DOWN at 104.53 yen from 104.62 yen

Euro/pound: DOWN at 89.62 pence from 89.70 pence

West Texas Intermediate: UP 1.2 percent at $40.60 per barrel

Brent North Sea crude: UP 0.9 percent at $43.17 per barrel

New York – Dow: UP 1.4 percent at 29,479.81 (close)

London – FTSE 100: DOWN 0.4 percent at 6,316.39 (close)

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.