Asian stocks rise on optimism for trade talks, shutdown deal

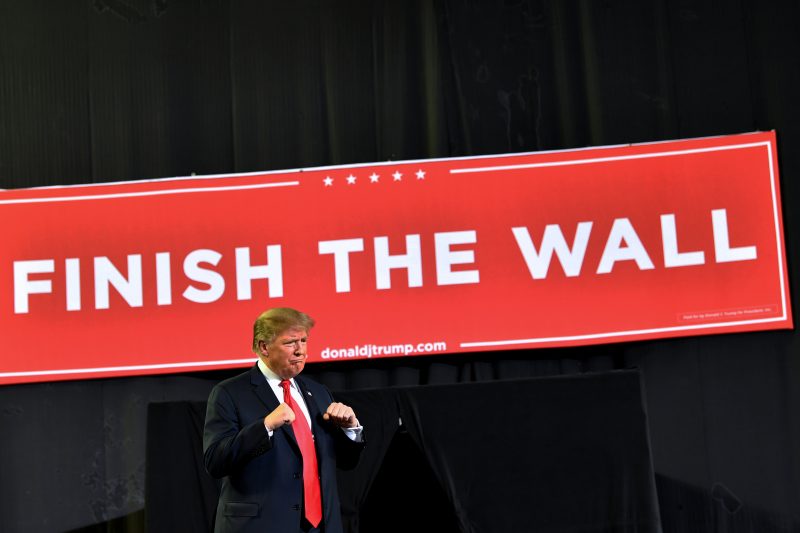

Even as US President Donald Trump stirred up border controversy at a raucous rally in the frontier city of El Paso, lawmakers said a provisional deal had been reached (Nicholas Kamm)

Hong Kong (AFP) – Asian stocks advanced Tuesday on optimism over US-China trade talks and a provisional deal to avoid a Washington shutdown, while the weak yen boosted exporters.

Initial trade talks are under way in Beijing aimed at averting punitive tariffs which could slow the global economy.

Top-level negotiators are set to arrive in the Chinese capital for meetings Thursday and Friday, ahead of a March 1 deal deadline.

Investors responded positively to reports that Donald Trump wants to meet Xi Jinping “very soon”, just days after the US president had appeared to write off an imminent summit with his counterpart.

“Officials on both sides of the US-China trade talks expressed satisfaction with the progress thus far,” wrote Jeffrey Halley, senior analyst at Oanda, in a commentary.

Washington is demanding changes from Beijing on what it says are unfair commercial practices.

Failure by the economic superpowers to reach an agreement would see US tariffs on $200 billion worth of Chinese imports more than double.

Meanwhile, US lawmakers said they had reached an agreement in principle on border security.

The announcement assuaged fears of a chaotic repeat of the recent 35-day partial US government shutdown — the longest in the country’s history.

The agreement included $1.4 billion in funding for a wall on the US-Mexico border — a key campaign promise of Trump.

News of the deal — which still needs to be accepted — came as the president stirred up border controversy at a raucous rally in the frontier city of El Paso.

Hong Kong edged up 0.1 percent, while Shanghai gained 0.7 percent.

Sydney added 0.3 percent, Seoul rose 0.5 percent, and Taipei jumped 0.9 percent.

Tokyo — returning from Monday’s public holiday — leapt 2.6 percent, as Japanese exporters further benefited from a resurgent dollar, which left the yen at its weakest level since the start of 2019.

– Dollar rises –

The dollar has returned to early January heights, on the US currency’s longest unbroken rally in three years — despite the Fed recently changing course on interest rate hikes.

Investors have turned to the greenback as concern has built over poor growth forecasts and the health of other currencies in Europe and beyond.

Multiple central banks have fallen in line with the Fed’s dovish stance since it held interest rates unchanged two weeks ago.

The weak yen saw Tokyo-listed exporters such as Toyota, Nissan and Honda rise.

The British pound clawed back some losses after dropping sharply Monday on dismal monthly GDP and manufacturing data, but the euro remained largely unchanged against the dollar.

“The problem for dollar bears is that there is a chronic shortage of currencies to like,” Societe Generale SA strategist Kit Juckes told Bloomberg.

“Lower bund yields, not to mention weak growth, political uncertainty and Brexit, make a good set of reasons to hate the euro as much as you hate the dollar.”

– Key figures around 0700 GMT –

Tokyo – Nikkei 225: UP 2.6 percent at 20,864.21 (close)

Hong Kong – Hang Seng: UP 0.1 percent at 28,171.70

Shanghai – Composite: UP 0.7 percent at 2,671.89 (close)

Euro/dollar: UP at $1.1283 from $1.1279 at 2200 GMT Monday

Dollar/yen: UP at 110.52 yen from 110.37 yen

Pound/dollar: UP at $1.2868 from $1.2859

Oil – West Texas Intermediate: UP 18 cents at $52.59 per barrel

Oil – Brent Crude: UP 24 cents at $61.75 per barrel

New York – Dow: DOWN 0.2 percent at 25,053.11 (close)

London – FTSE 100: UP 0.8 percent at 7,129.11 (close)

Disclaimer: This story is published from a syndicated feed. Siliconeer does not assume any liability for the above story. Validity of the above story is for 7 Days from original date of publishing. Content copyright AFP.