Global stocks gain as markets eye US stimulus talks

New York (AFP) – Global stocks rose Thursday on revived hopes for US stimulus despite mixed signs on the state of negotiations in Washington and rising worries about the coronavirus in Europe that have prompted fresh restrictions.

After stocks jumped Wednesday following President Donald Trump’s about face on stimulus talks, equities gained again as Trump on Thursday put the odds of a deal as “really good.”

But House Speaker Nancy Pelosi brushed aside narrowly-tailored legislation to support airlines, saying such measures were dead unless included in a broader bill, a prospect Republicans oppose.

The broad-based S&P 500 climbed 0.8 percent, with analysts offering different explanations for the rise.

Thursday’s gains reflect the market’s confidence that, at the end of the day, there will be stimulus, said TD Ameritrade’s JJ Kinahan.

“The hope is that throughout the weekend or early next week, we can get something done,” he said.

But Briefing.com analyst Patrick O’Hare said the market is finding other reasons to push higher and doesn’t see a stimulus as likely even if Pelosi strikes a deal with Treasury Secretary Steven Mnuchin, given opposition in the Republican-controled Senate.

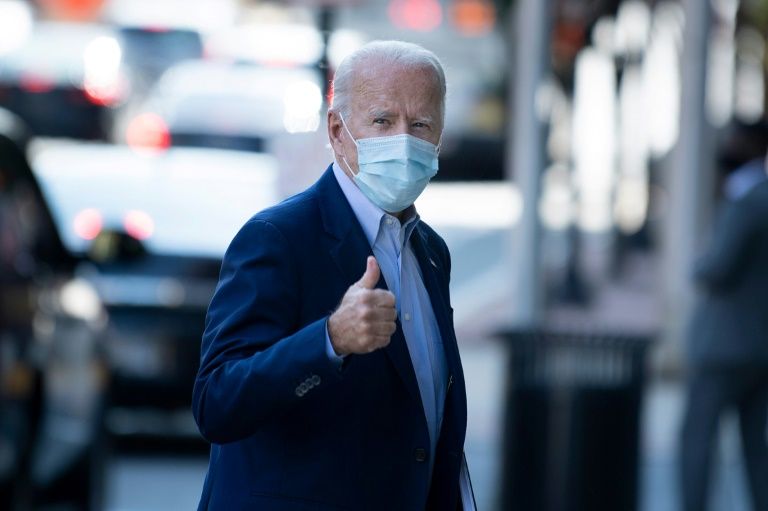

O’Hare said the market has become more confident the US election will not be contested following recent polls showing challenger Joe Biden with a widening lead.

Investors have also taken heart from Trump’s improving health, believing his apparent recovery from Covid-19 after taking experimental drugs gives hopes that such therapeutics could be effective.

“The market is getting around the idea that (coronavirus) is treatable,” he said. “The market is not living on the notion that it needs to get this stimulus now.”

– Europe in Covid-19 crosshairs –

Earlier, European equities also advanced despite rising concerns about coronavirus on the continent.

Madrid’s top court struck down virus restrictions on millions in the Spanish capital, while France put four more cities on its highest alert as European governments battled to control a sustained surge in virus cases.

Records are tumbling across the continent — even in Germany, which has been praised for its handling of the crisis but which logged more than 4,000 new cases in a day for the first time since April.

“It’s possible that the virus will spread uncontrollably,” said Lothar Wieler, the head of Germany’s Robert Koch Institute for disease control.

Among other markets, oil prices jumped, in part due to speculation that Hurricane Delta, the latest storm in a busy season, could pummel platforms in the Gulf of Mexico.

More than 90 percent of the region’s crude oil production was taken offline ahead of the strengthening storm, according to news reports.

– Key figures around 2100 GMT –

New York – Dow Jones: UP 0.4 percent at 28,425.51 (close)

New York – S&P 500: UP 0.8 percent at 3,446.83 (close)

New York – Nasdaq: UP 0.5 percent at 11,420.98 (close)

London – FTSE 100: UP 0.5 percent at 5,978.03 (close)

Frankfurt – DAX 30: UP 0.9 percent at 13,042.21 (close)

Paris – CAC 40: UP 0.6 percent at 4,911.94 (close)

EURO STOXX 50: UP 0.7 percent at 3,255.76 (close)

Tokyo – Nikkei 225: UP 1.0 percent at 23,647.07 (close)

Hong Kong – Hang Seng: DOWN 0.2 percent at 24,193.35 (close)

Shanghai – Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1758 from $1.1765 at 2100 GMT

Pound/dollar: UP at $1.2933 from $1.2919

Dollar/yen: UP at 106.03 yen from 105.98 yen

Euro/pound: DOWN at 90.91 pence from 91.05 pence

West Texas Intermediate: UP 3.1 percent at $41.19 per barrel

Brent North Sea crude: UP 3.2 percent at $41.99 per barrel

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.