Closing arguments next in FTX founder Sam Bankman’s fraud trial after his testimony ends

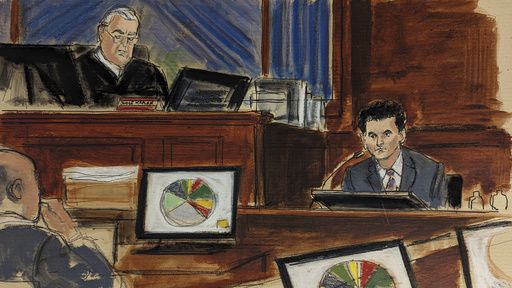

In this courtroom sketch, FTX founder Sam Bankman-Fried, right, testifies as Judge Lewis Kaplan, upper left, presides during Bankman-Fried’s trial in Manhattan federal court, Tuesday, Oct. 31, 2023, in New York. A pie chart showing where all the customer funds were spent is displayed on monitors. (Elizabeth Williams via AP)

NEW YORK (AP) — FTX founder Sam Bankman-Fried underwent a final barrage of questions on Tuesday from a prosecutor aimed at showing that he’s not being honest about how much he knew about the disappearance of $8 billion from his customers’ accounts, setting the stage for final arguments in his fraud trial on Wednesday.

The four days of testimony by the 31-year-old cryptocurrency entrepreneur will be summarized by his lawyer and prosecutors before a jury begins deciding his fate as early as Thursday.

Bankman-Fried insisted in his testimony in Manhattan federal court that he didn’t defraud anyone before his cryptocurrency empire collapsed last November, leading to his arrest a month later and his extradition to New York to face fraud charges that could result in decades in prison if he is convicted.

Initially freed on a $250 million personal recognizance bond, he was permitted to reside with his parents in Palo Alto, California, until August, when Judge Lewis A. Kaplan ruled that he had tried to influence prospective trial witnesses and needed to remain incarcerated.

Criminal charges and the trial reflected the steep fall Bankman-Fried has gone through since a year ago, when it seemed he was presiding over flourishing cryptocurrency companies that seemed to be among the stars of an emerging industry.

Celebrities including comedian Larry David and quarterback Tom Brady were promoting his products and Bankman-Fried was living with other top executives in a $30 million apartment in the Bahamas, while they made tens of millions of dollars in political contributions and charity donations and put millions of dollars more in speculative investments.

U.S. Attorney Damian Williams has said Bankman-Fried was overseeing one of the biggest frauds in U.S. history.

After taking the risk to testify, Bankman-Fried insisted for days that he believed that a hedge fund he started — Alameda Research — had sufficient assets to cover the billions of dollars that were being spent. He rejected claims by prosecutors that the money was stolen from customers at FTX, a cryptocurrency exchange he started in 2019.

On Tuesday, Assistant U.S. Attorney Danielle Sassoon repeatedly pressed Bankman-Fried to reveal what he knew and when he knew it and whether he was honest with FTX customers.

“In the context of your business dealings, wasn’t it your practice to maximize the potential to make money even if it created the risk of going bust?” Sassoon asked on the second day of cross examination.

“It depends on which business dealings you’re referring to,” Bankman-Fried answered.

“Would that be accurate with respect to some of your business dealings, Mr. Bankman-Fried?” she asked.

“With respect to some of them, yes,” he responded.

Repeatedly, she asked him why he didn’t insist on finding out about $8 billion dollars in Alameda liabilities to FTX customer funds that he first was told about in June 2022.

“I don’t recall following up that day and regret not doing so,” he said.

At times, the prosecutor mocked Bankman-Fried with her questions about his testimony that he didn’t know until September or October of 2022 that $8 billion of FTX customer money had been funneled through Alameda and spent.

“You didn’t call in your deputies and employees and say: ‘Who spent $8 billion?’” she asked.

“I had conversations with Alameda’s leadership, with Caroline in particular,” he answered referring to Caroline Ellison, a former girlfriend of Bankman-Fried who had installed as Alameda’s chief executive. “I asked her how it had happened, to the best of her knowledge.”

Ellison and other former top executives testified earlier in the trial that Bankman-Fried knew about the billions of dollars in spending all along and had helped ensure the money could be borrowed by setting up a $65 billion line of credit for Alameda to borrow unlimited money from FTX.

“But you didn’t tell your employees, don’t spend the FTX customer deposits, right?” Sassoon asked.

“I deeply regret not taking a deeper look into it,” Bankman-Fried replied.