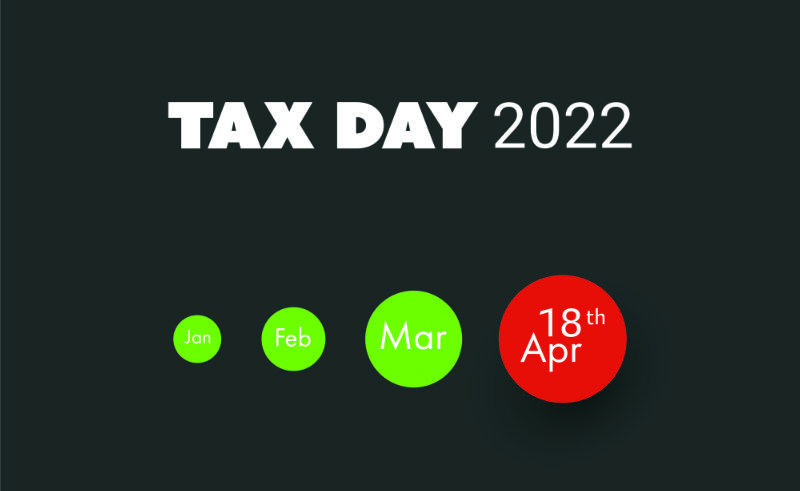

Changes For 2022 Tax Season

Tax season officially opened on Jan. 24 and the Internal Revenue Services will start issuing refunds after February 15th. For the early bird tax-filers, this means receiving payments in March. A friendly reminder, taxes are due by April 18 of this year. As of now, the I.R.S. is not considering any extensions.

Speakers

- Chuck Rettig, IRS Commissioner

- Ken Corbin, Wage and Investment Division Commissioner and Chief Taxpayer Experience Officer

“It is our intent that filing is as smooth and easy as possible. We want to make certain that consumers are getting all the credits and refunds they are eligible to receive.”

- Chuck Rettig, I.R.S. Commissioner

Rettig recommends filing electronically and using direct deposit since paper returns experience the greatest delays. In general, it takes 21 days to issue a refund after the tax return has been processed.

Online tax filing could be costly. Fortunately, the IRS has a free file program available to those with an Adjusted Gross Income of under $73,000.

The IRS recommends using the free file program at: https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

If internet access is a problem, the IRS offers the Volunteer Income Tax Assistance program, also known as VITA. The service is available to seniors, people with disabilities, Non-native English speakers, and those who earn less than $58,000 annually. VITA is available by phone or a local IRS office. The service is offered in 350 languages.

Several VITA sites are located at community centers. https://www.irs.gov/individuals/free-tax-return-preparation-for-qualifying-taxpayers

Rettig advises against using any other site besides IRS.gov, to avoid any potential scams.

Ken Corbin highlights several changes to the Earned Income Tax Credit program, allowing more people to utilize it. For families without children, the benefit has increased to a maximum of $1,529. Almost triple from the 2020 tax season.

There has also been an increase in credit for families with children. A qualifying child allows for a maximum credit of $3,733 if the household income is under $43,492. Two qualifying children allow for a maximum credit of $6,164 if the household income is under $49,399. Families with more than two children and a household income below $53,000, can receive a maximum credit of $6,935.

Another change for EITC is the lower minimum to qualify. The age has been lowered from 25 to 18, allowing minors who have aged out of foster care or are experiencing homelessness to qualify for the credit.

People with investment income under $10,000 may also qualify for EITC this year, given they meet the household income guidelines.

Corbin also points out that the Economic Impact Payments sent out last year is not considered taxable income, however, it must still be reported on the tax return.

Both speakers addressed the infamous scam IRS calls. They noted that an IRS officer will not call by phone without advanced notice. Corbin advises against accepting any suspicious text and/or call, especially if they ask for bank details or request payments through gift cards.

Consumers can read more about IRS scams at https://irs.gov/newsroom/dirty-dozen

Corbin makes a public appeal and shares the IRS’ goal: “we meet our taxpayers in the communities where they live and to expand options and choices.” To meet that goal, the IRS is hiring and looking for those fluent in a non-English language.

Job seekers can search for open positions at the agency: usajobs.gov