Global stocks rally on trade deal optimism as pound falls again

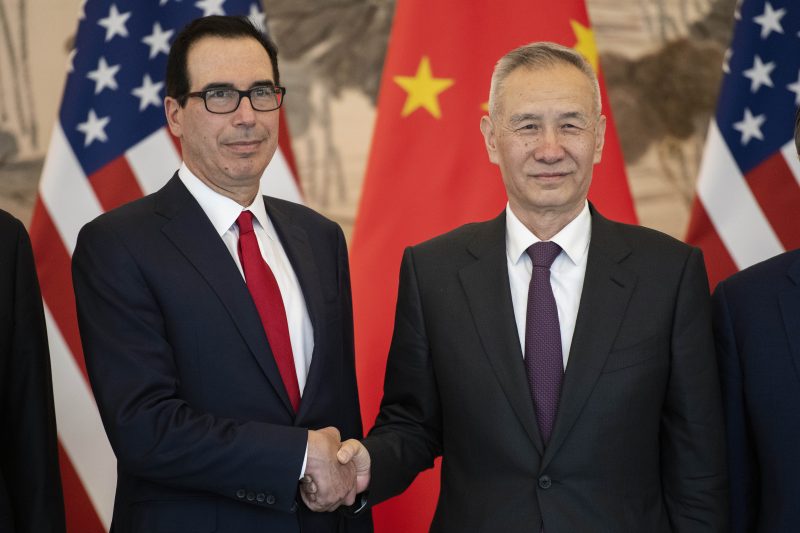

China’s Vice Premier Liu He (R) shakes hands with US Treasury Secretary Steven Mnuchin (L) as they pose for a group photo at the Diaoyutai State Guesthouse in Beijing (Nicolas ASFOURI, NICOLAS ASFOURI)

New York (AFP) – Global stocks rallied Friday on optimism over US-China trade talks, while the pound fell further as Britain veered closer to a potential “no deal” Brexit.

Bourses rose in the US and in major European and Asian centers, concluding the first quarter with a flourish.

Friday’s session was bolstered by upbeat comments from Trump administration officials following the latest round of trade negotiations in Beijing.

US and Chinese negotiators are working to find a binding agreement to address President Donald Trump’s complaints about years of unfair treatment of US companies by China, which would allow a rollback of the tariffs hitting businesses in both countries.

The White House reported “progress” in what it termed “candid and constructive discussions,” saying that the next round of talks will be held in the US capital on April 3.

Chinese state broadcaster CCTV said the latest round yielded “new progress,” without elaborating.

The broad-based S&P 500 ended at 2,834.40, up 0.7 percent for the session and 13.1 percent for the quarter, its best in almost a decade.

The first-quarter rally has been fed by optimism over the US-China trade talks and by the Federal Reserve’s dovish shift on monetary policy.

In a closely-watched premiere on public markets, ride-hailing company Lyft finished at $78.29, up 8.7 percent from its initial public offering price after the IPO raised $2.3 billion.

– ‘What happens next’? –

Meanwhile, the pound slid further after British MPs rejected Prime Minister Theresa May’s EU divorce deal for a third time, opening the way for a long delay to Brexit — or a chaotic “no deal” withdrawal in two weeks.

Lawmakers in parliament’s lower House of Commons defied May’s plea to end a political deadlock over Brexit, defeating her withdrawal agreement by 344 votes to 286.

“We thought it was going to be a lot closer,” Joshua Mahony told AFP on the IG trading floor in London. “Everyone is now starting to wonder exactly what happens next.”

“No-one really wants to say it but we are in danger of sleepwalking into an unintended no-deal scenario here, an outcome that looked highly unlikely just a couple of weeks back, and this poses a major risk for the pound,” said XTB analyst David Cheetham.

The EU Commission seemed to agree, saying after the vote that a no-deal Brexit was now a “likely scenario”.

The EU has set a deadline of April 12 for a decision, with two likely options: Britain leaves with no deal at all, or agrees a lengthy extension to allow time for a new approach.

“Whenever you’ve tracked the pound it has always been reflecting the market sentiment surrounding the possibility of a no-deal Brexit — and I think today’s move really does reflect that,” Mahony said.

– Key figures around 2100 GMT –

New York – Dow: UP 0.8 percent at 25,928.68 (close)

New York – S&P 500: UP 0.7 percent at 2,834.40 (close)

New York – Nasdaq: UP 0.8 percent at 7,729.32 (close)

London – FTSE 100: UP 0.6 percent at 7,279.19 (close)

Frankfurt – DAX 30: UP 0.9 percent at 11,526.04 (close)

Paris – CAC 40: UP 1.0 percent at 5,350.53 (close)

EURO STOXX 50: UP 1.0 percent at 3,351.71 (close)

Tokyo – Nikkei 225: UP 0.8 percent at 21,205.81 (close)

Hong Kong – Hang Seng: UP 1.0 percent at 29,051.36 (close)

Shanghai – Composite: UP 3.2 percent at 3,090.76 (close)

Oil – Brent Crude: DOWN 1 cent at $67.82 per barrel

Oil – West Texas Intermediate: DOWN 11 cents at $59.30 per barrel

Pound/dollar: DOWN at $1.3023 from $1.3044 at 2100 GMT

Euro/pound: UP at 86.14 pence from 86.03 pence

Euro/dollar: DOWN at $1.1217 from $1.1221

Dollar/yen: UP at 110.82 yen from 110.63 yen

burs-jmb

Disclaimer: Validity of the above story is for 7 Days from original date of publishing. Source: AFP.