Huge Spike in Crypto Scams, Over $1 Billion Lost Since 2021 – Youth Most Likely to Report a Loss: FTC

Since the start of 2021 through June 2022, people have reported losing over $1.3 billion in cryptocurrency to scams. Nearly half say the scam began with an ad, post, or message on social media. The largest share of the losses, about $785 million, involved bogus investment opportunities. Cryptocurrency was the payment method used for about one in every four dollars reported lost to fraud during this period.

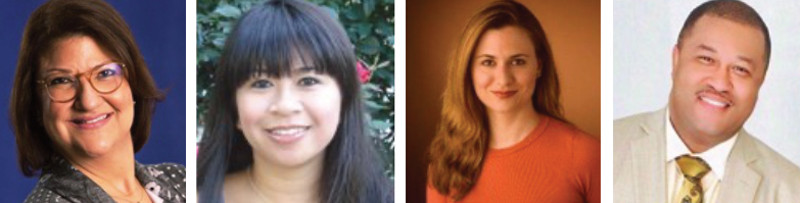

At a joint briefing by Ethnic Media Services and Federal Trade Commission, Sept. 9, FTC experts – Rosario Mendez, Senior Member, FTC; Elizabeth Kwok, Assistant Director of Litigation Technology & Analysis, Bureau of Consumer Protection, FTC; and Cristina Miranda, Consumer Education Specialist, Division of Consumer & Business Education, Bureau of Consumer Protection, FTC; and Jeffrey Vaulx, a Memphis Teacher, who shared a personal story – will explain how cryptocurrency scams work, why they are growing so fast, and what the latest “trending” scams are.

Speakers also talked about which population groups are most at risk, how to spot and avoid cryptocurrency scams, and how to report them.

Rosario Mendez, a senior member at the Federal Trade Commission (FTC) began with praising the media, “Play a critical role in helping us alert people and also businesses about the rights and responsibilities in the marketplace.

“At the FTC, we want to make sure that everyone gets the information that they need to be able to make the best decisions that they can as consumers and to spot problems like scams or bad business practices and report those to us.

Mendez introduced the first speaker, Elizabeth Kwok

“Our first case involving cryptocurrencies was as far back as 2014. For starters, cryptocurrency is a digital currency that exists primarily electronically. Cryptocurrency is very analogous to other forms of digital currency, for example, airline miles, or rewards points on your credit cards. They function in a very similar way. They’re a digital asset that you’re able to transmit online.

“Cryptocurrencies are different because of how they’re created. Cryptocurrencies are created through a different technology that was originally created in 2009, or thereabouts. They exist online and you almost never see any physical token.

“There are a couple of exceptions to that such as Bitcoin ATMs, where you can get a physical card or kind of representation of your Bitcoin holdings. But those are not terribly common and they’re unique to a particular set of people if you will, for example, I think there’s a lot of them in places like Puerto Rico, where some communities have cropped up of people who are interested in almost living off the grid and having this total kind of alternate community-based on using cryptocurrencies.

“In any case, primarily all cryptocurrencies exist digitally only, so you never have a physical item that represents your cryptocurrency.

“Secondly, it is meant to be a peer-to-peer system, so you are sending your cryptocurrency back and forth directly to the person you’re either paying or getting funds from. There is no middleman, typically that is kind of the whole spirit of cryptocurrencies is.

“It was meant to create a financial system where individuals could interact without having to set up accounts; without having to give over information about your identity, and that is one of the hallmarks of cryptocurrencies.

“There are centralized places now that are more user-friendly, places like Coinbase, where you can go online and purchase different kinds of cryptocurrency. Those do have a central aspect.

“Speaking of different kinds of cryptocurrencies, it’s not just Bitcoin. There are lots of cryptocurrencies. Every day there’s a new one because it is based on software and so people are creating new ones on a regular basis to be whatever it is they want to be.

