Fed chief says will do ‘whatever it takes’ for US economy

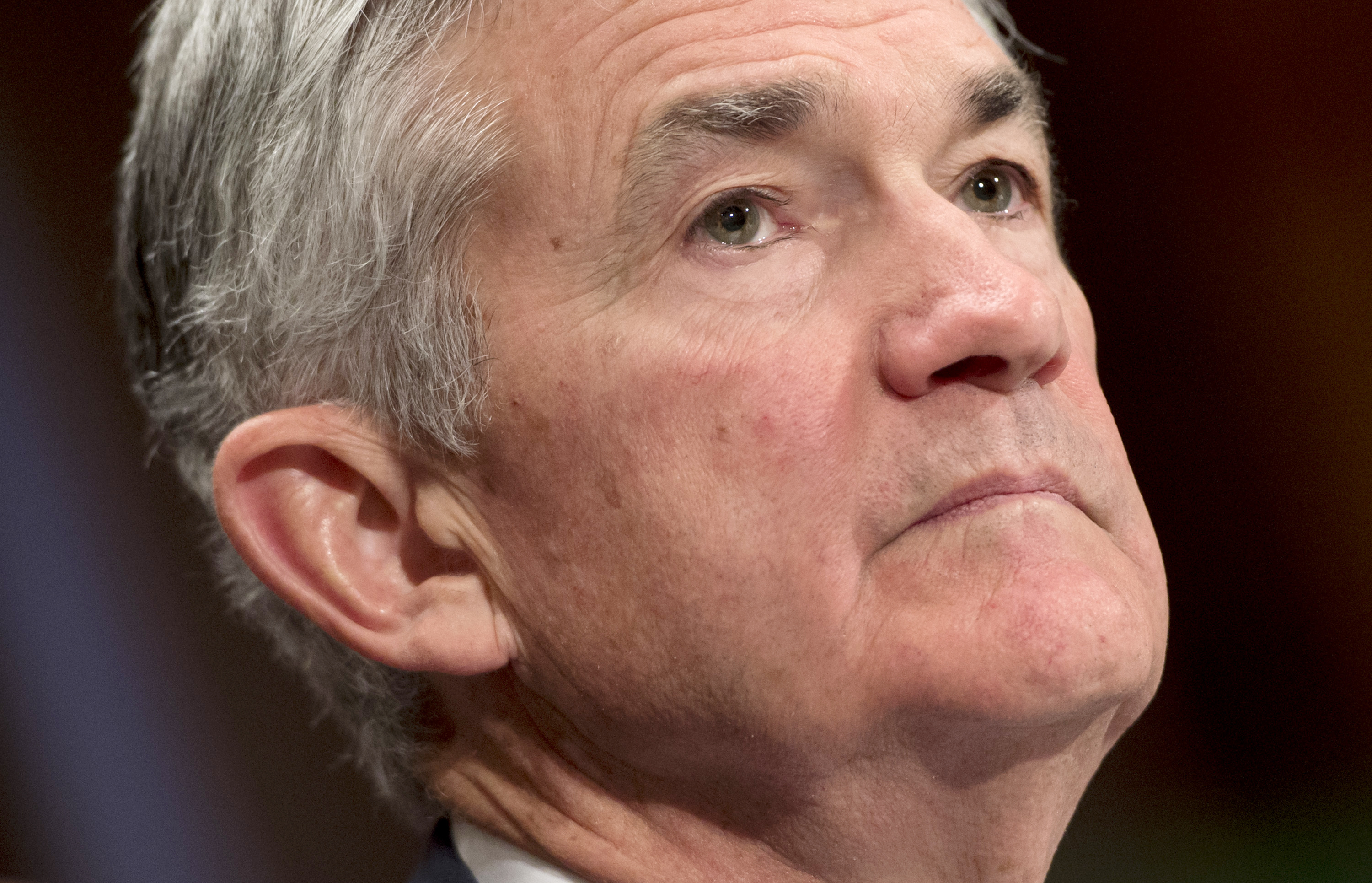

Powell noted that the economy remained strong and anyone who wanted a job could find one (SAUL LOEB)

Washington (AFP) – Avoiding any direct reference to President Donald Trump’s renewed criticism of the Federal Reserve’s handling of the economy, Fed chief Jerome Powell said Friday the central bank would do “whatever it takes” to head off inflation or react to a new crisis.

