US manufacturing in April slowest since 2016

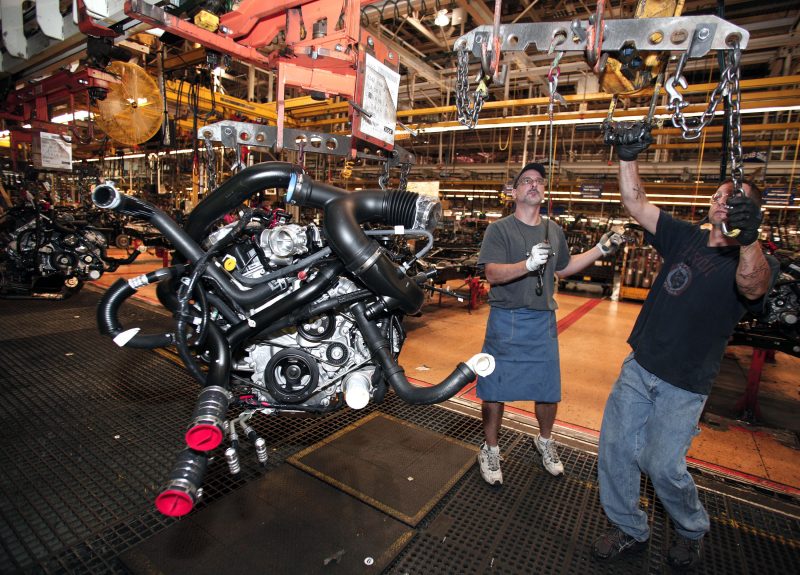

President Donald Trump’s trade war, a slowing global economy and a shortage of workers caused a slowdown in US manufacturing in April (BILL PUGLIANO)

Washington (AFP) – Slowing US production and weakening global demand in April sent US manufacturing activity to its weakest point in two and a half years, according to an industry survey released Wednesday.

The result showed that the months-long US labor shortage finally began to crimp output, while downtime for equipment maintenance and the slowing world economy also contributed to the disappointing result, according to the Institute for Supply Management’s monthly survey.

The ISM manufacturing index hit its lowest level since October 2016, as new orders and production slowed, while exports and imports both declined, the report showed.

The closely-watched headline index fell 2.5 points from March to 52.8 percent, markedly lower than analyst forecasts, and holding just barely above the 50-percent level which indicates growth.

Companies complained of continued uncertainty due to trade tensions and tariffs as well as President Donald Trump’s threat last month to shut the US-Mexico border.

The trade war Trump began last year has weighed on the US manufacturing sector, driving up input costs and eroding demand in export markets.

The April survey showed 13 industrial sectors reported expansion but five — apparel, primary metals, wood products, petroleum and coal and transportation equipment — reported contraction.

Employment also dipped 5.1 points to 52.4 percent as employers struggled to find qualified workers.

Export orders shrank for the first time in more than three years, likely feeding into a sharp drop in new orders for US-made goods, while imports fell for the first time since January 2017.

There still were some signs of steady demand, however, with an order backlog continuing to expand and customer inventories remaining too low.

Timothy Fiore, chair of ISM’s manufacturing survey, told reporters on the slowdown in production was in part due to equipment maintenance and a short supply of labor.

“Production could have been higher if we hadn’t been running at such a very high level for the last 30-something months and delayed some maintenance activities and the fact that we’re still struggling with employment,” Fiore said.

But he added that the slowing global economy was likely also weighing on the US manufacturing sector.

“When this whole manufacturing expansion started 32 to 36 months ago we were in what was synchronous growth, where most of the major economies of the world were all expanding and that’s just not the case anymore,” Fiore said.

Despite the disappointing result, Ian Shepherdson of Pantheon Macroeconomics said a rebound was likely in the coming months.

“It’s disappointing but not disastrous because the levelling-off in China’s PMIs in recent months strongly suggests that the incremental downside risk in the ISM from here is very limited,” he wrote in a client note.

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.