Shanghai tanks on virus fears to lead fresh Asia market retreat

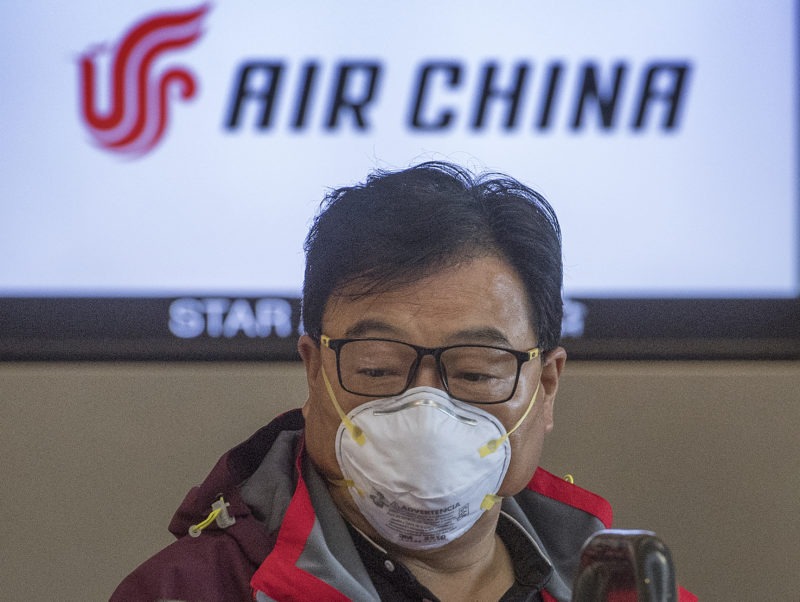

Several countries have banned flights to and from China as the coronavirus continues to spread, fanning concerns about the impact on the world economy (Mark RALSTON)

Hong Kong (AFP) – Chinese equities plunged almost nine percent Monday as nervous traders returned from their extended Lunar New Year break, hit by fears that the coronavirus, which has killed more people than SARS, could hammer the country’s economy.

The steep losses led another sell-off across Asia following a painful week for global markets with the virus killing 361 people and infecting more than 17,000, and governments around the world banning flights to and from China.

Analysts have warned the outbreak could slash global growth this year, throwing a spanner in the works just as economies were showing signs of stabilising after more than a year of slowing.

Observers said that with China being a crucial part of the global trade infrastructure, other countries would also be badly hit, while major corporate names have frozen or scaled back their Chinese operations, threatening the global supply chain.

The World Health Organization invoked a global health emergency last week but stopped short of recommending trade and travel restrictions that could have had a bruising effect on China.

“The situation is terrible and China’s economy will be dealt a bad blow,” said Stephen Innes at AxiCorp.

“As will (Association of Southeast Asian Nations) countries that have built significant trade ties with China, even more so those countries that are tourist destination spots and service providers to Chinese tourists. They will be dealt the nastiest blow of all.”

Shanghai plunged 8.7 percent at the open on the first day back after the Chinese New Year break as traders played catch-up with last week’s global retreat. The market had been due to reopen on Friday but authorities extended the holiday to buy time in the fight against the virus.

Monday’s losses were the biggest since the 2015 market rout, though the composite index managed to pare some of the losses, helped by the central bank’s decision to pump 1.2 trillion yuan ($173 billion) into the economy. The yuan fell about 1.5 percent against the dollar.

Firms linked to tourism and travel were among the worst hit, with energy, telecoms and tech companies also well down. More than 2,600 stocks fell by their daily 10 percent limit, while the main iron ore contract fell by its maximum allowed eight percent. Copper, crude and palm oil also sank by their limit.

“The near-term impact on Chinese GDP growth is likely to be large,” Oxford Economics said in a research note.

“Considering the affected areas account for just over 50 percent of total Chinese output, we think this could lead China’s annual GDP growth to slow to just four percent in (the first quarter),” it added — down from a previous forecast of six percent growth.

– Remaining upbeat –

Still, JP Morgan Asset Management strategist Tai Hui remained relatively upbeat about the future.

“As the number of infections is still likely to rise in the weeks ahead, we would expect the Chinese onshore equity market to come under pressure,” he said in a note.

“That said, we still believe that economic activities should recover swiftly once the number of new cases comes under control, and subsequently market sentiment should also improve. This could take time to play out, but this underpins our long-term optimism in the A-share market despite a challenging time ahead.”

There was red on the boards elsewhere in Asia. Tokyo went into the break one percent lower, while Sydney, Wellington and Taipei all shed more than one percent. Singapore dropped 0.8 percent, Jakarta shed 0.6 percent and Seoul was off 0.1 percent.

However, Hong Kong edged up after losing almost six percent in three days last week.

The flight out of riskier assets hit high-yielding currencies with the South Korean won down 0.4 percent and the Indonesian rupiah losing 0.5 percent.

Separately, the pound edged down after rallying Friday on the day Britain left the European Union after months of uncertainty.

Expectations that demand for oil will fall off in China is keeping pressure on the price of the commodity.

Both main contracts were down in early trade Monday and have lost almost a quarter of their value since hitting four-month highs in January.

The losses come as producers continue to boost output, while the cancellation of hundreds of flights in and out of China also having a major impact, analysts said.

– Key figures around 0300 GMT –

Shanghai – Composite: DOWN 8.1 percent at 2,734.13

Hong Kong – Hang Seng: UP 0.4 percent at 26,413.59

Tokyo – Nikkei 225: DOWN 1.0 percent at 22,981.99 (break)

Dollar/yen: UP at 108.56 from 108.33 at 2140 GMT on Friday

Pound/dollar: DOWN at $1.3177 from $1.3205

Euro/pound: UP at 84.10 pence from 84.00 pence

Euro/dollar: DOWN at $1.1082 from $1.1094

Brent Crude: DOWN 0.6 percent at $56.28 per barrel

West Texas Intermediate: DOWN 0.2 percent at $51.45 per barrel

New York – DOW: DOWN 2.1 percent at 28,256.03 (close)

London – FTSE 100: DOWN 1.3 percent at 7,286.01 (close)

— Bloomberg News contributed to this story —

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.