Asia stocks rise as recovery signs offset new lockdowns

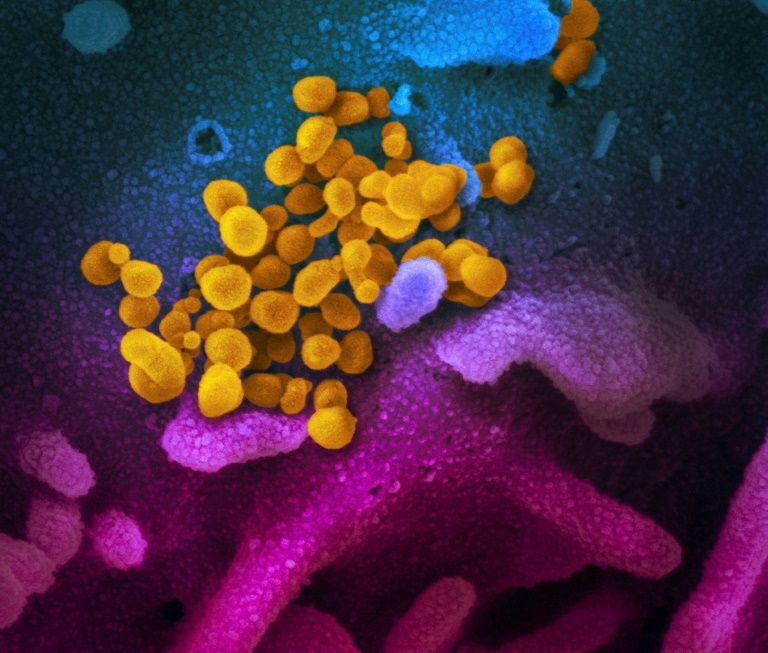

Investors have been cheered by positive results from tests of a possible virus vaccine . ©National Institutes of Health/AFP/File Handout

Hong Kong (AFP) – Asian markets rose Thursday following a record lead from Wall Street, with investors cheered by hopes for a vaccine, more positive economic data and further lockdown easing in Europe.

The developments helped offset a worrying spike in infections in the US, which has led to the reimposition of containment measures that could slow recovery in the world’s top economy, and warnings of worse to come.

Hong Kong led the gains on reopening after a one-day break, despite concerns about a new security law imposed on the city by China that observers said was more draconian than feared and could impact its future as an attractive business hub.

And while there are worries about the issue causing further friction between Beijing and the West, markets remain positive for now.

The Hang Seng Index rose 1.6 percent, Tokyo ended the morning 0.7 percent higher and Sydney put on more than one percent.

Shanghai, Seoul, Taipei, Singapore, Jakarta and Wellington were also well up.

The gains came after another all-time high for the tech-heavy Nasdaq on Wall Street, with investors now awaiting the release of key US June jobs data later in the day for a better grip on the economy following May’s surprise jump in employment.

There was some cheer from figures showing a 2.37 million increase in private payrolls, though that was slightly below forecasts.

Adding to signs that the worst of the economic hit may have passed, US factory activity began growing again, while the rise in German retail sales was four times more than expected in May.

Meanwhile, hopes for a vaccine were given a boost after Germany’s BioNTech and US pharmaceutical giant Pfizer reported positive preliminary results from a joint project, which showed positive antibody responses.

Europe continued with its lockdown easing, with the EU reopening its borders to visitors from 15 countries, while Spain and Portugal held a ceremony to free up their land border.

– Europe opens, US closes –

And the Netherlands confirmed the lifting of measures imposed on its brothels and red-light districts.

“It’s been a risk-positive start to the new quarter, starting as the old one went out, with more positive data surprises out of the US and encouraging news regarding potential coronavirus vaccine development,” said National Australia Bank’s Ray Attrill.

But he warned of a “need to be on guard for the recent stalling or even reversal of social distancing restrictions in many US states prompting setbacks in some of these readings in coming months.”

There are increasing worries over a second wave elsewhere around the world, led by the United States, which on Wednesday reported more than 50,000 new cases for the first time and several US states imposed 14-day quarantines on visitors ahead of the long weekend’s July 4 celebrations.

California suspended indoor dining at restaurants in Los Angeles and several counties, while New York scrapped plans to allow restaurants to seat customers inside from next week.

Apple announced it would close another 30 US stores on Thursday, half of them in California.

And the World Health Organization warned that with more than 10 million known infections worldwide and more than 500,000 deaths, the pandemic is “not even close to being over”.

“There’s this inherent tension between health of the economy and health of the population,” David Lebovitz, a strategist at JPMorgan Asset Management, said. “It’s going to be the way to think about what drives markets over the next couple of weeks or months.”

– Key figures around 0250 GMT –

Hong Kong – Hang Seng: UP 1.6 percent at 24,814.76

Tokyo – Nikkei 225: UP 0.7 percent at 22,266.23 (break)

Shanghai – Composite: UP 0.6 percent at 3,045.07

West Texas Intermediate: DOWN 0.1 percent at $39.79 per barrel

Brent North Sea crude: FLAT at $42.04 per barrel

Euro/dollar: UP at $1.1256 from $1.1249 at 2100 GMT

Dollar/yen: UP at 107.49 yen from 107.43 yen

Pound/dollar: UP at $1.2478 from $1.2468

Euro/pound: UP at 90.22 pence from 90.19 yen

New York – Dow: DOWN 0.3 percent at 25,734.97 (close)

London – FTSE 100: DOWN 0.2 percent at 6,157.96 (close)

— Bloomberg News contributed to this story —

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.