Asian markets mostly up but surging infections fuel fear

Hong Kong (AFP) – Asian markets mostly rose again Monday but investor sentiment remains divided between optimism over vaccine developments and concern about surging virus cases around the world.

A lack of movement in stimulus talks on Capitol Hill and a spat between the White House and Federal Reserve over cash for emergency lending facilities was also tempering the mood.

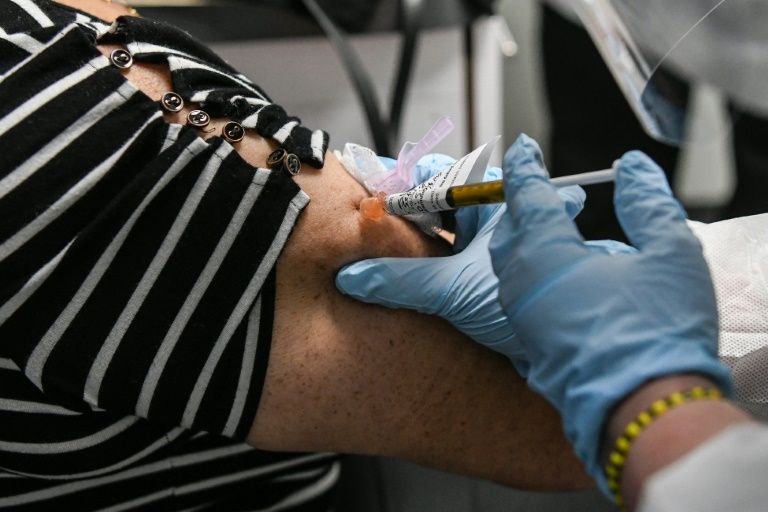

Hopes that the world can begin to return to some form of normal in the new year have been rising this month after top pharma giants announced better-than-expected results from trials of their vaccines.

On Friday Pfizer and its German partner BioNTech said they had applied for emergency use authorisation for their drug, which could be rolled out next month.

Moderna is expected to make its own application soon.

And on Sunday, a top government health official said he was hopeful jabs could be given within weeks.

“Our plan is to be able to ship vaccines to the immunisation sites within 24 hours of approval” by the US Food and Drug Administration, Moncef Slaoui, head of the US government virus vaccine effort, told CNN, pointing to possible dates of December 11-12.

FDA vaccine advisors will meet December 10 to discuss approval.

Slaoui estimated 20 million people across the US could be vaccinated in December, with 30 million per month after that. Britain and Germany are also hoping to begin offering jabs next month.

The need for an inoculation has been made stark by soaring infection and death rates in the US and elsewhere as the northern hemisphere heads into winter, when viruses usually spread more.

Some US states have started imposing new restrictions, while several European countries including England and France have returned to lockdowns.

“There is a lot of enthusiasm over the vaccine news and rightly so — as soon as we can get something that is very effective distributed widely, the sooner we can get back to ordinary life,” Brian Jacobsen, at Wells Fargo Asset Management, told Bloomberg TV.

“The problem, from our perspective, is we first have to get through winter and this is setting us up for some downside economic surprises.”

Seoul led gains, rallying more than one percent, while Shanghai, Sydney, Singapore, Wellington, Taipei, Manila and Jakarta also posted healthy gains.

But Hong Kong slipped as investors fret over a resurgence in the virus in the city that many fear could see economically painful containment measures reintroduced. Cathay Pacific tumbled more than four percent as a planned Hong Kong-Singapore travel bubble was called off. Singapore Airlines fell one percent in Singapore.

– More pain before relief –

“Market sentiment is likely to be caught near-term between negative Covid infection news… and positive vaccine news,” said Patrik Schowitz, a strategist at JP Morgan Asset Management.

“In the short term, the negative news may well win out, especially given how far markets have already rallied, and economic data in the US is beginning to wobble a bit. But if the market pulls back on that, it is likely to be a buying opportunity as over the medium run, eventually infection growth rates should peak… and vaccine rollout should begin.”

While vaccines are on their way, investors are keeping tabs on Washington, where lawmakers remain at loggerheads on a new, badly needed stimulus with analysts saying nothing will likely be agreed before Christmas.

Adding to the unease is concern about a spat between the White House and Fed after Treasury Secretary Stephen Mnuchin on Thursday refused to extend a series of programmes supporting the corporate credit market, municipal lending and small and medium-sized businesses.

He said the cash, which had not been used by the central bank, should be targeted at other pandemic-relief efforts.

But the Fed hit out at the move and observers questioned its timing.

“An emerging risk for investors is an untimely withdrawal of support for the US’s real economy, just as social mobility restrictions undermine activity for the second time this year,” said Axi’s Stephen Innes.

“Economic data will likely get worse before it gets better (and) the impact of continued lockdowns will be felt for some time before vaccines become widely available.”

In currency trading the pound extended gains on hopes Britain and the European Union could soon announce a post-Brexit trade deal.

European Commission President Ursula von der Leyen said Friday there had been better progress in recent talks, with an 11-month deadline on December 31 for the two sides to reach an agreement.

“After difficult weeks — with very, very slow progress — now we’ve seen in the last days better progress, more movement on important files. This is good,” Von der Leyen said.

– Key figures around 0230 GMT –

Hong Kong – Hang Seng: DOWN 0.1 percent at 26,416.30

Shanghai – Composite: UP 0.5 percent at 3,392.79

Tokyo – Nikkei 225: Closed for a holiday

Euro/dollar: UP at $1.1874 from $1.1857 at 2200 GMT

Pound/dollar: UP at $1.3322 from $1.3289

Dollar/yen: DOWN at 103.76 yen from 103.83 yen

Euro/pound: DOWN at 89.13 pence from 89.26 pence

West Texas Intermediate: DOWN 0.1 percent at $42.40 per barrel

Brent North Sea crude: UP 0.1 percent at $45.02 per barrel

New York – Dow: DOWN 0.8 percent at 29,263.48 (close)

London – FTSE 100: UP 0.3 percent at 6,351.15 (close)

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.