Fed to hold fire on interest rates as world economy slows

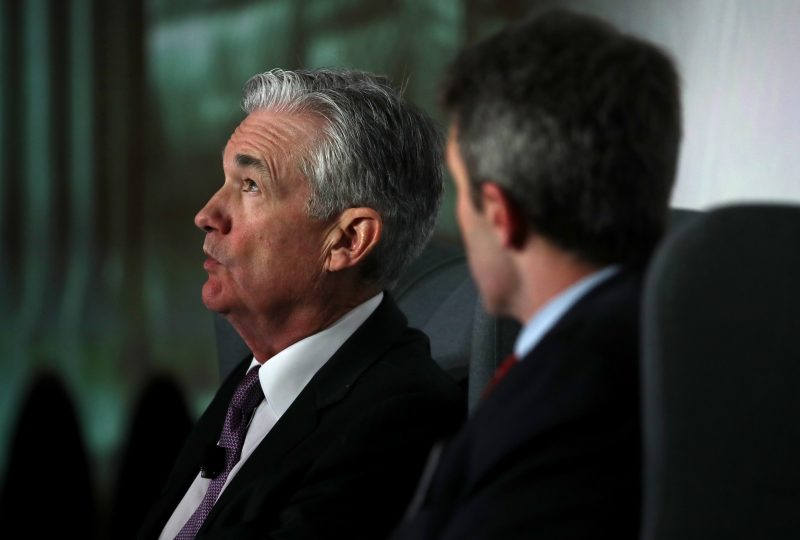

Futures markets put the odds at one in three the Fed will actually cut rates in the next 10 months (JUSTIN SULLIVAN)

Washington (AFP) – There is virtually no chance the US Federal Reserve will raise interest rates in the coming week, since policymakers have all but promised to hold their fire as the global economy slows.

With inflation still tame as US economic growth decelerates in 2019, economists also say Fed officials will once again lower the number of rate hikes they expect this year, from the two projected in December.

Fed Chairman Jerome Powell is due to announce the second policy decision of the year on Wednesday by the rate-setting Federal Open Market Committee.

The benchmark interest rates is now in a range of 2.25 to 2.5 percent and futures markets see no more rate hikes in 2019.

And investors now put the odds at one in three that the central bank will reverse directions and begin cutting rates in the next 10 months.

Some economists warn that is unlikely: with unemployment falling and eventually pushing wages higher, inflation might rear its head as soon as the summer, compelling the Fed to act.

But in congressional testimony last month, Powell said he anticipates low energy prices will drive inflation even further below the Fed’s two percent target, at least for a “for a time.”

Other influential players on the FOMC have likewise chimed in, calling for caution: New York Fed President John Williams said this month he expects economic growth to slow “considerably” this year.

And Fed Governor Lael Brainard said it was time for “a period of watchful waiting” on policy.

Her remarks marked a significant change: Six months earlier, Brainard — known as a “dove” who is less aggressive on raising rates — suggested the Fed would continue raising rates through 2019, not pausing to stop at “neutral,” the rates that neither stimulates nor slows the economy.

– One hike or none? –

“It’s a completely different world,” Kathy Bostjancic, head of US macro investors services at Oxford Economics, told AFP.

“I think they’ve been surprised that inflation hasn’t moved higher.”

Wall Street’s December rout, when the S&P 500 lost nearly 10 percent of its value on fears the Fed would keep hiking, was a learning moment, Bostjancic said.

“I think the markets spooked them a bit and I do think all of that together has led them to say let’s pause for some time,” she said.

Her firm, like many, has cut its forecast to a single rate increase this year — down from two — and expects first-quarter economic growth to slow to 0.7 percent, its slowest pace in more than three years.

Job growth ground to a halt in February but has maintained a good pace on average and the housing sector shows signs of recovery.

Meanwhile, manufacturing and consumer spending have fallen off sharply. A major question mark remains the extent of the slowdowns in China and Europe.

But Joseph Gagnon, senior fellow at the Peterson Institute for International Economics, said US growth should be stronger in the rest of the year, meaning it is unlikely the Fed will cut its median forecast for rate hikes in 2019 all the way to zero.

“They are thinking the slowdown is now below potential,” he said of Fed policymakers.

“If the economy keeps going at two percent, that would still justify another rate hike at some point.”

Disclaimer: This story is published from a syndicated feed. Siliconeer does not assume any liability for the above story. Validity of the above story is for 7 Days from original date of publishing. Content copyright AFP.