“Shiva Inu is a breed of dog. It was on this viral online meme; somebody thought it would be funny to turn that into a cryptocurrency. Now Dogecoin, as of early September, is worth four million. There are four million dollars worth of Dogecoin out there.

“It’s very important to understand that there are hundreds of cryptocurrencies and some of them have very specific uses. There is a lot of value, as of early September, there was 35 billion dollars, worth of Bitcoin, existing in the world.

“It is followed closely by Ether, which there’s 17 billion dollars, worth. It’s important to comprehend the scale of money that is being interacted here. We think of cryptocurrencies, as over. ‘This crazy thing, it’s going to go away, or maybe it’s just that people use it for dark web, or things like that,’ but it has become a very large financial system of its own.

“The important differences between cryptocurrencies and U.S. dollar is cryptocurrencies are not backed by a government whereas for the U.S. dollar there is the Fed, but you also have insurance on your deposits. There is no such thing typically for any cryptocurrency.

“Cryptocurrencies just exist. We have all heard of the volatility with Bitcoin, Ether, Dogecoin, there is nobody overlooking the system to make sure that the value is stable and that consumers can rely on it for any particular purpose.

“Similarly, if you know there’s a run on a particular exchange, such as Coinbase, there’s no government entity that’s going to step in and make sure that consumers can get their money back.

“The values are changing all day long, sometimes they change on an hourly basis, but certainly day to day. The volatility, especially over this last year, we’ve been in this period they’ve termed the ‘crypto winter,’ where Bitcoin has dropped to the low thousands, whereas it started the year in the mid 20’s. It has been as high as $60,000 for a Bitcoin and so there is just this huge amount of volatility.

“A lot of consumers may hear that out there but they don’t comprehend just how much they could have at risk and so it also truly means that you can’t rely on cryptocurrency as a currency to transact and trade for purchasing goods or services because it’s simply just not that stable.

“There is no middleman when you’re using cryptocurrencies. If you choose to pay somebody in cryptocurrency, you need to think of it like cash. The only way you’re going to get that back is if the person sends it back to you, so um if I accidentally send Bitcoin to the wrong person, unless that person sends it back to mem there’s nobody to help me.

“How do people use cryptocurrencies – it’s an investment, and a speculative one at that. Right now, the real big, kind of lion’s share of use, if you will, of cryptocurrency, is as a way to gain wealth and a lot of people are holding Bitcoin, or Ether, or Ripple, with the hopes that the value goes up and then you can sell it.

“As a matter of fact, that’s what a lot of the more traditional financial entities are allowing their consumers to do. It’s really viewed as an investment vehicle, not as a form of payment. But that is kind of quick payments is supposed to be one of the great advantages of cryptocurrencies, in theory you should be able to use it to send very small amounts of money with no fees.

“One of the great uses of Bitcoin for example was that you could use it for cross-border payments. The idea being that a lot of times you want to send just a couple of dollars.

“If you’re in a developing country, your transaction level amounts are very small. They’re usually a couple dollars once you do the exchange and to do so through a traditional financial service, is very expensive, but if you can do this peer-to-peer system, where I can just send you exactly what you need, with no fees, you remove that difficulty of being able to send these small payments, but also speed is important.

“The idea behind using the blockchain technology is that I send it over, there’s no middleman, nobody is sitting there to check your credentials because it’s based on software. It’s all just self-run, and once you hit that ‘send’ button, the software runs. It does its business and then your funds go through.

“The anonymity of it, meaning because this is a system with no middleman, there is no registry of who you are, and who is sending what. When you do look at the ledger, which is how transactions are tracked, think of it like your checkbook. It has the log that you’re supposed to write down whatever check you write with the amount, and who it is, so that you can balance your checkbook, to make sure you had enough money. This is the digital version of that. It’s called the ledger.

“Every single transaction involving, for example Bitcoin is on the Bitcoin blockchain, and when those transactions go through, certain pieces of information are recorded, such as your wallet address, it’s equivalent to your PayPal email address. Every transaction will have that piece of information logged, and the reason I raise that is because theoretically, you can analyze the blockchain data, this ledger, and start to put together a picture of a person who’s sending multiple transactions.

