Mexico unveils $5.5-bn rescue plan for ailing Pemex

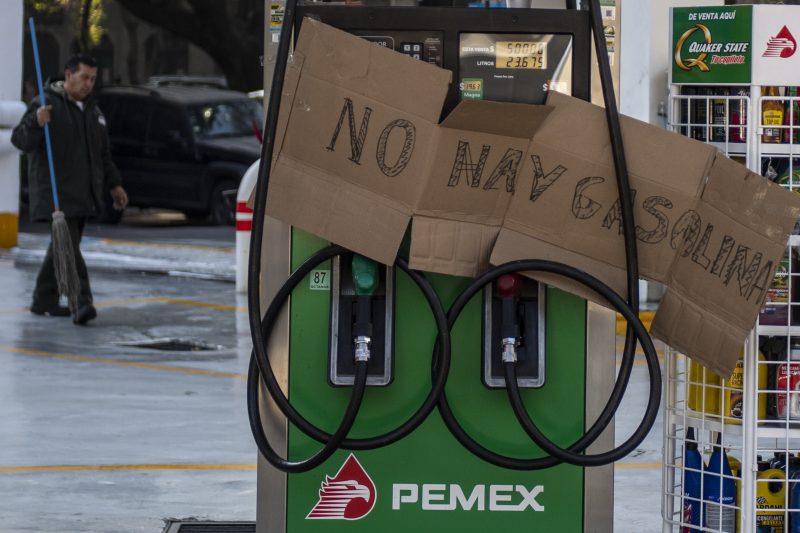

Imagen de una estación de gasolina cerrada debido al desabastecimiento en la Ciudad de México, el 9 de enero de 2019 (Pedro PARDO)

Mexico City (AFP) – The Mexican government said Friday it would bail out ailing state oil company Pemex with $5.5 billion in additional funds this year — though that falls short of what analysts say the firm needs.

The money — a mix of cash, tax benefits, pension fund support and expected savings — will help Pemex pay down its massive debt and invest more in its flagging production, officials said.

The company, which owes $100 billion in debt, said it would also stop taking out new loans.

“We have made the decision to support Pemex with everything we’ve got,” said President Andres Manuel Lopez Obrador, a left-wing energy nationalist who has made rescuing the firm a priority.

Concerns about Pemex — a key revenue source for Mexico — have raised questions about the future stability of Latin America’s second-largest economy.

The plan breaks down into $800 million in tax benefits, $1.3 billion in cash and $1.8 billion in assistance paying the company’s massive pension bill, officials said.

The remaining chunk consists of $1.6 billion in expected savings from combatting theft from Pemex’s fuel pipelines — a massive black-market industry in Mexico that has thrived with the help of corrupt officials and company insiders.

Lopez Obrador’s government is currently waging a major crackdown on fuel theft, which cost the country an estimated $3 billion in 2017.

Pemex’s chief financial officer, Alberto Velazquez, told a news conference the company would use the rescue plan to increase investment by 36 percent this year, to $14.9 billion.

The “vast majority” of Pemex’s debt under the previous government of President Enrique Pena Nieto “was lost to inefficiency and corruption,” said Finance Minister Carlos Urzua.

Analysts said the plan would probably not be enough.

“The measures are not a long-term fix and won’t be enough to stabilize oil output, which has halved since 2004,” said London-based consulting firm Capital Economics.

Ratings agency Fitch, which recently downgraded Pemex, says the firm needs an additional $9 billion to $14 billion annually to get back on its feet.

Urzua sought to downplay concerns, saying the government would back Pemex “totally.”

“If more funds are needed to recapitalize Pemex, including this year, we will do that,” the finance minister said.

Disclaimer: This story is published from a syndicated feed. Siliconeer does not assume any liability for the above story. Validity of the above story is for 7 Days from original date of publishing. Content copyright AFP.