Stock markets rise on trade talks, rates optimism

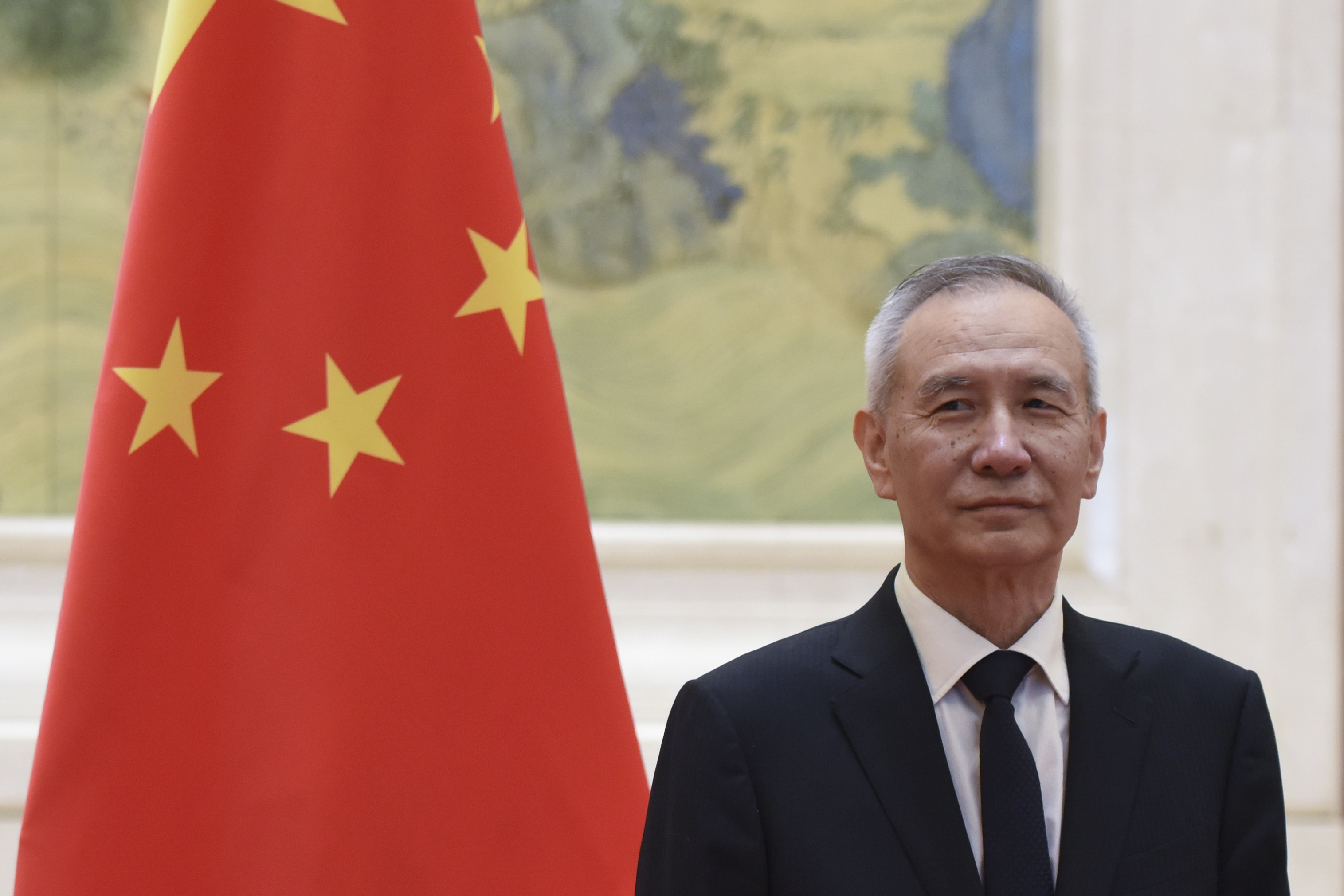

News that China’s top economic diplomat and Vice Premier Liu He was involved in trade talks with the US in Beijing provided some cheer to investors (WANG ZHAO)

London (AFP) – Stock markets mostly rose and the dollar firmed Tuesday as traders eye a pause in US interest rate hikes, with sentiment also helped by growing optimism over Washington’s trade talks with China.

Wall Street provided another positive lead Monday, extending Friday’s sharp gains, with Chinese monetary easing at the weekend adding to the positive tone.

“European equities have found some support along with US stock futures… as investors await developments on trade talks between the world’s two largest economies,” noted Oanda analyst Dean Popplewell.

“In Asia, equities traded mixed as a rebounding US dollar put some pressure on emerging markets.”

Federal Reserve chief Jerome Powell last week said that the US central bank had no “pre-set” plan for raising interest costs and was keeping a close watch on financial developments, fuelling hopes it will slow its pace of rate hikes.

“Mounting expectation that the Federal Reserve may not be in a position to hike interest rates at all during 2019 owing to the deteriorating global economic outlook has lent fresh support to US index futures,” said James Hughes, chief market analyst at Axitrader.

“There’s also optimism over progress being seen in the US-China trade talks which are ongoing in Beijing right now, with the involvement of President Xi’s most senior aide helping lend a degree of support.”

US officials held a second day of talks with Chinese counterparts in Beijing on Tuesday, the first time the two sides have met face-to-face since President Donald Trump and Chinese leader Xi Jinping agreed to a tariff truce during a meeting on December 1.

While there is little expectation this week for a full agreement on the issue, which has seen the two sides impose tariffs on goods worth hundreds of billions of dollars, there are hopes they can make some headway.

“While we don’t expect a full resolution in trade tension between China and the US in the foreseeable future, small steps in progress are likely to be taken favourably by investors,” said Tai Hui, chief market strategist for Asia-Pacific at JP Morgan Asset Management.

“The latest positive signals from the Trump administration of prospects of reaching some form of agreement and (top Xi aide) Vice Premier Liu He attending the negotiations should continue to cheer the market in the near term.”

On the corporate front, Samsung on Tuesday forecast a near-30 percent drop in operating profit for the December quarter — causing its shares to close down 1.7 percent.

The South Korean behemoth cited “lacklustre demand in the memory business and intensifying competition in the smartphone business”, fanning worries about the wider technology sector.

Its US rival Apple last week sent shudders through the markets when it warned of a bigger-than-expected drop in revenues owing to falling Chinese demand while highlighting the impact of the trade war.

– Key figures around 1145 GMT –

London – FTSE 100: UP 1.1 percent at 6,886.22 points

Frankfurt – DAX 30: UP 0.8 percent at 10,832.75

Paris – CAC 40: UP 1.4 percent at 4,785.03

EURO STOXX 50: UP 1.1 percent at 3,065.94

Tokyo – Nikkei 225: UP 0.8 percent at 20,204.04 (close)

Hong Kong – Hang Seng: UP 0.2 percent at 25,875.45 (close)

Shanghai – Composite: DOWN 0.3 percent at 2,526.46 (close)

New York – Dow: UP 0.4 percent at 23,531.35 (close Monday)

Dollar/yen: UP at 108.77 yen from 108.74 at 2200 GMT

Euro/dollar: DOWN at $1.1454 from $1.1472

Pound/dollar: DOWN at $1.2763 from $1.2769

Oil – Brent Crude: UP $1.11 at $58.44 per barrel

Oil – West Texas Intermediate: UP 81 cents at $49.33

burs-bcp/rfj/bmm

Disclaimer: This story is published from a syndicated feed. Siliconeer does not assume any liability for the above story. Validity of the above story is for 7 Days from original date of publishing. Content copyright AFP.