“The idea that the blockchain or bitcoin or cryptocurrencies as a whole class are anonymous, it’s not true. It is more anonymous than traditional financial service, but there are still ways to put together patterns and identify people, if you will.

“The last one is just avoiding fees. A very basic benefit of this system is that everybody just gets to use it, you don’t have to pay anybody a fee to send money back and forth,” said Kwok.

How does cryptocurrency work?

“At a very high level, this is all based on software and when you want to send money to somebody else, you either open an app on your phone, go online to a browser window on your computer, and you choose your method. If you have the software running on your computer or want to go to a website like Coinbase, pick your starting point.

“You go there, you access your account that has the funds in it, which is called your wallet, and then you tell it what you want to do – ‘I want to send half a Bitcoin to Christina’ and then you do that.

“In the background after all that happens, this information gets added to that ledger, I mentioned, and then the software validates all the information again. There’s a lot of work happening in the background in the software, but all of this gets validated. It usually takes about 10 minutes. At the conclusion of that approximate 10 minutes, your transaction is validated, and then the ledger has been updated to show that I sent half a Bitcoin to Christina, but in the meantime, she has also gotten her funds and we’re all on our merry way.

“The whole concept of cryptocurrencies is built on this underlying software that is run across all users’ computers, and the magic, if you will, of this underlying technology is that all the computers are constantly updating this ledger, and so they all have to agree on the latest piece of information which is why blockchain technology is shared and lauded as a possibility of the future, because it can’t be manipulated.

Therefore, that software is particularly valuable, if you will, for security and validation purposes,” said Kwok.

“In 2018, there was just $12 million reported cryptocurrency losses to scams but that has jumped exponentially to $680 million in 2021. There were $653 million worth of cryptocurrency losses to scams; investment related fraud at $785 million; followed by romance scams at $220 million; and then we also have business imposters and government imposters with $121 million and $56 million dollars in total reported losses.

“These figures are based on fraud reports to the FTC’s Consumer Sentinel Network from January 2021 through June 2022 and indicates cryptocurrency as the payment method,” said Cristina Miranda, consumer education specialist at the FTC.

Why have cryptocurrency scams taken off?

“The basic reason is that there is no bank or centralized authority on this. A lot of these transactions that happen, are irreversible. Also, a lot of people are getting scammed because they are unfamiliar with how cryptocurrency really works, so they also jump in with lots of enthusiasm around crypto and investing, and there’s this fear of missing out on something that they believe can make them a lot of money. We also note that social media and crypto is a very combustible combination that tends to lead people into becoming scammed,” said Miranda.

How to avoid cryptocurrency scams?

“As we know scammers are constantly finding ways to steal money so a sure sign of a scam is basically if you see a tweet, or a text, email, or a message on social media, from anyone, that says you need to pay with cryptocurrency, by wire transfer, gift card, they’re always going to be a scammer.

“If you pay with these methods, there’s almost no way to get the money back, which is what scammers are mostly counting on,” said Miranda.

The types of cryptocurrency scams

“We’re seeing an alarming growth of reported cryptocurrency losses to scams, and the biggest one is investment-related fraud or investment scams. This usually happens when you come across a company or person that promises earning lots of money in a short time to achieve financial freedom, and they share a lot of these common signs which are, fake promises to make lots of money in a short amount of time, and a lot of false guarantees, or zero risks.

“You need to look for the claims that scammers make. Those claims are – scammers will guarantee that you will make money; they’ll promise that you will make a profit; and that’s usually a scam even if it’s accompanied by a celebrity endorsement or some type of testimonial, because a lot of those endorsements or testimonials can be easily faked.

“Another type of claim is that the scammers will promise big payouts with guaranteed returns, but no one can guarantee that you will make money, or get a set return, much less on a very short amount of time.

