Asian markets drift as dealers track US stimulus, Brexit talks

Hong Kong (AFP) – Asian markets were mixed Thursday as investors kept an eye on US stimulus progress and the rollout of vaccines, while the pound was holding around 19-month highs on Brexit optimism, though surging infections and new lockdowns were keeping the mood subdued.

Lawmakers on both sides said they were hopeful of passing a much-needed rescue package for the troubled US economy as they haggle over details of a bipartisan proposal that appears to have broken months of deadlock.

With the two most contentious items removed from the plan, which is said to amount to around $900 billion, Republican Senate Majority Leader Mitch McConnell said leaders “made major headway toward hammering out a targeted pandemic relief package that would be able to pass both chambers with bipartisan majorities”.

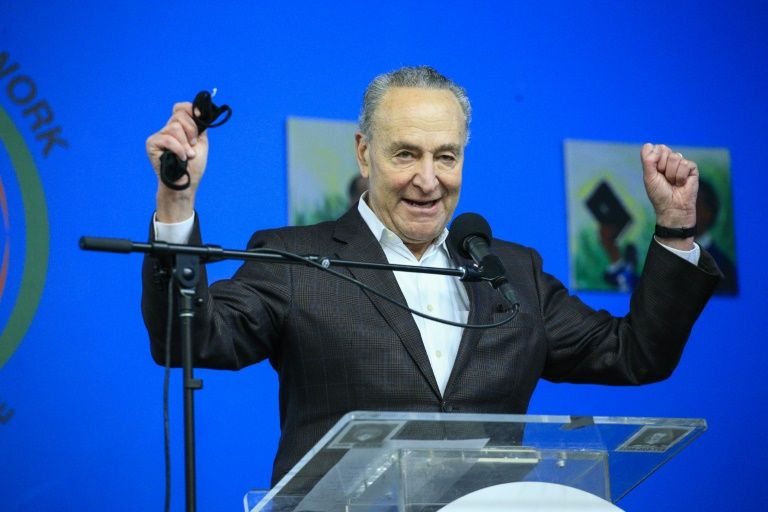

He added they had “agreed that we will not leave town until we’ve made law”, while top Senate Democrat Chuck Schumer said: “It’s not a done deal yet, but we are very close.”

OANDA analyst Craig Erlam said that there was chatter about a possible vote on Capitol Hill at the weekend.

Wall Street ended broadly higher with the Nasdaq chalking up another record, but Asia struggled to gain traction with hopes for a new stimulus offset by the imposition of strict containment measures around the world as coronavirus infection and death rates spike.

Tokyo and Hong Kong were flat, while Shanghai edged up slightly and Wellington rallied on data showing New Zealand’s economy grew more than expected in the third quarter. There were also gains in Sydney and Jakarta but Seoul, Taipei, Singapore and Manila all slipped.

As the stimulus talks continued, the Federal Reserve held its final policy meeting of the year at which it gave an upbeat assessment of the outlook for the world’s top economy next year and pledged to maintain its huge bond-buying, monetary-easing programme until it is back on an even keel.

But bank chief Jerome Powell reiterated the need for US lawmakers to reach a stimulus agreement, saying: “The case for fiscal policy right now is very strong. I think that is widely understood.”

– Powell’s ‘realism’ –

Stephen Innes at Axi said: “The big takeaway from the… meeting was the acknowledgement monetary policy can only have a limited influence on inflation now. Right now, fiscal policy is the most powerful economic tool.”

He said Powell “kept coming back to the need for fiscal policy to provide the base layer of support to the economy. That did not mean it was a highly political affair from Powell — it was not. Rather he gave a press conference full of realism and acceptance of what the Fed could and could not do.”

Talks across the Atlantic on a post-Brexit trade deal also appeared to be heading in the right direction, with European Commission President Ursula von der Leyen saying “the next days are going to be decisive”.

The pound was sitting around levels last since in May 2018, though it was struggling to break higher as Britain and EU negotiators remain unable to find common ground on fishing rights.

And British Prime Minister Boris Johnson said: “There’s every opportunity, every hope, that I have that our friends and partners across the Channel will see sense and do a deal.”

Bitcoin extended gains after breaking to a fresh record above $21,000 on Wednesday. The unit, which was wallowing around $5,000 in March, has soldiered higher since online payments giant PayPal said it would enable account-holders to use cryptocurrency.

While markets are stuttering this month heading into the Christmas break, Brian Nick at Nuveen sounded a note of optimism.

“The 12-month outlook looks quite a bit better because we have high conviction now that there is going to be mass vaccination,” he told Bloomberg TV. “There’s not going to be as acute of a health crisis as we’re experiencing right now.”

– Key figures around 0230 GMT –

Tokyo – Nikkei 225: FLAT at 26,754.79 (break)

Hong Kong – Hang Seng: FLAT at 26,459.20

Shanghai – Composite: UP 0.2 percent at 3,370.80

Pound/dollar: UP at $1.3527 from $1.3503 at 2240 GMT

Euro/pound: DOWN at 90.21 pence from 90.26 pence

Euro/dollar: UP at $1.2203 from $1.2194

Dollar/yen: DOWN at 103.33 yen from 103.43 yen

West Texas Intermediate: UP 0.7 percent at $48.16 per barrel

Brent North Sea crude: UP 0.6 percent at $51.40 per barrel

New York – Dow: DOWN 0.2 percent at 30,154.54 (close)

London – FTSE 100: UP 0.9 percent at 6,570.91 (close)

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.