Nasdaq ends at record, dollar falls as US Fed signals possible rate cut

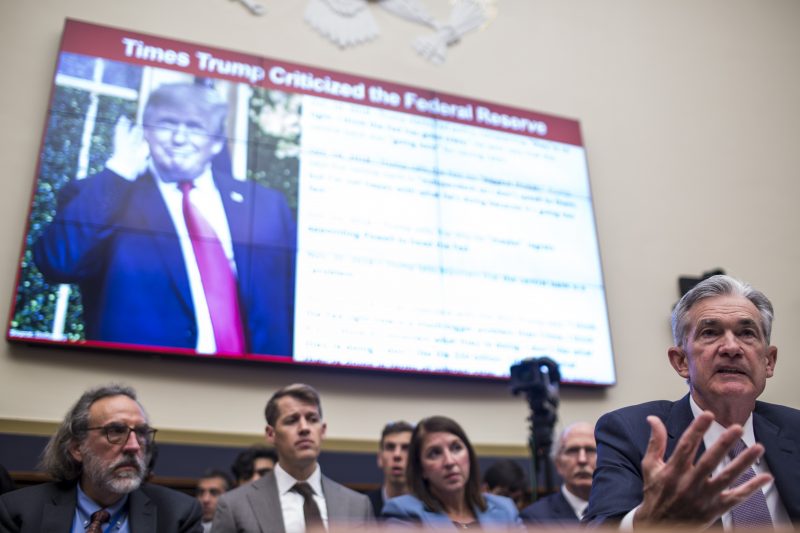

Federal Reserve Chairman Jerome Powell testifies during a House Financial Services Committee hearing on Capitol Hill (Zach Gibson)

New York (AFP) – Wall Street stocks cheered dovish testimony from Federal Reserve Chair Jerome Powell on Wednesday, lifting the Nasdaq to a fresh record while the prospect of looser monetary policy pressured the dollar.

In the first of two days of congressional testimony, Powell said many central bankers believed the case for lower rates “had strengthened” as myriad trade conflicts cloud the growth outlook.

Since the June meeting, when Powell’s dovish remarks were interpreted as signaling a possible cut, “it appears that uncertainties around trade tension and concerns about the strength of the global economy continue to weigh on the US economic outlook,” Powell said.

The remarks conformed to broad investor expectations about what Powell would say and appeared to quash speculation that last week’s strong US jobs report would prevent a rate cut later this month.

Powell has been under constant pressure from US President Donald Trump to cut interest rates but said again Wednesday that White House sniping played no role in his outlook.

All three major indices surged to all-time intraday records near the start of the Wall Street session after Powell’s written congressional testimony was released. But the tech-rich Nasdaq Composite Index was the only one to hold the record, ending at 8,202.53, up 0.8 percent.

The Dow and S&P 500 also finished higher on a day in which European stocks retreated and leading Asian bourses were mixed.

The dollar also shifted course following Powell’s remarks.

The US currency had rallied following the jobs report but “today’s testimony implies that a rate cut is a ‘done deal,'” said Matt Weller in a note on Forex.com.

– How aggressive? –

Heading into Wednesday’s much-anticipated hearing, many investors had taken an interest rate cut as a near certainty, viewing the next meeting as a question of how aggressively the Fed would act.

“I don’t think it’s changed anything. Everyone expected him to cut in July,” said Maris Ogg of Tower Bridge Advisors, who thinks the Fed will undertake a 25 basis point cut in interest rates this month.

“But a cut of 50 basis points is not gonna happen,” Ogg said. “We’re not seeing that much weakness and it would indicate that something is not working well.”

Following the testimony, most investors still predicted a smaller interest rate cut but a solid minority bet on a larger 50 basis point cut.

Christopher Vecchio of Daily FX, meanwhile, said Powell’s appearance “laid the groundwork for a series of interest rate cuts over the coming months.”

In other markets, oil prices jumped more than two percent after a government inventory report showed a massive drop in US stockpiles last week. Traders also cheered reports that Russian output fell in July to its lowest in nearly three years.

Other factors boosting oil prices included continued diplomatic tensions involving OPEC member Iran and a storm in the Gulf of Mexico that prompted some producers to evacuate offshore workers and suspend some output.

– Key figures around 2045 GMT –

New York – Dow: UP 0.3 percent at 26,860.20 (close)

New York – S&P 500: UP 0.5 percent at 2,993.07 (close)

New York – Nasdaq: UP 0.8 percent at 8,202.53 (close)

London – FTSE 100: DOWN 0.1 percent at 7,530.69 (close)

Paris – CAC 40: DOWN 0.1 percent at 5,567.59 (close)

Frankfurt – DAX 30: DOWN 0.5 percent at 12,373.41 (close)

EURO STOXX 50: DOWN 0.2 percent at 3,501.52 (close)

Tokyo – Nikkei 225: DOWN 0.2 percent at 21,533.48 (close)

Hong Kong – Hang Seng: UP 0.3 percent at 28,204.69 (close)

Shanghai – Composite: DOWN 0.4 percent at 2,915.30 (close)

Euro/dollar: UP at $1.1251 from $1.1208 at 2100 GMT

Pound/dollar: UP at $1.2504 from $1.2465

Dollar/yen: DOWN at 108.46 yen from 108.85 yen

Brent North Sea crude: UP $2.85 at $67.01 per barrel

West Texas Intermediate: UP $2.60 at $60.43 per barrel

burs-jmb/dg

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.