US stock defy consumers, hurricane to post new records

New York (AFP) – Major Wall Street indices again posted new records on Tuesday, shrugging off worrying signs in US consumer confidence data and a hurricane’s approach towards a major oil-producing region.

For the third consecutive session, the S&P 500 and Nasdaq both posted new all-time highs, with the latter tech-rich index approaching 40 records for the year.

However the benchmark Dow Jones Industrial Average was left out of rally, retreating 0.2 percent.

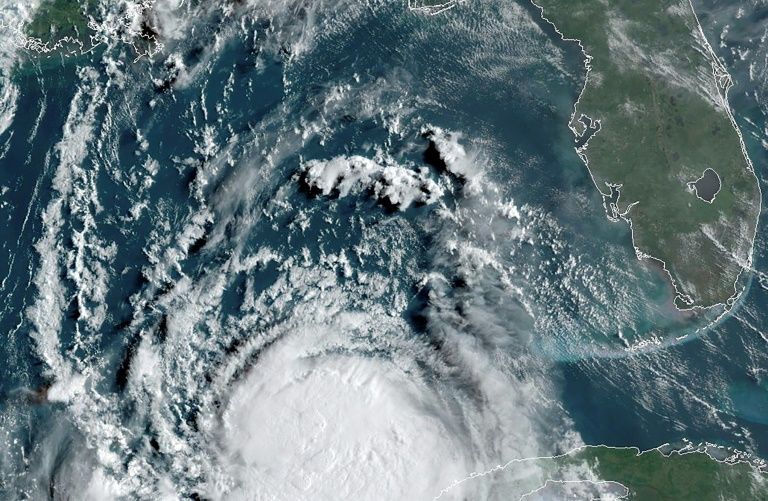

Oil prices held on to their gains as Hurricane Laura churned through the Gulf of Mexico, threatening US oil installations.

That was not yet enough to spook traders in the United States or Europe, who were in an upbeat mood after China and the US said top representatives had held a phone call on the “phase one” trade agreement they signed in January.

There had been concerns about the future of the deal as the Washington and Beijing’s relationship grows increasingly fraught over irritants including Hong Kong, the coronavirus, Huawei and TikTok.

“The market is driven by technical momentum right now, bullish momentum, more than fundamental factors,” said Karl Haeling of LBBW. “But at the same time the market is a bit overextended.”

Dueling data releases showed the precarious nature of the US economic rebound from the coronavirus pandemic.

There was a surge in July new home sales of 13.9 percent compared to the prior month, the metric’s third consecutive massive increase, according to government data, which echoed the massive jumps in existing home sales.

However, a closely tracked survey showed US consumer confidence deteriorated further in August as cases of the coronavirus continued to rise, with attitudes about the present and near-term prospects worsening.

“Given how reliant the US is upon domestic consumption, the dramatic collapse in consumer confidence does little to lift sentiment over forthcoming spending levels for US businesses,” said Joshua Mahony, a senior analyst at the online group IG.

– Where’s the vaccine? –

Global markets also had been underpinned by growing optimism that a coronavirus vaccine could be in the offing, and by an upbeat German business confidence indicator.

But with British pharmaceutical giant AstraZeneca “pointing towards a wait until winter 2021 for their vaccine, hopes of a speedy implementation could be ill-founded,” Mahony noted.

Trader’s attention turned towards a virtual meeting of central bankers in Jackson Hole, Wyoming, with the key event Thursday’s speech by Federal Reserve chief Jerome Powell.

“It feels like many market participants are sitting on their hands ahead of the Jackson Hole Symposium,” remarked CMC Markets analyst David Madden.

Investors hope Powell will provide an update on the world’s top economy and some forward guidance on his plans for monetary policy.

– Key figures around 2100 GMT –

New York – Dow: DOWN 0.2 percent at 28,248.44 points (close)

New York – S&P 500: UP 0.4 percent at 3,443.62 (close)

New York – Nasdaq: UP 0.2 percent at 13,001.99 (close)

London – FTSE 100: DOWN 1.1 percent at 6,037.01 points (close)

Frankfurt – DAX 30: FLAT at 13,061.62 (close)

Paris – CAC 40: FLAT at 5,008.27 (close)

EURO STOXX 50: DOWN 0.1 percent at 3,329.71 (close)

Tokyo – Nikkei 225: UP 1.4 percent at 23,296.77 (close)

Hong Kong – Hang Seng: DOWN 0.3 percent at 25,486.22 (close)

Shanghai – Composite: DOWN 0.4 percent at 3,373.58 (close)

Euro/dollar: UP at $1.1833 from $1.1788 at 2100 GMT on Monday

Dollar/yen: UP at 106.35 yen from 105.98 yen

Pound/dollar: UP at $1.3149 from $1.3063

Euro/pound: DOWN at 89.97 pence from 91.19 pence

Brent North Sea crude: UP 1.8 percent at $45.95 per barrel

West Texas Intermediate: UP 1.8 percent at $43.39

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.