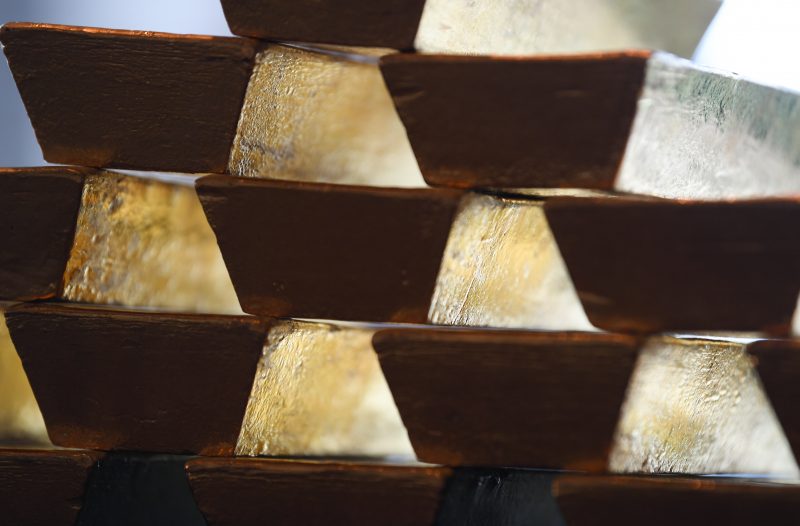

Canada’s Barrick Gold in hostile bid for rival Newmont

The merger of Barrick and Newmont — the world’s biggest gold miners — would create a juggernaut worth an estimated US$42 billion (Arne Dedert)

Toronto (Canada) (AFP) – Canadian mining company Barrick Gold on Monday launched a hostile bid worth around US$18 billion for American rival Newmont Mining.

Toronto-based Barrick said in a statement that it had made “a proposal to the Newmont Mining Corporation… to merge with Newmont in an all-share transaction.”

The combination of the world’s biggest gold miners would create a juggernaut worth an estimated US$42 billion.

Barrick is proposing a share swap of 2.5694 Barrick shares for each one of Newmont, which would give the Canadian firm 55.9 percent of the newly created entity.

Barrick President and CEO Mark Bristow called the proposal “logical and long overdue.”

“A combination of Barrick and Newmont would represent a unique, once in a lifetime opportunity to create the unrivalled leader in the gold sector and generate significant — and in our industry, unparalleled — value creation for our shareholders,” Bristow said in a letter to Newmont’s board of directors.

The companies had flirted with the idea of merging five years ago, but talks fell apart over who would lead the combined firm and where to locate its headquarters — Toronto or Denver.

Barrick last week confirmed it was considering another effort.

The industry has been consolidating as gold mines around the world get depleted, driving up costs and encouraging companies to come together in mergers and alliances.

In January, Colorado-based Newmont announced a US$10 billion stock deal for another Canadian mining company, Vancouver-based Goldcorp, in a move to leapfrog Barrick as top gold miner.

That acquisition — which is expected to close in the second quarter — came only three months after Barrick agreed to buy Britain’s Randgold Resources in a US$5.4 billion deal.

Bristow said the combination makes sense, noting that the firms have “highly complementary” neighboring operations in Nevada.

If the merger goes through, it will produce a global gold and copper giant with mines in Latin America, the United States, Africa and Australia.

Disclaimer: This story is published from a syndicated feed. Siliconeer does not assume any liability for the above story. Validity of the above story is for 7 Days from original date of publishing. Content copyright AFP.