SCAMS DON’T HAVE TO HURT

Ever wonder if you have been victim of scams such as immigration, religious belief, education, mortgage or financing, false advertising … the list is endless and most of the immigrant community is vulnerable due to their fear and ignorance of the law. A recent meet between members of the ethnic media and the Federal Trade Commission was organized by New America Media in San Francisco, writes Amar D. Gupta. (#FTC, @FTC, @NewAmericaMedia, #NewAmericaMedia, #Siliconeer, @Siliconeer, #FederalTradeCommisson, #FederalTradeCommission, #Consumers, @Consumers)

“Often times minority communities in particular of the important rights that they have or they might not be aware that different kinds of unlawful practices are taking place, so it’s better for them to be informed and prevent becoming a victim of fraud. If they do find themselves to be victims, they should come to us,” said Edith Ramirez, chairwoman, Federal Trade Commission, at a press meet in San Francisco, Feb. 11.

The FTC undertook a national initiative called “Every Community.” and this is the seventh city that the FTC has reached out to ethnic media. It is so important to get the word out to the immigrant communities about their rights and how they can prevent becoming victims of fraud.

Thomas Dahdouh, regional director of Western region – San Francisco and Los Angeles, FTC, said it would be a good idea for consumers to sign up for updates on their web site, http://consumer.gov. Citing examples of deceptive advertising, he showed an audio-visual commercial from DeVry University, where the FTC filed a case against the university, by which they hope to get the consumers their money back as the university was not exactly doing what it said on its commercial.

The commercial said 90% of DeVry graduates get jobs in their field of study within six months of graduation. The FTC charted the ads as deceptive as DeVry did not have the data to back up their claim.

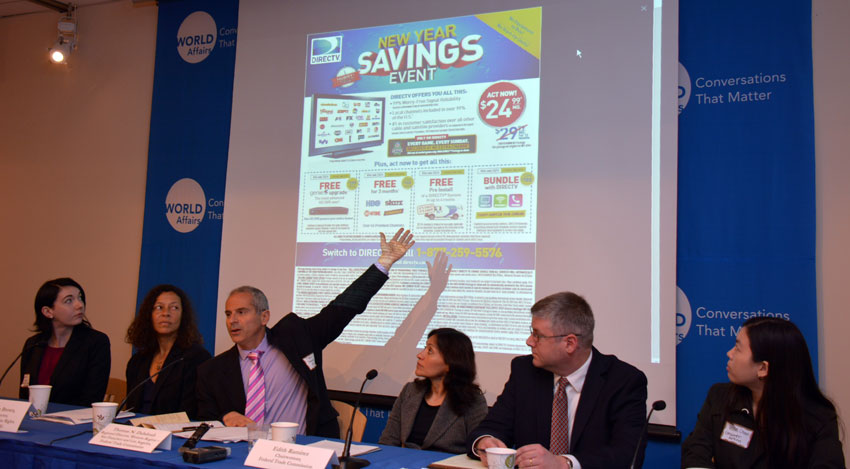

He also talked about another case of deceptive advertising by DirecTV, where DirecTV failed to disclose that their advertised price was only good for one year, the second year, the price would bump up considerably, and the contract was for two years with an early termination fee.

These are classic cases where a consumer, especially an immigrant consumer who might not be well-versed with the language, was likely to get hit. “People should know what they owe, they shouldn’t suddenly be hit with very high bills,” said Dahdouh.

He urged the communities to come forward and report such issues if they feel they have been victimized.

Maeve Elise Brown, executive director, housing and economic rights advocates, talked about scams and how her office is overwhelmed with calls and emails about what people are facing.

According to Brown, foreclosure rescue scams in every flavor and type are being constantly reported. One of her staff got a call from somebody who claimed to be the IRS.

A lot of homeowners are still struggling with foreclosure problems, one of the most reported scams in the community of color and low income communities, is the foreclosure loan modification scams. She says people are asked for fees to perform loan modification, and on top of that, the work is actually not getting performed.

A lot of people don’t find their way to legal help. There is very limited legal assistance out there.

Nicklas Akers, from the Attorney General’s Office talked about some of the current scams and asked for help from the ethnic media to spread the word about available help, encouraging communities to come to FTC, the attorney general’s office or the local law enforcement offices, if they feel they have been victimized.

Akers also mentioned that immigrants need not worry about their immigration status when coming forward as that is not a flag and they will not be reported even if their immigration status is not current.

Talking about predatory consumer lending schemes Akers said he wanted to hear about any kind of false or misleading practices, threats for debt collection and any such issues. If a sale is being discussed verbally in any language other than English, then legally, the contract should be written in the same language so the consumer with little understanding of English language is not cheated and knows exactly what he is signing for.

Akers wants consumers to come forward, more so in the ethnic communities.

Akers also mentioned Heald College, Everest College and Wiretech College in his talk, saying that there was help available for those students who were displaced following the closure of these colleges due to litigation.

Kara Alba of Consumer Justice Clinic, East Bay Community Law Center, citied an example of ethnic money transfer fraud involving an immigrant low-income couple who were scammed, a money transfer service and a local grocery store manager. The point she was trying to make was it was difficult to chase small time operators and had it not been for a larger entity like the money transfer company in this case, the couple could have lost all of their money that they intended to transfer to their loved ones back home.

The couple was victimized because of their trust in their own ethnicity, something that most ethnic people are found to be comfortable in doing, and they need to be more careful of scammers who look and talk like their own. For ethnic communities, it is more likely that they will let their guard down when dealing with one of their own and hence easily fall prey to such scammers.

What needs to be done to prevent scams?

Jennifer Lee from Washington, D.C., said a good way to mitigate scammers might be to not agree to any offers instantly. If someone is calling on the phone and wants you to accept what may be a too-good-to-be-true offer, trying to stall that person by saying you need to talk to someone about it blocks the process and many scams can be avoided by this simple and effective manner. As you stall, the scammer has already lost half the battle because they want you to sign up instantly and without much thinking.

Students, particularly those coming from abroad to study in “degree mills,” often find themselves victims of multi-fold scams. Right from the point where they seek admission to completion of the degree courses, there are many instances where these foreign students are probably victimized and might not even know. If you suspect you are being scammed, there is help. But you need to come forward and voice your concerns to the right authorities.

Larry Blazer from Alameda County DA’s Office, said “ethnic communities are more vulnerable because perhaps they are not as sophisticated, perhaps there is a language barrier.” He said at his office, they don’t care about a person’s immigration status, and hence people should not be scared to report scams even if they an immigration status that may be compromised.

Then there are predatory scammers like astrologers and clairvoyants who often prey on peoples’ misery. These can be anything like claims of promises about getting a job, to having a baby, or curing a major illness.

If you find yourself in this situation, the authorities advise you to immediately contact them. Making false claims is against the law, and an astrologer is not “God’s own voice” in the eyes of the law. Speaking up against such people who thrive on one’s misery and ignorance, can only help rather than hurt.