Asian shares ease as US-China trade talks begin

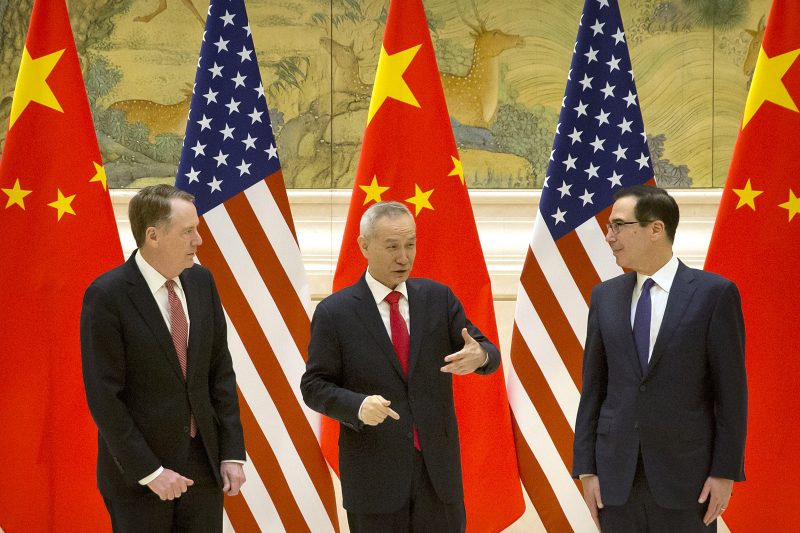

US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin are meeting with China’s top economic czar Liu He. (Mark Schiefelbein)

Hong Kong (AFP) – Asian stocks eased Thursday as traders anxiously awaited news from high-level US-China trade talks starting in Beijing.

Negotiators from the two economic superpowers kicked off discussions in the Chinese capital aimed at defusing a row that has already triggered tariffs on billions of dollars worth of exports and threatened to stymie global growth.

Failure to resolve the dispute would initiate a sharp hike in US tariffs on $200 billion of Chinese goods, although President Donald Trump indicated this week he could extend his March 1 deadline if progress is made in Beijing.

US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin met with China’s top economic czar Liu He.

Chinese President Xi Jinping plans to meet the US officials later this week, a report in the South China Morning Post said Wednesday, bolstering hopes for the talks and markets in Asia.

Trump told reporters in the Oval Office on Wednesday that preliminary discussions in Beijing had gone “very well,” Bloomberg reported.

But a wide gulf remains on some issues. The US is demanding far-reaching changes to Chinese practices that it says are unfair.

Hong Kong dropped 0.7 percent, while Shanghai traded flat and Tokyo inched up 0.1 percent.

Chinese trade figures were due Thursday.

In Hong Kong, smartphone component maker Sunny Optical dropped 8.7 percent as a stock exchange filing showed a sharp fall in net profit for last year.

Japanese government data showed the economy expanded in the final quarter of 2018 as the negative impact from a series of natural disasters over the summer receded.

The 0.3 percent expansion was slightly below forecasts, but followed a 0.7 percent contraction in the quarter before.

Meanwhile oil prices extended gains after the International Energy Agency reported lower output from OPEC producers.

Both the main crude oil contracts posted further gains on the news that the Organization of the Petroleum Exporting Countries in January had largely complied with an agreement to cut output.

Prices were firmed up by US National Security Advisor John Bolton’s warning that countries which buy Venezuelan resources including oil “will not be forgotten”.

Wall Street had seen relatively tepid growth Wednesday after senator Marco Rubio pledged to tax corporate buybacks the same way as dividends.

– Key figures around 0240 GMT –

Tokyo – Nikkei 225: UP 0.1 percent at 21,155.44

Hong Kong – Hang Seng: DOWN 0.7 percent at 28,312.54

Shanghai – Composite: FLAT at 2,721.04

Euro/dollar: UP at $1.1271 from $1.1270 at 2130 GMT Wednesday

Dollar/yen: DOWN at 111.00 yen from 111.02 yen

Pound/dollar: UP at $1.2857 from $1.2848

Oil – West Texas Intermediate: UP 15 cents at $54.05 per barrel

Oil – Brent Crude: UP 18 cents at $63.79 per barrel

New York – Dow: UP 0.5 percent at 25,543.27 (close)

London – FTSE 100: UP 0.8 percent at 7,190.84 (close)

Disclaimer: This story is published from a syndicated feed. Siliconeer does not assume any liability for the above story. Validity of the above story is for 7 Days from original date of publishing. Content copyright AFP.