Asian markets rattled by fresh trade concerns

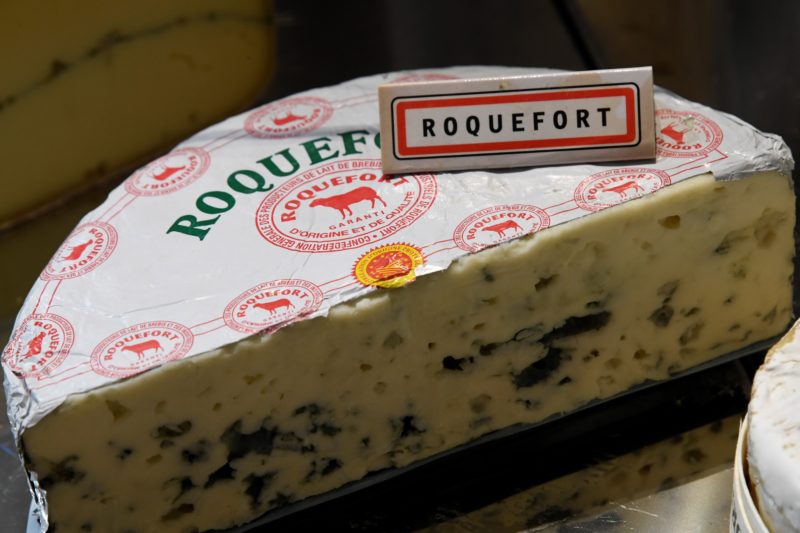

Roquefort cheese and sparkling wine are among the French goods that could be hit with huge tariffs by the US in retaliation for a digital tax (BERTRAND GUAY)

Hong Kong (AFP) – Asian markets tumbled on Tuesday as global trade uncertainty returned to the fore after the United States reimposed tariffs on Argentina and Brazil, threatened steep levies against France and warned China of new measures if ongoing talks are not successful.

Optimism that Beijing and Washington will eventually hammer out a partial agreement as part of a wider deal has provided support to equities for weeks, helping Wall Street to numerous records.

But investor sentiment was dealt a blow on Monday when Donald Trump said he would reinstate steel and aluminium tariffs on the two South American countries, which he accused of manipulating their currencies and hurting US farmers.

Later, officials warned they would hit France with up to 100 percent in levies on $2.4 billion in goods, saying a digital tax was discriminatory against US tech firms such as Google, Apple and Amazon.

Sparkling wine, yoghurt and Roquefort cheese could be hit as soon as next month, while US Trade Representative Robert Lighthizer warned his office was also considering similar moves against Austria, Italy, and Turkey.

“Given Brazil was seen as a close friend of Trump and even they could not be exempt from tariffs, there is a notion that every country, regardless of what they do, could have tariffs imposed, which creates a lot of uncertainty of businesses,” said Tapas Strickland at National Australia Bank.

– New warning to China –

Analysts said the moves against Brasilia and Buenos Aires citing currency movements raised the possibility the US could use a similar justification against China, which it has also accused of forex manipulation.

Adding to the sense of unease, US Commerce Secretary Wilbur Ross told Fox News that more tariffs on Chinese goods planned for December 15 would be imposed if the first phase of trade talks was not completed by then.

“If nothing happens between now and then, the president has made quite clear he’ll put the tariffs in,” he said.

Tokyo ended the morning 0.9 percent lower, Hong Kong shed more than one percent, Shanghai eased 0.5 percent and Sydney sank two percent.

Seoul retreated 0.7 percent and Singapore was off 0.1 percent and Manila eased 0.2 percent. Taipei and Jakarta were flat.

Still, JP Morgan Asset Management strategist Kerry Craig said: “We expect that a narrow deal around trade can be achieved, and this would be one where no new tariffs or those planned but not implemented are postponed.”

But he added: “While there is a clear economic incentive from both sides to do some sort of deal, the political desire to reach more than the minimum is weak, as the two sides are still going to want to compete in areas such as technology.”

The uncertainty over trade, combined with a disappointing US manufacturing report, sent all three main indexes on Wall Street tumbling, while Paris and Frankfurt also suffered big losses.

On forex markets, the yen, considered a safe haven in times of uncertainty, rallied higher on Monday against the dollar but pared its gains in early Asian business.

Oil prices extended gains ahead of a key meeting of OPEC and other major producers, which is expected to see them maintain output cuts into June, with speculation they could go on until the end of 2020.

– Key figures around 0230 GMT –

Tokyo – Nikkei 225: DOWN 0.9 percent at 23,328.27 (break)

Hong Kong – Hang Seng: DOWN 1.1 percent at 26,144.30

Shanghai – Composite: DOWN 0.5 percent at 2,861.65

Euro/dollar: DOWN at $1.1072 from $1.1078 at 2145 GMT

Pound/dollar: DOWN at $1.2932 from $1.2943

Euro/pound: UP at 85.62 pence from 85.58

Dollar/yen: UP at 109.07 from 108.96 yen

West Texas Intermediate: UP 14 cents at $56.10 per barrel

Brent North Sea crude: UP 13 cent at $61.05 per barrel

New York – Dow: DOWN 1.0 percent at 27,783.04 (close)

London – FTSE 100: DOWN 0.8 percent at 7,285.94 (close)

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.