Asian markets boosted by fresh hopes for US stimulus

Hong Kong (AFP) – Asian markets rallied Wednesday as investors cheered news that the White House had put forward a fresh stimulus proposal of more than $900 billion, lifting hopes US lawmakers could pass a deal before Christmas.

The prospect of a rescue package for the world’s top economy helped revive equities, which have drifted for most of the month after November’s surge, while the rollout of vaccines in Britain and imminent authorisation in the US has added to the optimism.

However, spiking virus cases around the world and the imposition of tough containment measures continues to cast a long, dark shadow over trading floors.

Eyes are also on Brussels, where Prime Minister Boris Johnson is due to hold crunch talks with EU chief Ursula von der Leyen on a post-Brexit trade deal.

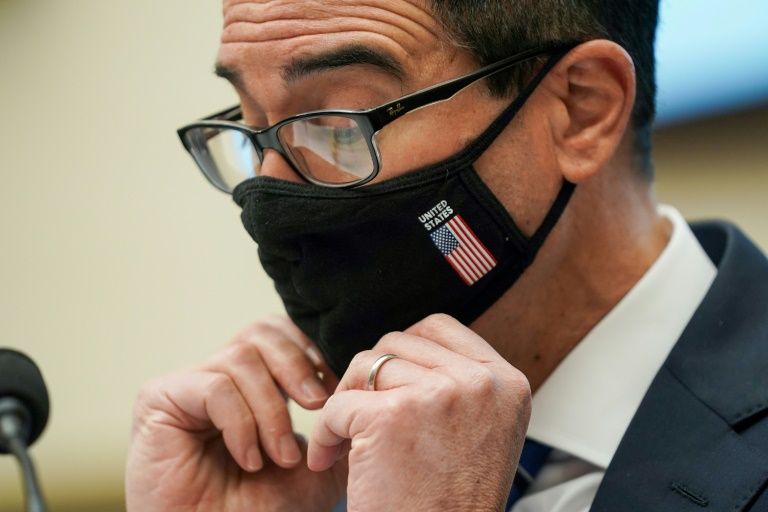

Equities have struggled this week as focus has been on the disease but Treasury Secretary Steven Mnuchin provided a much-needed shot in the arm Tuesday when he said he had presented Democrat House Speaker Nancy Pelosi with a new economic rescue package.

The $916 billion plan is bigger than the $908 billion proposal put forward last week by a bipartisan group of lawmakers, and Mnuchin said it includes “money for state and local governments and robust liability protections for businesses, schools and universities”.

Those elements have been key sticking points in negotiations between Democrats and Republicans. Crucially, the bill has been viewed by Donald Trump and Senate Majority Leader Mitch McConnell.

“My view, and I think it’s a view shared by literally everybody on both sides of the aisle, is that we can’t leave without doing a Covid bill,” McConnell said before the proposal was made public. “The country needs it.”

Hong Kong, Seoul and Wellington all rose more than one percent, while Tokyo put on one percent and Sydney jumped 0.9 percent.

There were also gains in Shanghai, Taipei and Singapore.

– Popeye’s spinach –

Regional investors were given a strong lead from Wall Street, where the Nasdaq and S&P 500 notched up fresh records.

“With the markets starting to exhibit some year-end fatigue, any stimulus holiday stocking-stuffer will come at a most welcome time and ensure that well-subscribed equity markets will cross the year-end finishing line on a positive note,” said Axi strategist Stephen Innes.

“The bulls remain very much in the driving seat; every time the word stimulus gets a mention, investors immediately start feeling like Popeye after sucking down a can of spinach.”

The pound edged up but traders are keeping a nervous eye on developments in the Brexit negotiations with Johnson’s meeting with Von der Leyen crucial to the outcome just weeks ahead of the December 31 deadline for an agreement.

Britain made a gesture of good faith by withdrawing controversial elements of a legislative package concerning the future border in Ireland.

But while EU member Ireland said a pact between the sides on post-Brexit Northern Ireland offered some hope for a broader trade deal, optimism was at a premium.

Observers have warned Britain’s economy, and that of the EU to an extent, face a tough outlook if it leaves the single market without a follow-on trade deal.

But Johnson was hardly upbeat heading to the Belgian capital.

“You’ve got to be optimistic, you’ve got to believe there’s the power of sweet reason to get this thing over the line,” he said. “But I’ve got to tell you it’s looking very, very difficult at the moment.”

– Key figures around 0230 GMT –

Tokyo – Nikkei 225: UP 1.0 percent at 26,743.52 (break)

Hong Kong – Hang Seng: UP 1.2 percent at 26,627.42

Shanghai – Composite: UP 0.1 percent at 3,413.56

Pound/dollar: UP at $1.3370 from $1.3354 at 2150 GMT

Euro/pound: UP at 90.65 pence from 90.63 pence

Euro/dollar: UP at $1.2119 from $1.2104

Dollar/yen: UP at 104.18 yen from 104.16

West Texas Intermediate: DOWN 0.3 percent at $45.48 per barrel

Brent North Sea crude: DOWN 0.2 percent at $48.73 per barrel

New York – Dow: UP 0.4 percent at 30,173.88 (close)

London – FTSE 100: UP 0.1 percent at 6,558.82 (close)

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.