BHIM App to Enable Fast, Secure Cashless Payments via Mobiles

Indian visitors check their phone at a Digital Wealth Fair promoting e-payments in Mumbai, Jan. 3. India is attempting to move towards a digital or cashless economy following the government’s move in November 2016 to withdraw high-denomination 500 and 1,000 rupee banknotes from circulation in a bid to tackle tax evasion. (Indranil Mukherjee/AFP/Getty Images)

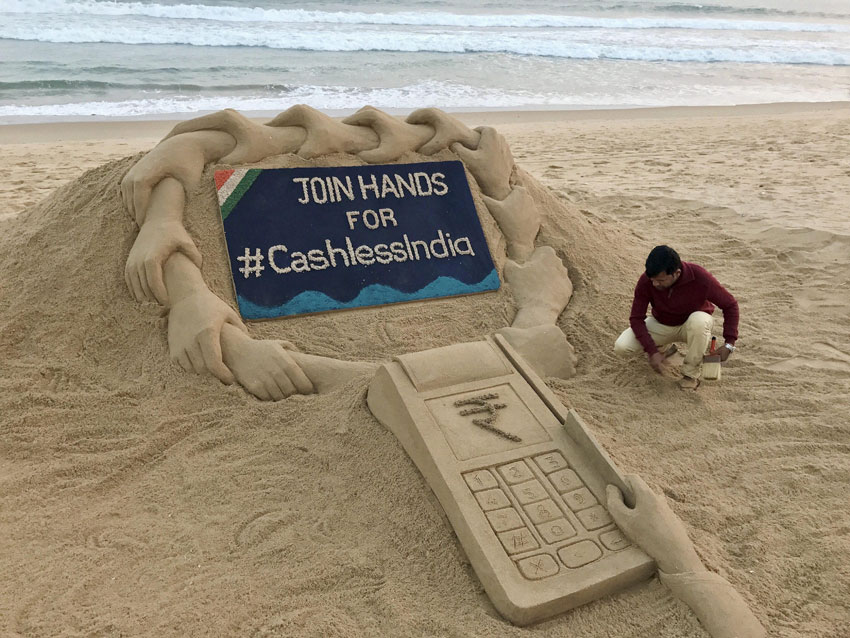

In a bid to further push adoption of e-payments in the country, Prime Minister Narendra Modi launched an indigenous digital payments app ‘BHIM,’ Dec. 30, that will enable fast and secure cashless transactions using mobile phones. – @Siliconeer #Siliconeer #India #Demonetisation #Demonetization #NaMo #NarendraModi @NaMo @Narendramodi #IndianCurrency #DigiDhan #DigitalWealth #BHIM

Named after the architect of the Indian Constitution, Babasaheb Bhim Rao Ambedkar, the Bharat Interface for Money (BHIM) is a simplified payment platform designed to make Unified Payment Interface (UPI) and USSD payment modes simpler and usable across feature phones and smart phones.

“The day is not far, when people will conduct their business through this app … It is a simple app and you can download it on your smartphones or feature phones. You don’t even require Internet connection for this,” Modi said in his address at ‘DigiDhan Mela’ in New Delhi.

The government had announced scrapping of old Rs 500 and 1,000 notes on November 8. While this led to a cash crunch and serpentine queues at banks and ATMs, the decision also pushed uptake of digital payments in the country.

Developed by National Payment Corporation of India (NPCI), BHIM is supported by host of banks, including State Bank of India, ICICI Bank, Axis Bank, HDFC Bank, Bank of India, Canara Bank, Kotak Mahindra Bank, Oriental Bank of Commerce and Punjab National Bank, among others.

The app, which can be downloaded from Google Play store, is currently available in Hindi and English, and support for more languages is expected soon.

BHIM is interoperable with other Unified Payment Interface (UPI) applications and bank accounts.

“We all want our country to develop, become economically stronger and a resurgent nation. Through Digital India initiative, the country has take a giant leap towards that direction,” IT Minister Ravi Shankar Prasad said.

Users can register their bank account with BHIM, and set a UPI PIN for the account. The mobile number then acts as the user’s identifier, enabling transactions like sending or receiving money.

NITI Aayog CEO Amitabh Kant said, “It is only a matter of time before the entire country goes digital.”

Digital payments company MobiKwik’s Founder and CEO Bipin Preet Singh said this will further strengthen digital payment system and add to building of a cashless economy.

“Going forward, we hope that provisions would be made for adding e-wallets on UPI enabling people to pay through bank accounts or e-wallets using the BHIM app,” Singh added.

Trupay co-founder Rahul Gochhwal said, “UPI is the most advanced payment system in the world. This will develop the overall payments ecosystem in the country.”