Pound drops as Johnson faces battle to pass Brexit bill

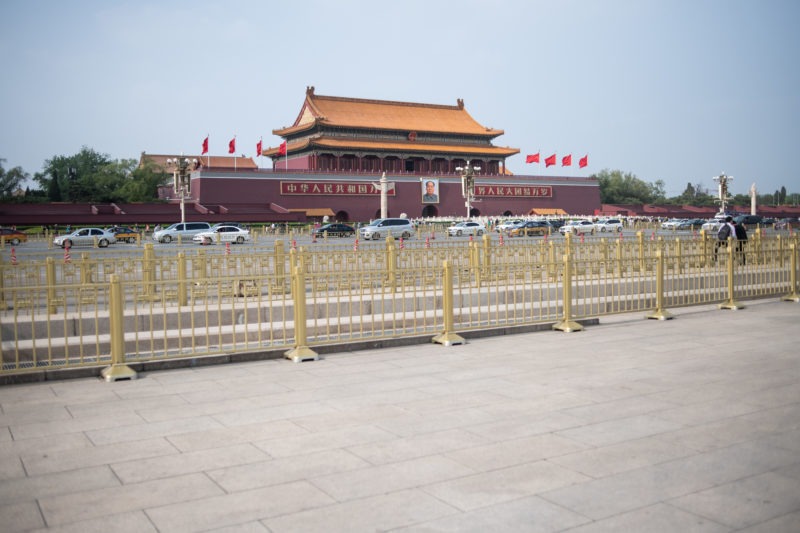

China’s economy expanded at its slowest pace in 27 years during the third quarter, weighed by weakness at home and the trade war with the United States (STR)

Hong Kong (AFP) – Sterling fell Friday as investors fret over Boris Johnson’s chances of pushing his Brexit deal through parliament, while Asian markets were mostly down after data showed China’s economy expanded at its slowest pace in nearly three decades.

The pound rallied almost to $1.30 on Thursday following news that negotiators had hammered out an agreement that would avoid Britain’s leaving the EU without a divorce deal, a move many warn would be economically catastrophic.

However, the joy was soon tempered by the realisation that the British prime minister faces an uphill task in getting it past lawmakers, with opposition MPs and even some in his own Conservative party saying they were against it.

Most importantly, Northern Ireland’s Democratic Unionist Party (DUP), which props up Johnson’s government, said it was “unable to support these proposals”.

Forex traders sold sterling, pushing it back down below $1.29, and it extended losses in Asia.

Focus is now on a crucial vote on the deal pencilled in for Saturday.

“Much will depend on the PM’s ability to get some if not all DUP and (Scottish National Party) MPs onside, in addition to also getting the backing from the 21 ex-Conservative MPs he expelled from the party last month,” said National Australia Bank’s Rodrigo Catril.

“Rejection of the deal might well see more political brinkmanship around a ‘no-deal’ Brexit, but the most likely scenario would be yet another extension of the 31 October Brexit date.”

Jeffrey Halley, senior market analyst at OANDA, said whichever way the vote goes, “traders should prepare themselves for some severe volatility on Monday morning, with multiple big-figure moves a strong possibility”.

– China growth slows further –

Asian equity markets were mostly lower after China said its economy expanded six percent in the third quarter, marking the slowest pace in 27 years, as leaders struggle to address weak domestic demand and the long-running US trade war.

The reading was a drop from the previous three months but in line with an AFP forecast and the government’s 6.0-6.5 percent target for the year.

While the National Bureau of Statistics said the economy “maintained overall stability”, it added that it “is under mounting downward pressure” from weakness at home and abroad.

In early trade Hong Kong and Shanghai each fell 0.1 percent, while Sydney shed 0.6 percent and Singapore eased 0.2 percent.

Wellington, Taipei and Manila were also lower but Tokyo went into the break with gains while Seoul was slightly higher.

Hopes for the China-US trade talks were given a lift after Beijing’s commerce ministry said negotiators have “accelerated efforts” to hammer out details of last Friday’s mini deal and were holding talks on moving on to the next phase of a wider agreement.

Donald Trump said Wednesday he hopes to sign the deal with President Xi Jinping at the APEC summit in Chile next month.

“A meaningful de-escalation in US-China trade frictions would help alleviate some of the market’s most bearish concerns, and at a minimum, it could ease the… headwinds,” said AxiTrader’s Stephen Innes.

A sense that tensions are easing provided a lift to high-yielding, riskier currencies such as the South Korean won and Australian dollar.

And the Turkish lira jumped more than one percent after Ankara said it would halt military operations in northern Syria and US Vice President Mike Pence said Washington would not impose any fresh sanctions.

– Key figures around 0230 GMT –

Pound/dollar: DOWN at $1.2862 from $1.2891 at 2050 GMT

Euro/pound: UP at 86.51 pence from 86.31 pence

Euro/dollar: UP at $1.1129 from $1.1127

Dollar/yen: UP at 108.66 yen from 108.62 yen

Tokyo – Nikkei 225: UP 0.6 percent at 22,576.96 (break)

Hong Kong – Hang Seng: DOWN 0.1 percent at 26,811.90

Shanghai – Composite: DOWN 0.1 percent at 2975.82

West Texas Intermediate: DOWN six cents at $53.87 per barrel

Brent North Sea crude: DOWN 21 cents at $59.70 per barrel

New York – Dow: UP 0.1 percent at 27,025.88 (close)

London – FTSE 100: UP 0.2 percent at 7,182.32 (close)

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.