Buffett, mum on a successor, dreams of ‘elephant-sized’ acquisition

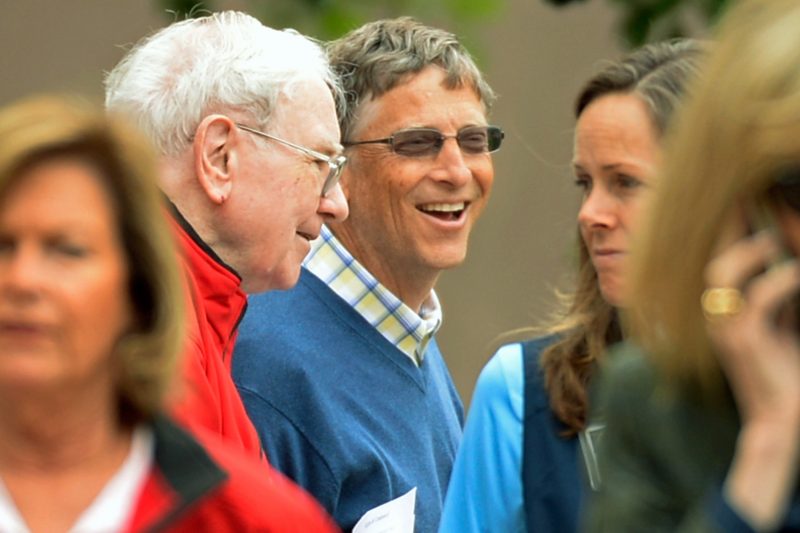

Berkshire Hathaway CEO Warren Buffett (L) shares a laugh with Microsoft founder Bill Gates at a 2013 conference in Sun Valley, Idaho (KEVORK DJANSEZIAN)

Washington (AFP) – Billionaire investor Warren Buffett has yet to name a successor and at age 88 still dreams of making an “elephant-sized” acquisition, he said in his annual letter to shareholders.

The letter to shareholders of Buffett’s holding company, Berkshire Hathaway, is considered a must-read on Wall Street, distilling the views of the “Oracle of Omaha” on the state of the economy and the wisdom of investing in this or that investment product.

In the latest edition, Buffett says it is the prospect of an “elephant-sized acquisition” that causes his heart, and that of his longtime partner, 95-year-old Charlie Munger, “to beat faster.”

“In the years ahead, we hope to move much of our excess liquidity into businesses that Berkshire will permanently own,” he said.

“The immediate prospects for that, however, are not good: Prices are sky-high for businesses possessing decent long-term prospects,” he added.

At the moment, Berkshire Hathaway has more than $100 billion in liquid assets that would be rapidly available if an opportunity should present itself.

The investor remained silent on who might succeed him as Berkshire’s CEO but he was unstinting in his praise of his two lieutenants, who since 2018 have taken the reins of essential day-to-day operations: Ajit Jain and Greg Abel.

The decision to give them a more central role was “overdue,” he said. One of the two men is expected to succeed Buffett.

“Berkshire is now far better managed than when I alone was supervising operations,” he said.

– A bet gone bad –

In terms of results, the year did not end well for Buffett. His bet on Kraft Heinz, maker of the famous ketchup and instant macaroni and cheese, erased nearly $3 billion from Berkshire’s bottom line, which nonetheless posted $4 billion in earnings.

Kraft Heinz — in which Berkshire has a 25 percent stake — announced a roughly $15 billion write-down of its assets stemming from its failure to adapt to changing consumer tastes.

Buffett also once again criticized an accounting rule that requires including unrealized gains or losses in the calculations of net quarterly results.

With a stock portfolio valued at $173 billion at the end of 2018, “wide swings in our quarterly GAAP earnings will inevitably continue.” GAAP stands for Generally Accepted Accounting Principles.

“Indeed, in the fourth quarter, a period of high volatility in stock prices, we experienced several days with a ‘profit’ or ‘loss’ of more than $4 billion,” he wrote.

Disclaimer: This story is published from a syndicated feed. Siliconeer does not assume any liability for the above story. Validity of the above story is for 7 Days from original date of publishing. Content copyright AFP.