“Scammers are also very good at promising free money. They’ll promise it in cash or cryptocurrency, but free money promises are always fake, and lastly with what another claim is that scammers will often make claims without a lot of details or explanations.

“Please do your research to understand how it works and ask questions about where your money is going. Honest investment managers and advisors will want to share that type of information and will always back it up with details.

“Another type of investment scam, although it can go two ways, is Roman scams or online dating scams. These are when scammers contact them on online dating sites or apps and they start telling stories to try to tap into the emotions of the people that they are targeting. They start charming people, talking about wealth sophistication, they try to make that meaningful connection and then what we’ve seen, is that they start giving advice and start offering help with cryptocurrency investing. Then they’ll often ask for money. If you send them cryptocurrency, they’ll help you invest.

“The thing here is that if someone that you haven’t met in person, messages you a money request on a dating a site, or an app, demanding that you send cryptocurrency, the money will typically be gone, and you usually cannot get it back.

“Impersonator scams are scammers sending unexpected texts impersonating well-known companies like Amazon or a security alert might pop up on some person’s computer that looks like it’s a message from a company like Microsoft. What happens is if you click on a link on any of the text or if you call the number on that pop-up you’ll be connected to a scammer that tells you about fraud on your account and that your money is at risk. Other scammers like to impersonate government agencies and will say well that your accounts or benefits will be frozen as part of some type of an investigation. We’ve also seen reports of scammers who will call impersonating a local utility company with some problem. They might often say that ‘you won the lottery, or some sort of a prize, but you need to pay to obtain this type of prize,’ they will often demand that people withdraw money from their bank, their investments, or their retirement accounts, to protect their money by paying them with cryptocurrency to resolve whatever issue that they’re calling about.

“Sometimes these scammers will tell the people to stay on the phone and direct them to a store with a cryptocurrency ATM machine. Then they will be instructed while they’re still on the phone with the scammer, to insert money into that machine to pay. They’ll be told to send the cryptocurrency bot on the crypto ATM by scanning a sort of QR code that is sent to them by the scammers, but obviously the QR code will lead right into the scammers’ wallets, and by that time the money is gone.

“Two other types of cryptocurrency scams that are worth mentioning are job scams and blackmail emails.

“As for job scams, some scammers might list fake jobs on websites or send unsolicited job offers to help recruit cryptocurrency investors, sell cryptocurrency, mine cryptocurrency, or basically help them with converting cash to Bitcoin, or another digital currency. They will promise people a job but ‘only if you pay them first.’ I pay a fee first and they’ll end up usually taking the person’s money and the person’s personal information.

“Blackmail emails are not seen as often but this was prevalent when we started tuning into cryptocurrency type scams. This basically happens when a scammer sends an email or a letter saying that they have embarrassing or compromising photos, videos, or some type of personal information about them, and then they threaten to make it public unless they are paid in cryptocurrency.

“What we would like to tell people is that this is obviously blackmail in a criminal extortion attempt, and it’s very important to report it to the FBI immediately.

Where do you go to report all these types of scams?

“You go to reportfraud.ftc.gov.

“It’s very important to report fraud, especially in the various communities across the United States and in Puerto Rico, because this is how we can help each other see what types of fraud and scams are happening in these communities so that we can try to do something to stop it.

“It is important to report fraud to us at the Federal Trade Commission.

“You should also report this type of fraud cryptocurrency scams to the Commodity Futures Trading Commission at cftc.gov complaint.

“You can also report it to the U.S. Securities and Exchange Commission at sec.gov.

“It’s also important to tell people that if they have a cryptocurrency loss, they should also report it to the cryptocurrency exchange company that they used to send the money in the first place.

“We also have many resources available at http://ftc.gov/cryptocurrency.

“You can also get alerts to sign up for the latest cryptocurrency scams at ftc.gov/consumeralerts,” said Miranda.

Jeffrey Boakes, a teacher in Memphis, Tenn., spoke from his classroom to share his story and put a human face on this very rapidly and dangerously growing scam.