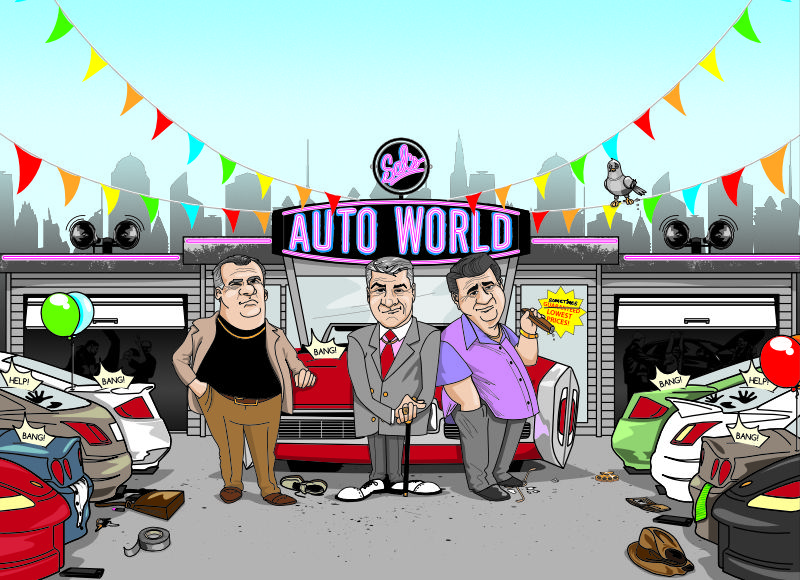

‘Stealerships’ Dealerships – Know When You’re Getting Conned

TL;DR

One of the largest investments we make in our lifetime, besides a home, would be a car. We rely on it for transportation, emergencies, running the household, and some even rely on it for income. Essentially, a car is part of the American lifestyle and has become more of a necessity than a luxury. In a recent conversation, industry legal experts share how fraudulent dealer practices constitute the fourth leading source of consumer fraud in the United States.

Speakers

- Daniel Dwyer, Attorney, Division of Financial Practices, FTC

- Elizabeth C. Goodell, Supervising Attorney, Mid-Minnesota Legal Aid

- Joe Jamarillo, Staff Attorney, Housing and Economic Rights Advocates (HERA), Oakland, CA

Buying a car through a dealership has become more of a hassle than it was a mere decade ago. With shortages plaguing the automotive industry and inventory at an all-time low, the automotive market has gone from being a buyers’ market to a sellers’ market. Dealers are simply jacking up the prices and adding on unnecessary fees to make up for their “losses.”

The whole world agrees that car salesmen are the least trustworthy people in the industry. They have a reputation for being pushy, non-transparent, and sometimes even dishonest. Misleading ads, deceptive sales pitches, the small print in the contract, phony online car selling, “yo-yo” financing schemes are just some of the “magic” tricks up dealerships’ long sleeves. For all we know, we might have been victims of these tactics even if we didn’t realize it at the time.

Fraudulent Practices

The Federal Trade Commission received more than 100,000 complaints from buyers, last year received. Most complaints centered around one narrative: they were duped by fraudulent salespeople. To add insult to injury, minority communities and low-income people are the most vulnerable to these fraudulent tactics, according to Daniel Dwyer.

One livid case the FTC settled involved a Honda dealership in the Bronx. The general manager, Carlos Fittanto, instructed his sales team to overcharge Hispanic and African American customers by charging higher financing markups and fees.

Fittanto advised that these minority groups have limited education, therefore should be targeted instead of White customers. The complaint alleged that African American and Hispanic customers paid more for financing than White customers with similar backgrounds.

Along with discrimination, the Bronx Honda sales team also falsified prices on paperwork without informing the buyer, failed to honor advertised sale prices, and as mentioned earlier, overcharged taxes and fees to minority buyers. Justice was served when Bronx Honda was ordered to pay $1.5 million to settle the case.

Tips and Tricks

The car-buying process should be envisioned as a research project. Extensive homework is strongly advised before setting foot in the showroom. Dwyer outlines the following tips for preparation:

- Knowledge is power: knowing the vehicle you want and how much you can afford will help against dealers trying to up-sell you.

- For used vehicles, you can check the history from trusted sources listed here: https://vehiclehistory.bja.ojp.gov/

- Confirm the final out-the-door price before heading to the dealership. Also, confirm the availability of the advertised vehicle. Dealers will often advertise a vehicle with a lower price, and then claim that the vehicle has been sold or is not available for sale.

- Get pre-approved for a loan from a financial institution to avoid relying solely on dealer financing options – often higher interest rates and potential for fraud.

- Thoroughly read and review all the paperwork before signing to ensure that the terms agreed upon are reflected. Don’t fall for “yo-yo” financing.

- Remember dealers will sell optional extras as required additions. Read through all the fees and extras thoroughly and be ready to question the dealer on unnecessary extras.

- No matter how hot the automotive market is, there is always room for negotiations on price and financial terms – interest rates, loan term, etc.

The Used Car Peril

Many families rely on used cars and often are the most vulnerable to these fraudulent tactics. If the financial fiasco wasn’t stressful enough, used car dealers are notorious for selling vehicles that end up being inoperable within months of purchasing one.

Elizabeth C. Goodell highlights many instances where a car stalls or the dreaded check engine light illuminates, one to six months after being purchased. Goodell says, “It is insanity to keep paying for a car that no longer works.” Yet, the reality is even if the buyer doesn’t have possession of the car, dealers will still encroach buyers to cover up the remaining balance of payments.

At this point, the consumer, being harassed by the dealer and dealing with a debt spiral, could resort to small claims court. Goodell, however, cautions, “Most cases end up with the dealer prevailing. Consumers rarely get to tell their side of the story.”

Goodell also advised against trusting salespeople just because of language affinity, alluding to enumerable cases of dealers targeting minority communities.

Buyer’s Rights

As buyers, we do have some rights depending on the state where the car is purchased. Joe Jamarillo notes that California, for example, has the Car Buyer’s Bill of Rights.

On a high level, the Buyer’s Bill of Rights state that dealers are required to itemize every charge in writing, and contracts must be translated to the buyer’s first language. Dealers must also provide credit scores and inspection reports. As far as the vehicle itself goes, dealers are required to denote whether the vehicle is being sold “as is” or there is a warranty. A full warranty should cover all repairs.

On the financial paperwork front, Jaramillo advises buyers to inspect the “Truth in Lending” box to determine the terms negotiated for financing. Many states allow for a “cooling off” period where a car can be returned without charges.

Ending Remarks

One of the most expensive investments people make in their life is a vehicle. Cars, strongly integrated into America’s culture, play a significant role in daily living. If buyers aren’t properly educated and succumb to the dealers’ malpractices, they can potentially lose thousands of dollars and wind up without reliable transportation. Dwyer encapsulates the role of cars in our life with one statement, “Cars are key to how we live, learn and provide for our families. They are also one of the most expensive and complicated purchases many people will make.”