Wirecard shares bounce back after denying fraud allegations

Stocks in Wirecard fell sharply last week in reaction to two Financial Times reports on alleged fraud (Christof STACHE)

Singapore (AFP) – Shares in German payment services firm Wirecard rebounded sharply in Frankfurt Monday, after the company issued a strong denial of fraud allegations reported last week.

The stock gained 12.2 percent by 10:40 am (0940 GMT) to trade at 121.75 euros ($139.40), topping the DAX index of blue-chip shares.

In a statement, Wirecard said it had hired Singaporean law firm Rajah and Tann to investigate allegations of fraud by an employee in the city-state, reported last week by the Financial Times (FT).

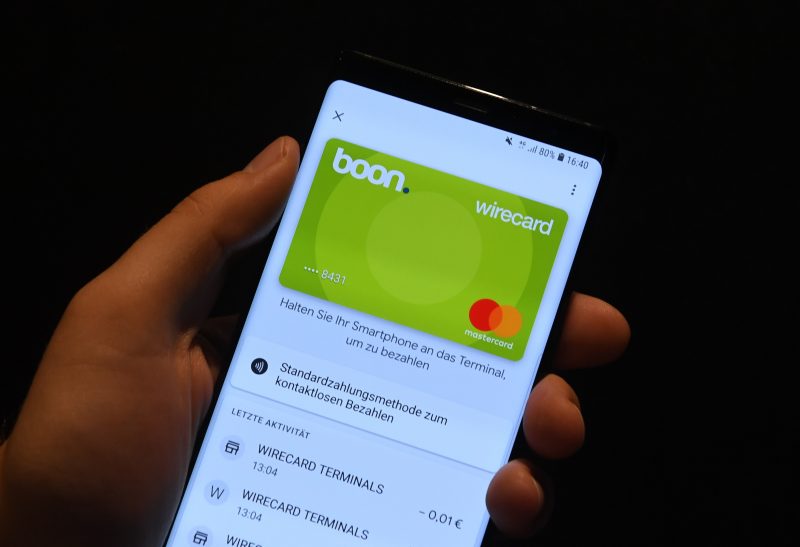

Shares in the firm, whose products range from software for processing online payments to card terminals for shops and creditworthiness checks, lost more than 30 percent of their value last week.

An internal probe had already “found no evidence to support the allegations and concluded that they were unfounded,” the company added.

“Furthermore, there were indications that the allegations could be related to personal animosity between the employees involved,” Wirecard said.

The company’s renewed denial of the allegations comes after Singaporean police said they were launching their own investigation.

In an emailed statement to AFP Monday, a spokesperson said police were “looking into the matter.”

In Singapore, a regional finance hub, the police’s Commercial Affairs Department carries out investigations on financial crimes such as money laundering.

The FT reported last week it had seen documents from Rajah and Tann citing evidence of “serious offences of forgery and/or of falsification of accounts/documents”.

“There are reasons to suspect that they may have been carried out to conceal other misdeeds, such as cheating, criminal breach of trust, corruption and/or money laundering,” the document seen by the FT said.

At the time, Wirecard blasted the newspaper’s reports as “inaccurate, misleading and defamatory”.

On Monday, it released a letter from Rajah and Tann saying the law firm’s investigation is “ongoing”.

“To date we have made no conclusive findings of criminal misconduct on the part of any officer or employee” at Wirecard, the lawyers said.

In Germany, financial markets watchdog Bafin said Thursday it was launching an investigation into possible market manipulation over the story.

Wirecard stunned the traditional German banking sector last year by displacing banking stalwart Commerzbank from the prestigious DAX index.

Hailed as a champion of the “fintech” (financial technology) scene with its software for cashless and contactless payments, it then boasted a market valuation of more than 23 billion euros — outweighing even giant Deutsche Bank.

burs-tgb/dlc/rl

Disclaimer: This story is published from a syndicated feed. Siliconeer does not assume any liability for the above story. Validity of the above story is for 7 Days from original date of publishing. Content copyright AFP.