Trump’s latest attacks, delivered in an interview this week, meant politics cast a shadow over the highly anticipated speech, the highlight of the annual gathering of global central bankers in Jackson Hole, Wyoming, an idyllic setting in the American West for serious discussions on how to manage the economy.

In an address, Powell stayed resolutely focused on the policy debate and the challenges facing the Fed’s rate-setting Federal Open Market Committee (FOMC) and made it clear officials were focused on the economic data.

“I am confident that the FOMC would resolutely ‘do whatever it takes’ should inflation expectations drift materially up or down or should crisis again threaten,” he said in prepared remarks.

However, he noted the US economy remained strong and anyone who wanted a job could find one, while prices were rising at about the Fed’s target pace of two percent.

And “we have seen no clear sign of an acceleration above two percent, and there does not seem to be an elevated risk of overheating.”

As a result, “if the strong growth in income and jobs continues, further gradual increases in the target range for the federal funds rate will likely be appropriate,” Powell said, echoing recent FOMC statements.

As the US economy has recovered, the Fed has raised the benchmark lending rate seven times since December 2015, twice this year under Powell, and is expected to hike again in September and December.

But Trump has said rising interest rates — which tends to strengthen the dollar, making US exports more expensive — will slow the economy and offset the impact of the tax cuts he championed.

Trump has repeatedly said he is “not thrilled” with Powell’s raising of interest rates.

– Anchoring inflation –

The president has also repeatedly hammered away at Fed policy for not supporting faster economic growth but he went even further this week when he declined to confirm his support for the central bank’s independence, something that has the potential to worry financial markets.

Questioning Fed actions is normally off limits for US politicians, since it could raise fears central bankers would feel political pressure and fail to act to head off rising inflation.

Powell referenced that in his speech as well, stressing the importance of ensuring that businesses and consumers do not start to believe inflation will be allowed to accelerate, something central bankers call “anchoring” inflation expectations.

He said “one overwhelmingly important lesson for monetary policymakers: Anchoring longer-term inflation expectations is a vital precondition for reaching all other monetary policy goals.”

So even if factors occur that push prices up or down, “people expect that inflation will return fairly promptly to the desired value,” he said.

– Fed independence –

The Fed chief has addressed the issue of central bank independence various times, stressing the need for policy deliberations to be free of political considerations.

Fed officials “don’t take political considerations into account,” he said in July. “I’m deeply committed to that approach.”

Asked at the time another bout of Trump critiques, Powell said “no one in the administration has said anything to me that really gives me concern on this front.”

The Jackson Hole conference has taken on a mystique since past Fed chairs, and other central bankers, have occasionally used the event to signal a change in policy.

But Powell’s speech focused squarely on lessons learned in past economic eras and how to apply them to the current situation, which he called “challenging.”

He also did not reference Trump’s many trade wars, which central bankers have pointed to as a potential “consequential risk” to the economy.

Trump’s willingness to breach norms and attack the Fed directly worries economists, and prompted extra scrutiny of the speech.

“I was a little surprised that he left out trade tensions, explicit Fed independence and even a more detailed discussion of inflation or wage growth dynamics, instead focusing on long-term forecasting uncertainties,” Greg Daco of Oxford Economics told AFP.

“His references to the 1970s & a de-anchoring of inflation expectations does however implicitly reflect upon the importance of an independent Fed.”

Disclaimer: This story has not been edited by Siliconeer and is published from a syndicated feed. Siliconeer does not assume any liability for the above story. Validity of the above story is for 7 Days from original date of publishing. Content copyright AFP.