Asian markets rally as stimulus hope trumps vote worries

Hong Kong (AFP) – Asian markets rallied Thursday as Joe Biden inched towards becoming the next US president, with investors now hoping lawmakers will soon pass a much-needed new stimulus package.

Traders brushed off Donald Trump’s claims of fraud and calls to stop vote-counting by calling in lawyers, instead taking heart from the failure of a Democratic sweep of Congress, which would have likely led to tax hikes and regulation.

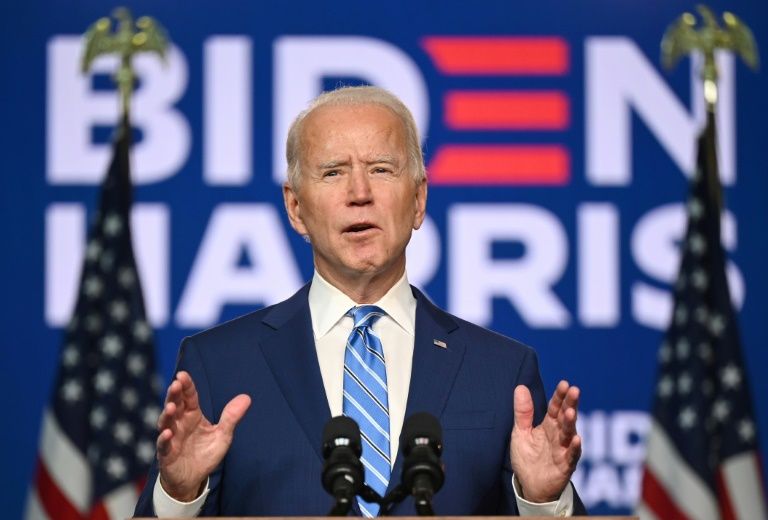

While crucial battleground states remain close, the former vice president said he was confident that “when the count is finished, we believe we will be the winners”.

All three main indexes on Wall Street surged, with the Nasdaq soaring almost four percent as tech titans including Apple and Facebook breathed a sigh of relief.

“Up until about last week, the consensus belief was a full blue sweep — now that’s changing you’re seeing a repricing taking place in the market,” Anna Han, at Wells Fargo Securities, told Bloomberg TV.

However, Trump earlier claimed victory unilaterally and made clear he would not accept the reported results, issuing unprecedented complaints — unsupported by any evidence — of fraud.

“The damage has already been done to the integrity of our system, and to the Presidential Election itself,” he tweeted, alleging without proof or explanation that “secretly dumped ballots” had been added in Michigan.

Still, analysts said that while Trump’s court bids could cause some uncertainty, many investors were confident the uncertainty would not likely drag on.

“The contest is not over, and President Trump will not go down without a fight, but financial markets are confident to price in a Biden presidency along with a Republican controlled Senate,” said OANDA’s Edward Moya.

– Vaccine optimism –

Hong Kong rose two percent and Tokyo jumped one percent, while Sydney, Singapore, Seoul and Jakarta were all up more than one percent. Shanghai gained 0.6 percent and Manila jumped 2.8 percent.

Hopes for a new economic rescue package out of Washington were providing support to equities, even though any spending bill will not be as big as previously thought under a Democrat-run Congress.

With politicians going back to work on Monday, Republican Senate leader Mitch McConnell lifted hopes for a quick resolution, saying: “We need another rescue package.

“Hopefully the partisan passions that prevented us from doing another rescue package will subside with the election. And I think we need to do it and I think we need to do it before the end of the year.”

And in a sign that the impasse that prevented agreement over the past few months was subsiding, he indicated he would be willing to look at cash for local and state governments, which was a key sticking point.

Dealers were also keeping tabs on coronavirus developments with England going into lockdown for a second time, joining France and other key European economies, though observers said they had largely been priced into markets now.

Axi strategist Stephen Innes said: “Accelerating Covid cases and new shutdowns are obviously not good, but I think the market will quickly look past these new measures.

“Rolling shutdowns are part of the pandemic new normal, and most traders understand this will be a global feature until we get a vaccine or herd immunity.”

He added that vaccine hopes were also rising, with Britain and Germany possibly on course for a jab by the end of the year.

– Key figures around 0230 GMT –

Tokyo – Nikkei 225: UP 1.0 percent at 23,929.61 (break)

Hong Kong – Hang Seng: UP 2.0 percent at 25,371.56

Shanghai – Composite: UP 0.6 percent at 3,296.03

Euro/dollar: DOWN at $1.1728 from $1.1732 at 2230 GMT

Dollar/yen: DOWN at 104.30 yen from 104.50 yen

Pound/dollar: DOWN at $1.2968 from $1.2993

Euro/pound: UP at 90.44 pence from 90.27 pence

West Texas Intermediate: DOWN 1.9 percent at $38.42 per barrel

Brent North Sea crude: DOWN 1.9 percent at $40.44 per barrel

New York – Dow: UP 1.3 percent at 27,847.66 (close)

London – FTSE 100: UP 1.7 percent at 5,883.26 (close)

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.