Stocks climb, dollar drops after Trump stimulus assault

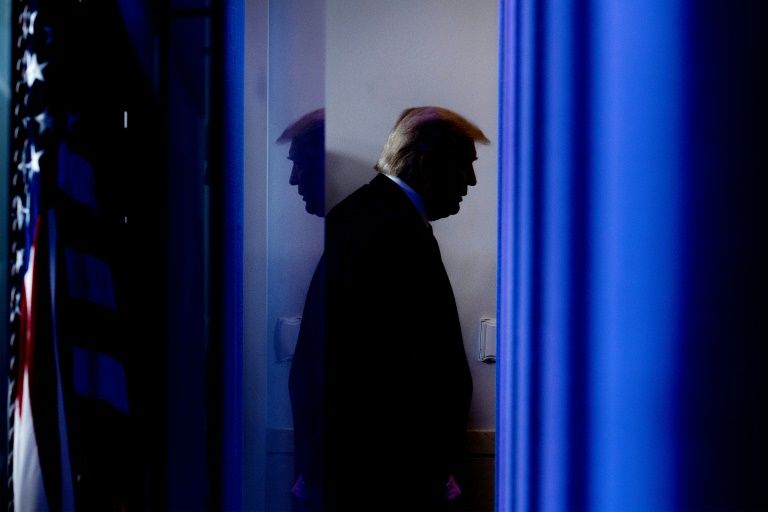

Donald Trump hit out at the $900 billion stimulus package agreed this week and told lawmakers to make amendments. ©AFP JIM WATSON

London (AFP) – Stock markets rose and the dollar fell Wednesday after US President Donald Trump called a key US stimulus package “a disgrace” and told lawmakers to fix it.

The pound won back ground on post-Brexit trade deal hopes meanwhile.

Oil prices edged higher after big losses this week as coronavirus cases surged across the planet and a new strain was reported in the UK.

That forced governments to impose tight restrictions and lockdowns to contain the disease over the holiday period.

“Even though the Trump news is a bump in the road, there is some hope that a deal will eventually be put into place,” said CMC Markets analyst David Madden.

“Stock markets in Europe are broadly building on yesterday’s gains, even though the health crisis is still rumbling on and there has yet to be a deal agreed between the UK and the EU.”

Asian stock markets closed mainly higher, and the Dow Jones index was 0.5 percent stronger in early trading.

The worrying spike in infections has overshadowed the rollout of vaccines and news at the start of the week that Congress had finally hammered out an economic rescue package worth around $900 billion.

However Trump rejected the package as not doing enough for families and told Congress to rethink it, raising the possibility of it being held up until after Christmas.

“It really is a disgrace,” he said in a video message posted on Twitter.

He demanded that individuals receive relief cheques totalling $2,000, up from $600 — with couples getting $4,000.

Looking ahead, Axi analyst Stephen Innes warned the first quarter of 2021 could be a struggle for markets.

“Even with the vaccine rollout getting underway, people have become polarised into one of two groups — those ready to travel now and those who are not prepared for six months or more.

“With the new variant of the virus unleashing its wrath on the UK, it is not a stretch to assume that the percentage of those ready to travel anytime soon will drop.”

Investors are keeping an eye on post-Brexit trade talks as British and European Union negotiators struggle to find common ground ahead of a year-end deadline.

– Key figures around 1430 GMT –

London – FTSE 100: UP 0.1 percent at 6,458.20 points

Frankfurt – DAX 30: UP 1.9 percent at 13,558.18

Paris – CAC 40: UP 0.9 percent at 5,513.50

EURO STOXX 50: UP 0.9 percent at 3,528.93

New York – Dow: UP 0.5 percent at 30,179.05

Tokyo – Nikkei 225: UP 0.3 percent at 26,524.79 (close)

Hong Kong – Hang Seng: UP 0.9 percent at 26,343.10 (close)

Shanghai – Composite: UP 0.8 percent at 3,382.32 (close)

Pound/dollar: UP at $1.3526 from $1.3375 at 2145 GMT

Euro/pound: DOWN at 90.14 pence from 90.94 pence

Euro/dollar: UP at $1.2196 from $1.2164

Dollar/yen: DOWN at 103.47 yen from 103.60 yen

West Texas Intermediate: UP 0.3 percent at $47.30 per barrel

Brent North Sea crude: UP 0.3 percent at $50.34 per barrel

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.