Taiwan’s GlobalWafers in talks to buy German rival Siltronic

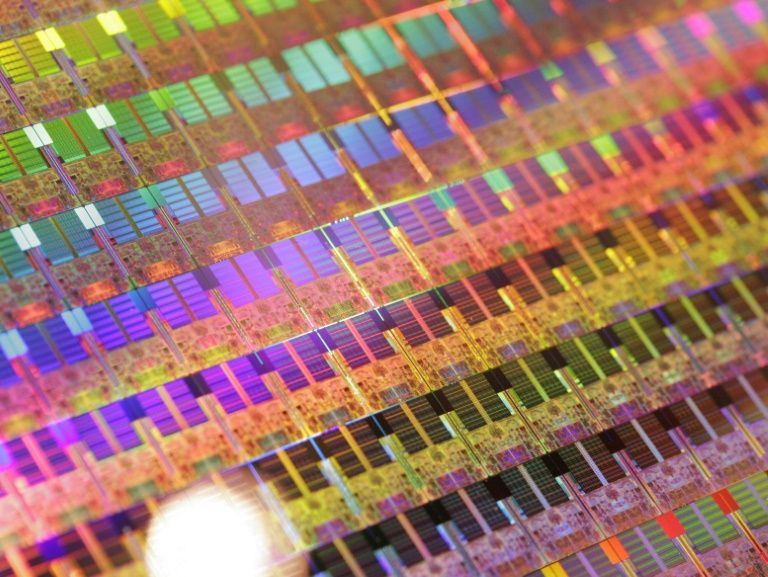

Taipei (AFP) – Taiwan’s GlobalWafers, the world’s third-largest maker of semiconductor wafers, confirmed Monday it is in advanced talks to acquire German rival Siltronic AG in a deal worth an estimated $4.5 billion.

Both companies issued statements saying they were in “near to final discussions” with GlobalWafers preparing to offer 125 euros per share to Siltronic’s shareholders.

“A combination of GlobalWafers and Siltronic would create a leading player in the industry with a comprehensive product portfolio that can offer technologically sophisticated products to all semiconductor customers globally,” said spokesman William Chen.

The deal is estimated to be worth $4.5 billion (3.75 billion euros) if GlobalWafers buys all of Siltronic’s outstanding shares.

The deal would require approval of the boards of both companies as well as regulators.

Siltronic said its board viewed the offer price “to be attractive and appropriate” and said it could stave off any job losses in Germany until at least 2024.

“The deal may fail due to anti-trust review, but if a merger is approved, this will be beneficial to GlobalWafers’ shareholders,” Bloomberg News quoted Richard Hsia, an analyst at Fubon Securities Investment Services Co, as saying.

Hsia said a successful acquisition would help GlobalWafers surpass Japan’s two market leaders, Shin-Etsu Chemical and Sumco, to become world number one by revenue, with a market share of 32 percent to 35 percent.

Siltronic AG, the world’s fourth largest wafer material maker, is a subsidiary of chemical group Wacker Chemie AG.

The takeover offer is the latest of a spate of semiconductor deals this year that is set to break the record $122 billion in chip acquisitions in 2016, Bloomberg reported.

GlobalWafers shares were up 9.8 percent in Taiwan on Monday.

Siltronic shares rose to up to 12 percent in early trading, their biggest intraday gain since March.

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.