Jettisoning “Make in India” for Quick Growth

File photo of an illuminated ‘Make in India’ logo being installed at Udyog Bhawan in New Delhi, Aug. 2016. (Manvender Vashist/PTI)

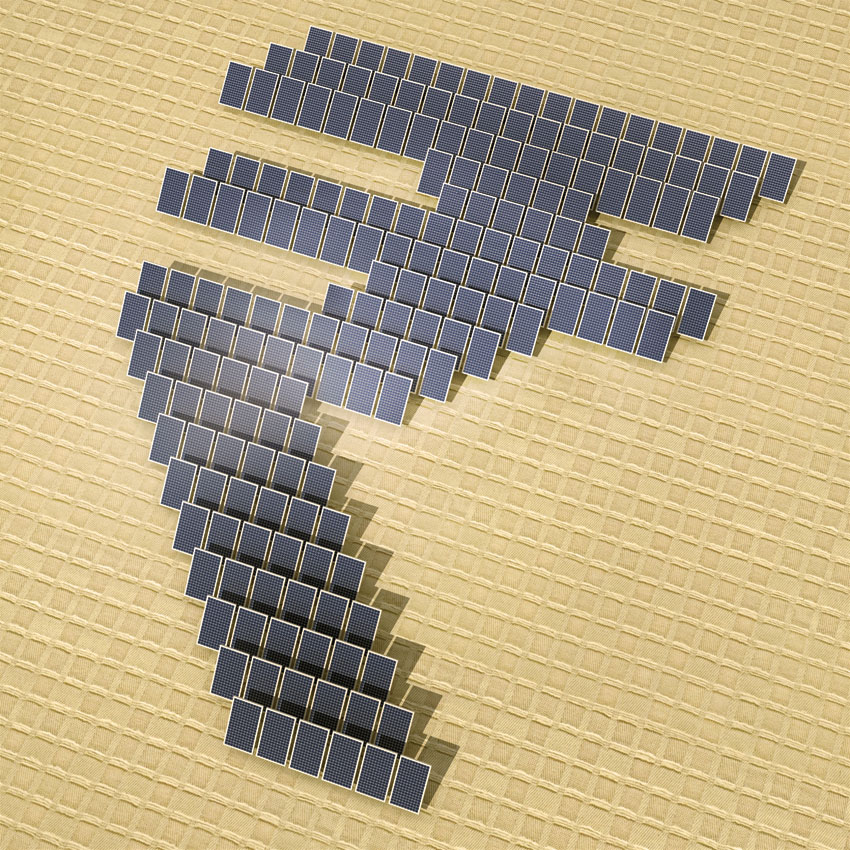

Indian businesses have mostly backed Prime Minister Narendra Modi’s “Make in India” vision that translates to incorporating policy frameworks that encourage domestic manufacturing. The objective is to achieve multiple goals that include employment, saving foreign exchange and enabling Indian companies to scale up and become global players. Curiously, the “Make in India” strategy is not working in the solar sector, one of the big focus areas of the Modi government, writes Siddharth Srivastava.

Major Indian solar module makers such as Indosolar, Tata Power Solar, Adani Group, Jupiter Solar, Moserbaer and state-owned BHEL are struggling to keep the business afloat as price differential with imports, mainly from China, has widened to 10-12%. At stake is total of $2 billion investments and brownfield manufacturing capacity of over 3150 MW that has already been created.

This is despite the fact that market for solar equipment in India is quite big. Solar developers are expected to place 80,000 MW orders worth Rs 2.5 trillion given India’s stated target of 100,000 MW capacity creation by 2022. As matters stand, domestic manufacturers are, however, unlikely to win too many contracts as developers continue to favor imports that has helped drive down tariffs to under Rs. 2.5 per unit in India.

Karunesh Chaturvedi of Vikram Solar recently told The Times of India that developers prefer cheap equipment as their interest spans 5-7 years within which they seek to recover costs. “But projects have a 25-year span. So you are compromising on quality with cheap imports at the cost of the project’s future,” Chaturvedi said.

Uncertainty about business prospects means new players that have not committed investments are wary about import-led and extremely price-conscious Indian market. China-based Trina Solar recently put on hold its plan to set up a 1,000 MW manufacturing unit in India due to low prices. “Though India remains one of the most important market for Trina, the fact that it is low selling price market cannot be ignored,” said Gaurav Mathur, India sales head of Trina Solar, the world’s biggest solar panel maker.

Trina is hoping India’s proposed domestic manufacturing policy for solar will offer incentives to invest in the country. “We are willing to manufacture in India, provided we get some kind of benefit, specifically for solar. We will set up (the manufacturing unit) provided we have the right kind of policy support from the government,” Mathur said.

Analysts compare the plight of solar manufacturers as similar to the situation a decade back when the Indian government was pushing hard to expand thermal capacity. At that time too, developers opted for cheaper equipment from China to offer low tariffs to customers, which nearly drove domestic manufacturers to closure.

The government then instituted quality, security and other norms which were essentially non-tariff barriers to thwart the Chinese competition. However, the scenario now is quite different due to the pre-existence of thermal power at low rates. Given rapid creation of new capacities in wind and solar there are valid fears of overcapacity creation.

And, with the near-total withdrawal of government subsidies, solar generators today are in direct competition with coal-fired plants. Distribution companies or discoms, the main bulk buyers of power in India, meanwhile, are extremely price sensitive, and are increasingly resorting to spot market purchases of the cheapest power available, whether thermal or renewable.

Ministry Supports Imports

In this context, due to pressure from developers, the renewable energy ministry has been resisting moves to impose anti-dumping duties on solar equipment imports from China, Taiwan and Malaysia. Renewable energy minister R.K. Singh recently said existing solar projects and bidders for new ones must be insulated from uncertainty of antidumping duties. In a recent note to the Directorate General of Anti Dumping (DGAD), that is hearing a petition by the Indian Solar Manufacturers Association (ISMA) seeking imposition of anti-dumping duty, the renewable ministry argued that if at all duty is imposed on imported solar cells, panels or modules, it should be “moderate.”

“There should not be too much impact on solar power tariffs, otherwise the growth of the solar sector may be negatively affected.” While costs of imported solar equipment was indeed “artificially low,” imposing anti-dumping duty can seriously impede India’s ambitious solar energy program, the renewable ministry further warned. Some investors, however, do not want to lose out on the prospects of a potentially huge market should the policy paradigm for equipment manufacturers turn favorable.

Baba Ramdev-led Patanjali Ayurveda, known for its swadeshi FMCG products that is giving companies such as Nestle and Hindustan Unilever a run for their money, has ventured into solar manufacturing. The company is investing Rs. 1 billion to build a facility at Greater Noida near New Delhi that will be inaugurated in January. Patanjali’s strategy, it would seem, is to develop expertise in the field and scale up in future should the opportunity arise. It is unlikely that such a scenario will emerge in the near future.