Global stocks surge on hopeful signs from US-China trade talks

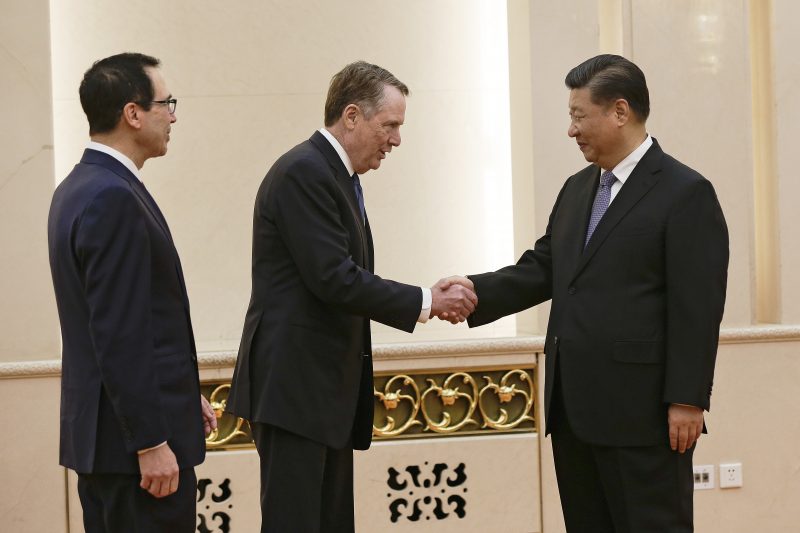

US Trade Representative Robert Lighthizer told Chinese President Xi Jinping that “we have additional work to do, but we are hopeful” (Andy Wong)

London (AFP) – Global stock markets leapt on Friday as positive signs emerged from China-US trade talks aimed at averting an escalation of a tariff war between the world’s top two economies.

The White House said that two days of high-level negotiations in Beijing “led to progress between the two parties” while Chinese President Xi Jinping announced the talks would continue in Washington next week.

“Investors are still hopeful on constructive resolution to US-China trade talks,” VTB Capital analyst Neil MacKinnon told AFP.

Wall Street opened higher on the news, following the lead of Frankfurt’s DAX 30, which jumped 1.8 percent in afternoon trading, with the Paris CAC 40 up 1.8.

Madrid’s IBEX 35 index was up 1.7 percent after Spanish Prime Minister Pedro Sanchez called an early general election, following the rejection of his draft budget in parliament over the Catalan secession crisis.

“There is more political uncertainty in Europe as Spain will hold a snap election,” said David Madden, analyst at CMC Markets UK.

London’s index rose as stronger than expected UK retail sales were reported for January, and consumers seemed to shrug off Brexit blues.

However Prime Minister Theresa May suffered another parliamentary defeat on Friday as she seeks changes to the Brexit deal ahead of the UK exit from the EU on March 29.

The dollar was up versus the euro, while Brent crude oil hit a 2019 high on tighter supplies caused by a dip in overall OPEC output and a crisis in cartel member Venezuela.

Brent North Sea reached $65.71 per barrel, the highest level for almost three months.

Earlier in Asia, equity markets had closed sharply lower as Chinese inflation eased more than expected, reflecting sluggish demand.

– ‘We are hopeful’ –

But investor hopes were buoyed on Friday after President Xi said US-China “consultations between the two teams have made important step-by-step progress”.

“Next week the two sides will also meet in Washington. I hope that you will continue to work hard to promote a mutually beneficial and win-win agreement,” Xi said.

On the US side, Trade Representative Robert Lighthizer said that while there was more work to do, they had made progress.

“We have had two very good days of negotiations,” Lighthizer told Xi. “We have additional work to do, but we are hopeful.”

American and Chinese officials had gathered in a bid to resolve their trade differences before US President Donald Trump’s March 1 deadline for escalating tariffs on $200 billion of Chinese imports.

Michael Hewson, chief market analyst at CMC Markets UK, said the week’s talks seemed to have created a framework for more discussion to resolve the issue.

“Ultimately it appears that conciliation appears to be the name of the game, in expectation of a truce beyond 1st March,” he said.

– Key figures around 1540 GMT –

London – FTSE 100: UP 0.8 percent at 7,257.06 points

Frankfurt – DAX 30: UP 1.8 percent at 11,1298.60

Paris – CAC 40: UP 1.8 percent at 5,155.12

Madrid – IBEX 35: UP 1.7 percent at 9,120.10

EURO STOXX 50: UP 1.8 percent at 3,240.16

New York – Dow: UP 1.1 percent at 25,719.73

Tokyo – Nikkei 225: DOWN 1.1 percent at 20,900.63 points (close)

Hong Kong – Hang Seng: DOWN 1.9 percent at 27,900.84 (close)

Shanghai – Composite: DOWN 1.4 percent at 2,682.39 (close)

Euro/dollar: DOWN at $1.1277 from $1.1292 at 2200 GMT Thursday

Pound/dollar: UP at $1.2832 from $1.2795

Dollar/yen: DOWN at 110.43 yen from 110.69 yen

Oil – Brent Crude: UP $1.02 cents at $65.59 per barrel

Oil – West Texas Intermediate: UP 96 cents at $55.37

burs-dl/jh

Disclaimer: This story is published from a syndicated feed. Siliconeer does not assume any liability for the above story. Validity of the above story is for 7 Days from original date of publishing. Content copyright AFP.