US, European stocks in record territory on stimulus, Brexit deal

Paris (AFP) – US and European stocks pushed into record territory on Monday, buoyed by a pandemic recovery package agreed in the US and Britain’s Brexit deal with the EU.

Wall Street also snapped higher, with the Dow, S&P 500 and Nasdaq Composite all pushing past record closing levels.

“The stock market is in a celebration mode this morning,” said Patrick J. O’Hare at Briefing.com.

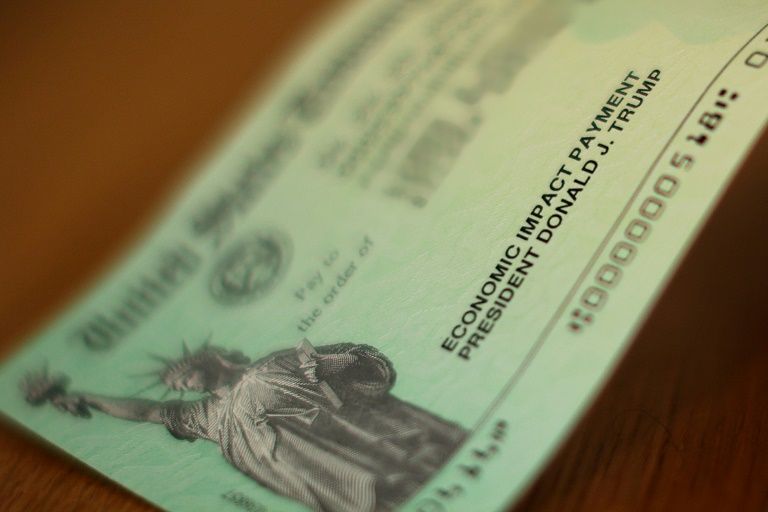

The jump came after US President Donald Trump signed a $900 billion (735 billion euros) stimulus bill late Sunday, averting a government shutdown and removing considerable uncertainty for the world’s largest economy.

Trump had previously refused to sign the relief package, arguing that it included wasteful spending.

Meanwhile in Europe, Frankfurt’s blue-chip DAX index set an intraday high of 13,818.65 points, topping the previous high set in February before the coronavirus pandemic forced Europe into lockdown.

It ended the day with a gain of 1.5 percent at 13,790.29 points, a record closing level.

In Paris, the CAC 40 rose 1.2 percent, while the stock market in London was closed for a holiday.

On December 24, Britain and the European Union agreed a post-Brexit deal that allayed the threat of disruption to business on January 1, when measures extending free trade are set to end.

EU states approved the measure on Monday and it will take effect provisionally while European lawmakers consider it after the start of the year.

The Brexit deal and the US aid package were pushing the DAX to “a new high”, said Jochen Stanzl, an analyst at CMC Markets.

The market is “breathing a sigh of relief” after the Brexit deal, independent analyst Timo Emden added.

Several EU nations including France, Germany, Italy and Spain began rolling out their first Covid-19 vaccinations on Sunday, although the supply is limited.

“For the markets, it remains crucial to get Covid-19 under control as soon as possible,” Emden said.

The DAX’s previous intraday high was 13,795 points in February, but it plunged to 8,255 points in March as the pandemic shutdowns battered Europe’s economy.

Markets recovered as restrictions on the economy were lifted in the summer and after central banks pumped billions in monetary stimulus into the economy, including 1.85 trillion euros by the European Central Bank.

– US shutdown avoided –

The emergency US package is part of a larger spending bill that, with Trump’s signature, will avoid a government shutdown on Tuesday.

The president’s turnaround came after a day marked by calls from across the political spectrum for action to avert a financial and social disaster in the world’s largest economy, especially among the most vulnerable.

“For Americans that have been endlessly checking their mailboxes for a stimulus check, this is the best holiday present anyone could ask for,” said Axi strategist Stephen Innes.

“The stimulus balloon will allow the markets to navigate better the number of new air pockets… due to the virus’s latest variant,” he added.

Markets have recently been shaken by the news of the emergence of a new variant of the coronavirus that authorities believe may spread more easily.

Asian markets traded mixed on Monday.

– Key figures around 1630 GMT –

New York – Dow: UP 0.8 percent at 30,431.74 points

Frankfurt DAX 30: UP 1.5 percent at 13,790.29 (close)

Paris CAC 40: UP 1.2 percent at 5,588.30 (close)

EURO STOXX 50: UP 1.0 percent at 3,578.04

London – FTSE 100: UP 0.1 percent at 6,502.11 (Thursday close)

Tokyo – Nikkei 225: UP 0.7 percent at 26,854.03 (close)

Hong Kong – Hang Seng: DOWN 0.3 percent at 26,314.63 (close)

Shanghai – Composite: FLAT at 3,397.29 (close)

Pound/dollar: DOWN at 1.3449 from $1.3533 late Friday

Euro/pound: UP at 90.85 from 89.98 pence

Euro/dollar: UP at 1.2216 from $1.2179

Dollar/yen: UP at 103.89 from 103.70 yen

West Texas Intermediate: DOWN 0.3 percent at $48.10 per barrel

Brent North Sea crude: DOWN less than 0.1 percent at $51.25 per barrel

burs-rl/cdw

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.