Buh-Bye COVID. Hello Inflation.

With the end of the COVID-19 pandemic on the horizon, a new worry for the middle class has loomed: inflation. With prices soaring exponentially for consumer goods and necessary services, the middle class in America faces yet another hurdle since the beginning of this decade. In a press briefing, experts share the effects of the widening income gap and ways to mitigate the risk of the middle class sliding down the socio-economic ladder.

The enveloping question: is the middle class eroding due to inflation?

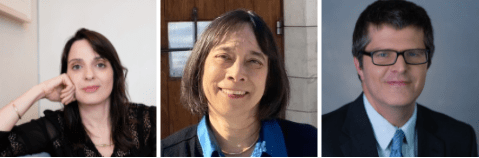

Speakers

- Alissa Quart, Executive Director of the Economic Hardship Reporting Project, and author of Squeezed, Why Our Families Can’t Afford America and soon to be released Bootstrapped, Liberating Ourselves from the American Dream.

- Penny Wang, Deputy Editor, Special Projects-Money, Consumer Reports

- Josh Bivens, Director of Research for the Economic Policy Institute

Everyone is impacted by record inflation. With exponentially rising gas prices, rising costs on food and medical care, and exorbitant housing costs, inflation is appending to our daily living, since the beginning of the Biden administration. Experts believe that reducing unemployment rates and closing racial disparities in income should be the goal of policymakers to reduce the impact of inflation.

In all this havoc, there is some good news. Despite the economic impact of the pandemic, experts believe that inflation should start to wind down by mid-2022.

Defining Today’s Middle Class

Alissa Quart highlights how destabilized the middle class is in America. Defining them as “precariat,” Quart explains the middle class is “…a cross between the proletariat and the precarious. It’s when the middle class (51% of the population) looks like the unstable working class in terms of contingency, job anxiety, economic doubt, inability to pay basic fees and rents.” The middle class faces the most significant impact of inflation on transportation, housing, and medical care costs.

An eye-opening statistic pointed out by Quart – 40% of US workers have experienced job instability and inequality since the start of the pandemic. For example, the media industry has dealt with 27,000 job losses.

Decoding Inflation

Penny Wang provides a simpler context to inflation. Wang highlights, “One reason that prices are going up now is that there’s a lot of cash sloshing through the economy.” People’s spending habits and financial plans have changed since the beginning of the pandemic.

Although over 90% of Americans are seeing rising prices for all goods and services, gas and groceries appear to be the biggest pain points for consumers. Wang says there is no “silver bullet” for solving the rising prices. Wang suggests that families just need to adapt and budget for the time being.

For struggling families, some programs can help aid with living costs. Wang highlights the American Connectivity Program which can aid in paying for internet service.

The biggest concern, according to Wang, is housing costs. “That’s going to have to be something that policymakers and advocates really push on.”

Solving Inflation

Josh Bivens cautions, “There’s no knob you can turn that only reduces inflation without having consequences for lots of other things we care about in the economy as well, like sustaining job growth, and how able people are to get wage increases.” Bivens reckons that solving inflation requires understanding the reason behind the rising prices.

Bivens emphasizes that the economic shock of COVID was witnessed on a global level. “We have inflation, because COVID imposed extreme distortions on the economy, both on the demand side and the supply side.” Bivens attests that inflation is going decelerate significantly, by itself “We have started to delink economic activity from COVID.” Bivens alludes to January’s Omicron spike. Although we witnessed a significant spike in COVID-19 cases in the United States, concurrently, 470,000 new jobs were created.

Bivens believes that tackling unemployment and bridging racial income disparities should be the core focus for economic stabilization. “We came into the pandemic with crazy disparities by income group by race. None of them got better during the pandemic, and we haven’t done anything, in the long run, to really push them back together. (Low) unemployment is one of the few things that actually does help racial disparities a little bit, it pushes wages closer together. We should always be searching for it.”

Final Thoughts

With the aftereffects of the pandemic whiplashing the economy, the middle class of America has to endure rising prices on consumer goods and services. The good news is that inflation will decelerate significantly by the middle of 2022 as the economy starts to stabilize. Experts believe that policymakers should focus their efforts on job creation and bridging the income gap that America faces today.