Crunch time as high-level US-China trade talks resume

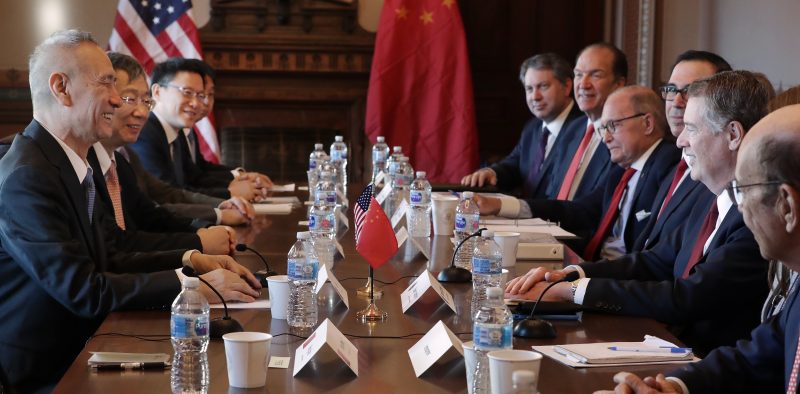

Chinese trade envoy Liu He smiles during talks in Washington in January (CHIP SOMODEVILLA)

Washington (AFP) – With eight days left in their trade truce, top US and Chinese officials were due Thursday to return to the daunting task of bridging a chasm between the world’s two largest economies.

US President Donald Trump has repeatedly claimed the talks with Beijing are going “very well,” but concrete signs of progress have not been apparent in the three months since the two sides agreed to pause their trade war.

Analysts say the distance separating Washington and Beijing and the short time remaining before the March 1 deadline make it likely the outcome would feature banner announcements but would fall short of Trump’s most far-reaching goals.

“I think the consensus of people that have been following this thing is that they’re not making nearly as much progress as the president tweets that they’ve been making,” said William Reinsch, a former US trade official now at the Center for Strategic and International Studies.

Chinese trade envoy Liu He will lead Beijing’s delegation in meetings with US Trade Representative Robert Lighthizer and other American officials Thursday and Friday as they work to head off an escalation of US tariffs. This fourth round of negotiations follow two days of preliminary talks at the deputy level.

Trump this week said a March 1 deadline to reach a deal was in fact “not a magical date,” raising hopes that he could delay the plan to more than double duties on $200 billion in Chinese goods.

China’s party-owned Global Times late Tuesday warned raising US tariffs would amount to “a catastrophic strike” on global stock markets, which have been buffeted for months by the uncertainty and the prospects for slower global growth.

Since July, Washington and Beijing have hit each other with tariffs on more than $360 billion in two-way trade, weighing on the manufacturing sectors in both countries.

Washington has demanded that Beijing reverse much of its industrial policy, charging that China has sought global dominance through the alleged theft of American technology, massive subsidies and the promotion mammoth state-owned enterprises.

US officials have stressed that any agreement must have teeth to ensure that China keeps its promises.

– When Trump can claim ‘victory!’ –

Demands for structural changes likely will be far harder to resolve than complaints about the soaring US-China trade imbalance, which has hit record heights since Trump took office.

Trump has said the ultimate bargain will be struck at a meeting with China’s President Xi Jinping.

Reinsch told AFP the two sides were likely to strike some kind of bargain.

“I’m sure they’ll come up with something that will be more than cosmetic but less than we’re asking,” he said.

“It’ll probably in the area of intellectual property theft and more open investment in China because they’re the things that benefit them as well as benefit us.”

But other changes — such as subjecting China’s state-owned enterprises to free-market principles — could weaken the communist party’s hold on power, making Chinese officials very reluctant to budge, he added.

Meanwhile, China’s economy has begun slowing sharply as well, eroding prospects for global growth this year. Japan reported Tuesday that China-bound exports had dived 17.4 percent last month, the biggest drop in three years as demand there tumbled.

But research by the Institute for International Finance, the impact of punitive US tariffs on $250 billion in Chinese goods has been partly offset by last year’s six percent depreciation of the currency.

While that softened much of the blow China’s exports and on the US consumer, IIF chief economist Robin Brooks told AFP it has hit the bottom line of Chinese companies.

Gary Clyde Hufbauer, a former US trade official now at the Peterson Institute for International Economics, said he expected China to make a mega-bucks offer to buy more American exports — and possibly even unilaterally remove tariffs on US goods.

“I’m thinking there’ll be an eye-catching announcement as to how much China will buy in the next year or so that will enable Trump to say ‘victory! victory!'” he told AFP.

But should the agreement fail to hold — causing Washington to impose more tariffs while accusing Beijing of backsliding — that could pose prove embarrassing for the Americans, he said.

“The question is a year from now, as we’re going into the election cycle, how a renewal of testy trade relations with China will play politically and in the markets,” Hufbauer said.

“I don’t think you want to go into an election with a downer stock market.”

Disclaimer: This story is published from a syndicated feed. Siliconeer does not assume any liability for the above story. Validity of the above story is for 7 Days from original date of publishing. Content copyright AFP.