US rules out any intervention on dollar: Trump advisor

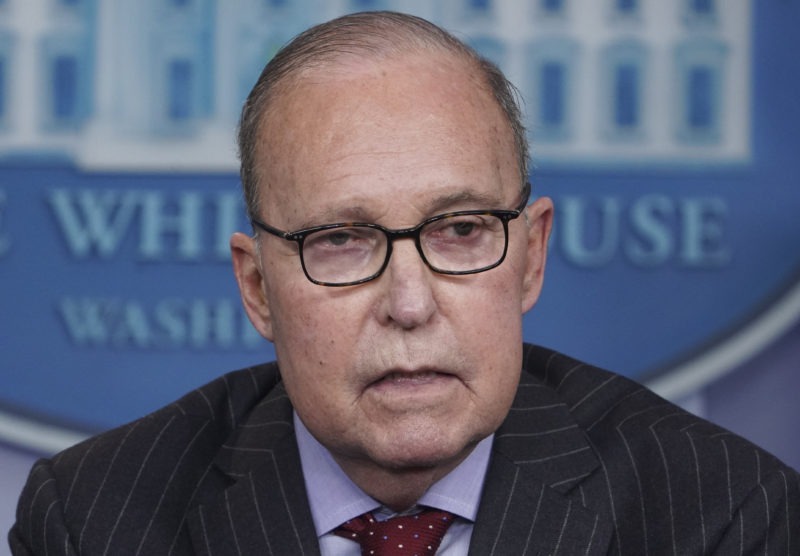

Director of the US National Economic Council Larry Kudlow said the US has the ‘hottest economy in the world’ (Mandel NGAN)

Washington (AFP) – The US government will not intervene to weaken the value of the dollar, despite persistent concerns about actions by other countries to influence their currencies, a top White House economic aide said Friday.

President Donald Trump met with his economic team in the past week and “we have, as a matter of policy, ruled out currency intervention,” said Larry Kudlow, head of the White House National Economic Council.

The fact the White House was even discussing intervention was a bombshell to some economists.

“The administration was seriously considering currency intervention. … That in itself is extremely concerning,” Gregory Daco of Oxford Economics said on Twitter.

“I see this as a key risk over the next 12 months,” he told AFP.

Trump has repeatedly accused countries like China and Germany of taking advantage of weaker currencies to boost exports to the United States but according to a report in Politico on Friday, he smacked down a push by White House trade hardliner Peter Navarro to weaken the dollar to compensate.

“China and Europe playing big currency manipulation game and pumping money into their system in order to compete with USA,” Trump tweeted earlier this month.

Adam Posen, a former central banker who leads the Peterson Institute for International Economics, said Kudlow felt obliged to go on record about White House policy amid increased recent speculation that Trump was considering launching an effort to move exchange rates.

He cautions that “if we start attacking the currency policy of Japan and China for doing quantitative easing or loose monetary policy, that that’s just going to backfire on us.”

The United States is growing faster than many of its major trading partners and as those economies slow their currencies will tend to lose value, making their exports more competitive.

The euro is relatively weaker than the dollar because the European economy is slowing but trying to counteract that is “probably going to cause more economic damage,” Posen told AFP.

– Trump doesn’t want weak dollar –

Amid signs the US economy has stumbled, in part due to Trump’s aggressive trade war, the Federal Reserve is poised to cut the benchmark interest rate next week, reversing what now appears to have been a mistaken increase in December.

Trump has blamed the Fed for raising interest rates, which increases demand for the dollar, but Kudlow disputed the claim the president wants a weaker dollar which would tend to make American exports be priced more favorably against foreign competitors.

“I don’t agree with your assertion that the president wants a weak dollar,” Kudlow told CNBC.

“He tweeted last week that the dollar is the dominant currency in the world and he wants it to stay that way.”

However, Kudlow said Trump is concerned about foreign countries that may be manipulating their own currencies lower to “try to gain some short-term temporary trade advantage. That we do not like.”

“In some cases we think there is manipulation” by other governments.

But the US Treasury’s twice-yearly report on currency practices has failed to find any cases of outright manipulation.

Still, Treasury has toughened its standards and the Commerce Department currently is considering a change in rules that would allow it to impose retaliatory tariffs on countries that have gained a trade advantage after manipulating exchange rates.

Demand for the US dollar remains high since investors worldwide buy dollar-denominated assets as a hedge against high inflation in their own countries, especially as US interest rates have risen over the past year.

“The steady, reliable, dependable dollar is attracting money from all over the world,” Kudlow said. “We are the hottest economy in the world, and I expect us to stay that way.”

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.