New US jobless claims drop amid fears of throttled recovery

The Labor Department reported 881,000 new filings for aid in the week ended August 29, but the report is the first to use a new seasonal adjustment formula, which analysts say may account for much of the week-on-week drop.

Nonetheless, the result was better than expected. The data showed the insured unemployment rate fell 0.8 points to 9.1 percent with 13.3 million people receiving benefits in the week ended August 22, the latest for which data was available.

However, using non-seasonally adjusted data, initial claims actually increased to 1.6 million from 1.4 million the week prior, including 759,482 people who filed last week under the Pandemic Unemployment Assistance program (PUA) aimed at those not normally eligible for such aid.

No matter how interpreted, the result was worse than any single week of the 2008-2010 global financial crisis, reflecting the ongoing damage from business shutdowns that began in the US earlier this year to stem what became the world’s worst coronavirus outbreak.

“The fact that we still have all these people in the system looking for benefits just shows we have a large number of people not attaching to the labor force,” William Spriggs, chief economist at the AFL-CIO trade union federation told AFP. “We’re looking at long-term unemployment as a huge issue.”

– No help yet –

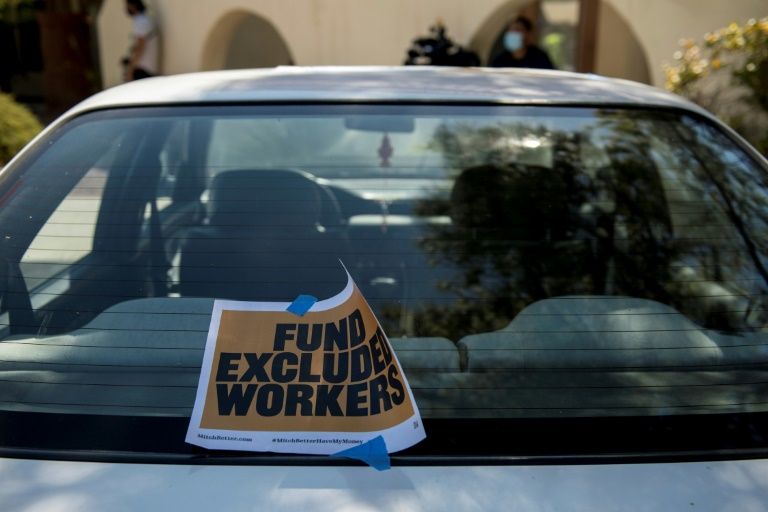

Tens of millions of people have lost their jobs since the coronavirus pandemic hit the world’s largest economy, but states’ efforts to reopen as well as the $2.2 trillion CARES Act stimulus package has been credited with spurring some rehiring.

Key provisions of that law, such as an extra $600 per-week in payments to the unemployed and a program of loans and grants to keep small businesses afloat, expired in recent weeks, and lawmakers in Congress have not been able to reach an agreement with the White House on an extension, despite lengthy negotiations.

In an analysis, Rubeela Farooqi of High Frequency Economics said there were signs in the claims data that the very tentative recovery was already waning.

The total number of people receiving aid as of August 15 was 29.2 million, an increase of nearly 2.2 million from the week before that was driven mostly by new claims filed under the PUA.

And the drop in insured unemployment may also be indicative of people who have been receiving benefits for so long, they have exhausted their allotment.

“The labor market remains exposed to weak demand and virus containment restrictions — especially service sector employment — which are resulting in permanent job losses that will have implications for the pace of recovery going forward,” Farooqi said.

– Mixed data elsewhere –

Separate Commerce Department data released Thursday showed the trade gap jumping to $63.6 billion in July on a surge in US imports, much more than economists had expected.

The 19 percent jump in the deficit from June came despite American exports rising as well, as firms continue to recover from trade disruptions brought about by border closures and business shutdown orders brought on by the pandemic.

The Institute for Supply Management also reported slowing growth in the non-manufacturing sector, with its services index still expanding but slipping 1.2 points to 56.9 percent.

Despite the stumble in the pace of growth, the survey’s chair Anthony Nieves told reporters “all signs indicate unless we have a derailment in the next few months, that we will continue to see this growth going forward.”

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.